Insider Sell: CEO Jesse Singh Sells 13,000 Shares of The AZEK Co Inc

On September 11, 2023, Jesse Singh, the CEO and President of The AZEK Co Inc (NYSE:AZEK), sold 13,000 shares of the company. This move is part of a trend for the insider, who over the past year, has sold a total of 133,000 shares and purchased none.

Jesse Singh has been at the helm of The AZEK Co Inc, a leading manufacturer of beautiful, low-maintenance residential and commercial building products. The company leverages its proprietary materials science to create premium, versatile residential and commercial products that are highly engineered and superior in performance to traditional wood and other materials.

The insider's recent sell has raised eyebrows in the financial community, prompting a closer look at the company's stock performance and insider trading trends.

The insider transaction history for The AZEK Co Inc shows a clear trend of insider selling. Over the past year, there have been 13 insider sells and no insider buys. This could indicate that those with the most intimate knowledge of the company do not see the stock as undervalued at current prices.

On the day of the insider's recent sell, shares of The AZEK Co Inc were trading for $32.66 apiece, giving the stock a market cap of $4.854 billion. The price-earnings ratio stands at a lofty 232.14, significantly higher than the industry median of 14.42 and the companys historical median price-earnings ratio.

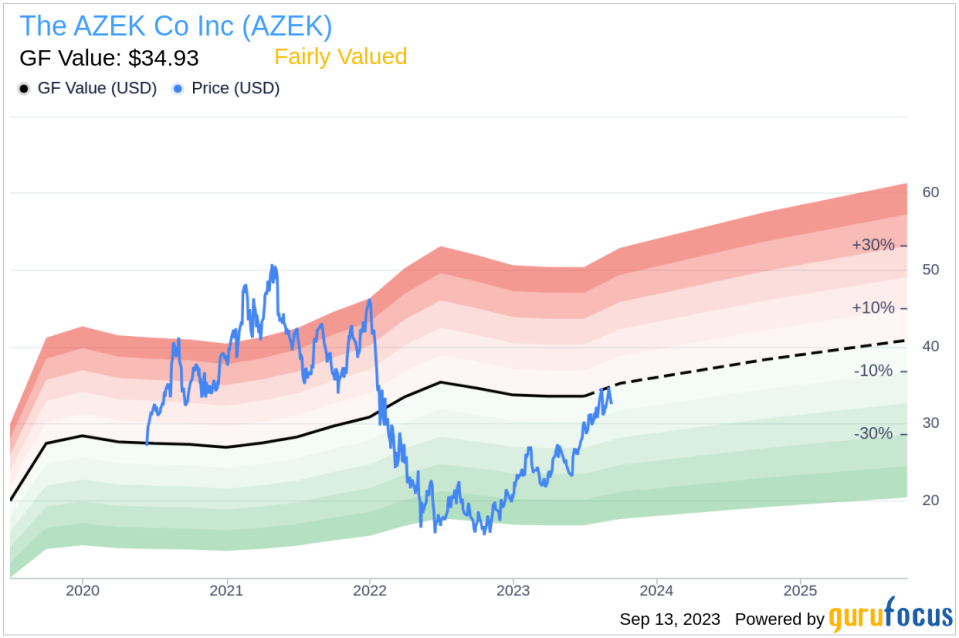

Despite the high P/E ratio, the stock appears to be fairly valued based on its GuruFocus Value. With a price of $32.66 and a GuruFocus Value of $34.93, The AZEK Co Inc has a price-to-GF-Value ratio of 0.94.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, the insider's recent sell of The AZEK Co Inc shares, coupled with the company's high P/E ratio and fair GF Value, suggests that the stock may be fully valued at current prices. Investors should keep a close eye on the company's future performance and any further insider selling.

This article first appeared on GuruFocus.