Insider Sell: CEO George Chamoun Sells 443,776 Shares of ACV Auctions Inc (ACVA)

ACV Auctions Inc (NASDAQ:ACVA) has recently witnessed a significant insider sell by its CEO, George Chamoun. On December 15, 2023, the insider executed a sale of 443,776 shares of the company, a transaction that has caught the attention of investors and market analysts alike. This article delves into the details of the sale, the insider's history, the company's business model, and the potential implications of this insider activity on the stock's valuation and investor sentiment.

Who is George Chamoun of ACV Auctions Inc?

George Chamoun is a prominent figure in the automotive and technology industries, known for his role as the CEO of ACV Auctions Inc. Under his leadership, ACV Auctions has grown to become a leading online automotive marketplace for dealers and commercial partners. Chamoun's expertise and strategic vision have been instrumental in the company's expansion and innovation in providing a transparent and efficient platform for buying and selling used vehicles.

ACV Auctions Inc's Business Description

ACV Auctions Inc operates as a digital marketplace for wholesale vehicle transactions. The company's platform leverages data and technology to enable dealers and commercial partners to buy and sell used vehicles through a transparent auction format. ACV Auctions provides vehicle condition reports, comprehensive inspections, and logistical support, streamlining the process and reducing the traditional frictions associated with wholesale automotive transactions. The company's innovative approach has disrupted the traditional car auction industry, offering a more efficient and accessible solution for its users.

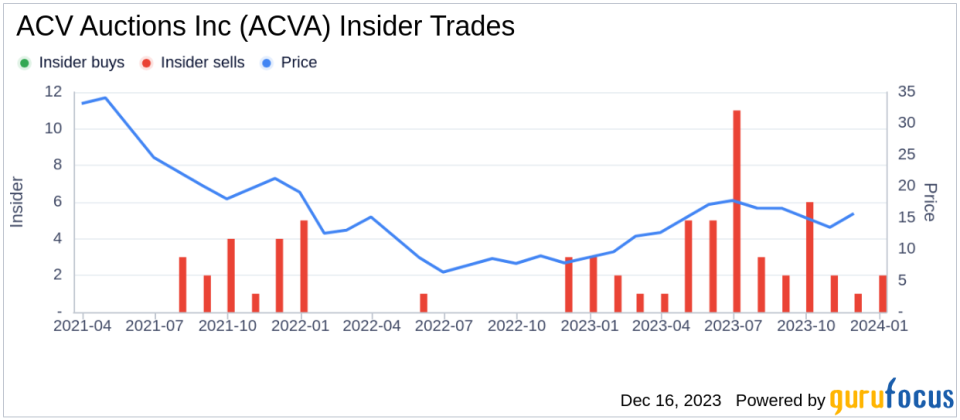

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions can provide valuable insights into a company's health and the sentiment of its executives. In the case of ACV Auctions Inc, the insider, CEO George Chamoun, has demonstrated a pattern of selling shares over the past year, with a total of 1,479,685 shares sold and no recorded purchases. This consistent selling activity may raise questions among investors regarding the insider's confidence in the company's future prospects.

It is important to consider the context and potential motivations behind the insider's decision to sell such a substantial number of shares. Insider sells can occur for various reasons, including personal financial planning, diversification of assets, or other non-company related factors. However, when an insider like the CEO, who is expected to have an in-depth understanding of the company's operations and outlook, engages in repeated selling, it can sometimes be interpreted as a lack of optimism about the stock's future performance.

The relationship between insider selling and stock price can be complex. While significant insider selling can lead to negative investor sentiment and downward pressure on the stock price, it does not always indicate a bearish outlook for the company. In some cases, the market may have already priced in the insider's actions, or the selling may be viewed as routine and not reflective of the company's intrinsic value.

On the day of George Chamoun's recent sell, ACV Auctions Inc's shares were trading at $14.74, giving the company a market cap of $2.347 billion. This valuation places the stock in the mid-cap category, which can be subject to higher volatility and market fluctuations compared to larger-cap stocks.

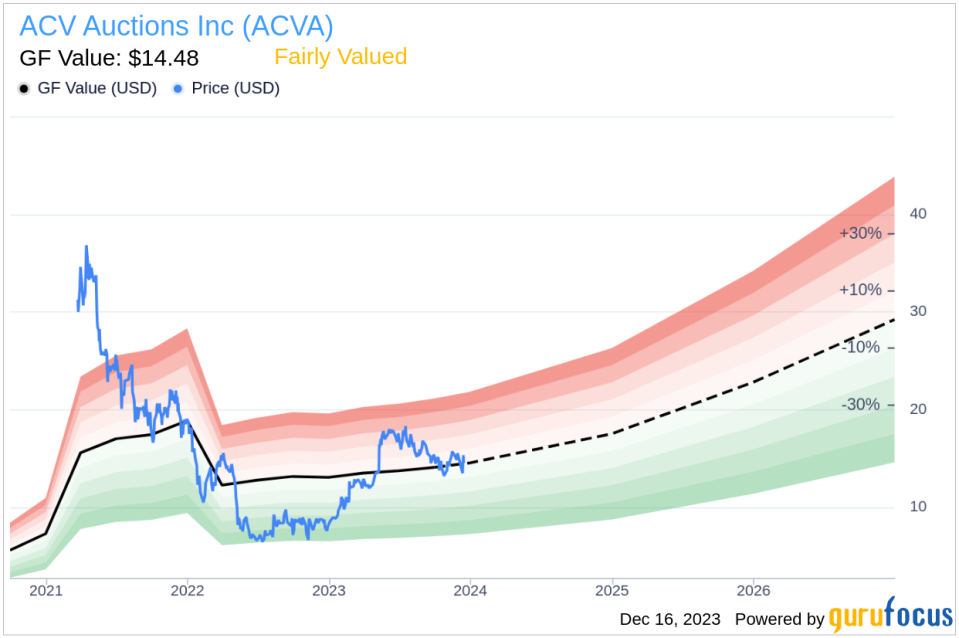

Regarding the stock's valuation, the price-to-GF-Value ratio stands at 1.02, indicating that ACV Auctions Inc is Fairly Valued based on its GF Value. The GF Value is a proprietary metric developed by GuruFocus, which considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. A ratio close to 1 suggests that the stock is trading at a price that aligns with its intrinsic value, as estimated by GuruFocus.

However, investors should not solely rely on this metric when making investment decisions. It is crucial to conduct a comprehensive analysis that includes reviewing the company's financial statements, understanding its competitive position, and considering broader market conditions.

The insider trend image above provides a visual representation of the insider transaction history for ACV Auctions Inc. The absence of insider buys and the prevalence of insider sells over the past year could be a point of concern for potential investors. A lack of insider buying may suggest that insiders do not perceive the stock as undervalued or do not expect significant appreciation in the near term.

The GF Value image further illustrates the stock's valuation in relation to its intrinsic value estimate. While the current price-to-GF-Value ratio suggests that the stock is fairly valued, investors should remain vigilant and consider the implications of the insider's selling activity when evaluating the stock's investment potential.

Conclusion

CEO George Chamoun's recent sale of 443,776 shares of ACV Auctions Inc represents a notable insider transaction that warrants attention from the investment community. While the stock appears to be fairly valued based on the GF Value, the consistent pattern of insider selling over the past year may influence investor sentiment and the stock's future performance. As with any investment decision, it is essential for investors to conduct their due diligence, taking into account insider activity, company fundamentals, and market conditions before making any conclusions about the stock's attractiveness as an investment opportunity.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.