Insider Sell: CEO Michael Castagna Offloads 200,482 Shares of MannKind Corp (MNKD)

In a significant move within the pharmaceutical industry, CEO Michael Castagna has parted with a substantial number of shares in MannKind Corp (NASDAQ:MNKD). On December 15, 2023, the insider executed a sale of 200,482 shares, a transaction that has caught the attention of investors and market analysts alike.

Who is Michael Castagna of MannKind Corp?

Michael Castagna is a prominent figure in the biopharmaceutical sector, serving as the CEO of MannKind Corporation. His leadership has been pivotal in steering the company through the complex landscape of biopharmaceuticals, focusing on the development and commercialization of therapeutic products for diseases such as diabetes. Castagna's expertise and strategic vision have been instrumental in MannKind's pursuit of innovative treatments that aim to improve the quality of life for patients around the globe.

MannKind Corp's Business Description

MannKind Corporation is a biopharmaceutical company that specializes in the discovery, development, and commercialization of therapeutic products. The company is renowned for its flagship product, Afrezza, an inhalable insulin therapy for adults with diabetes. MannKind's commitment to leveraging its proprietary technologies to create distinctive, user-friendly pharmaceutical products sets it apart in the industry. The company's focus on patient-centric solutions underscores its dedication to addressing unmet medical needs and enhancing patient outcomes.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

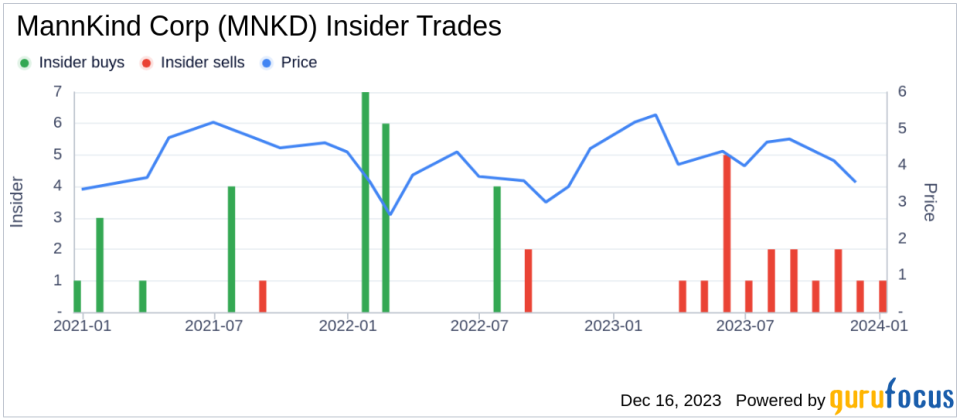

The insider's recent sale of 200,482 shares is part of a broader pattern observed over the past year. Michael Castagna has sold a total of 610,482 shares and has not made any purchases during the same period. This one-sided transaction history could signal various strategic considerations, including portfolio diversification or personal financial planning. However, such a consistent selling trend by a high-ranking executive often prompts investors to scrutinize the underlying reasons and potential implications for the company's future.The absence of insider buys over the past year, coupled with 17 insider sells, paints a picture of caution. Insider selling can sometimes be interpreted as a lack of confidence in the company's prospects or as an indication that the insiders believe the stock may be overvalued. However, it is essential to consider that insider transactions are influenced by numerous factors and do not always reflect a direct correlation with the company's performance or stock valuation.

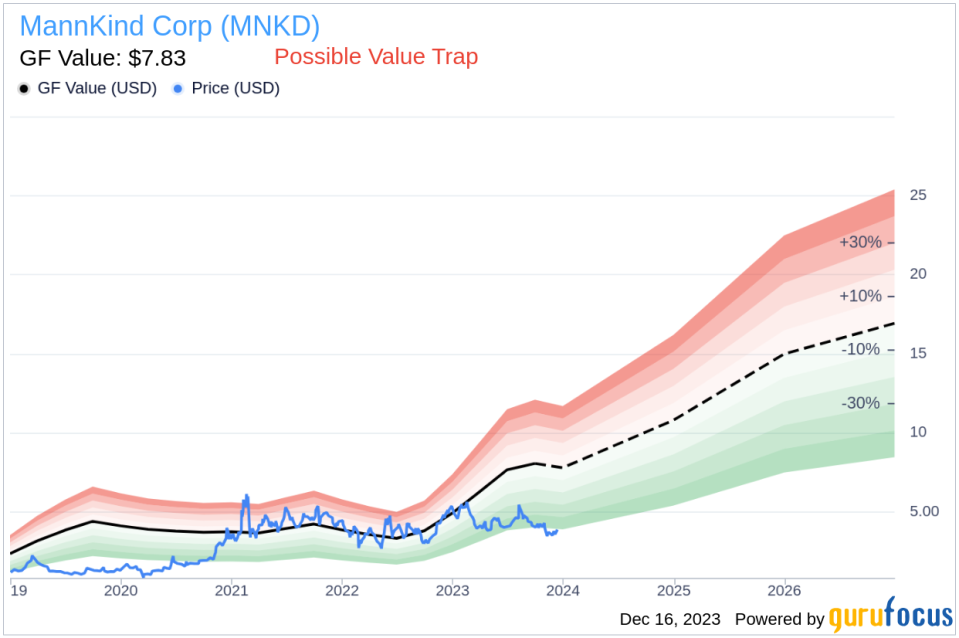

On the day of the insider's recent sale, MannKind Corp's shares were trading at $4, giving the company a market cap of $1.062 billion. This valuation is particularly intriguing when juxtaposed with the GuruFocus Value (GF Value) of $7.83 per share. The price-to-GF-Value ratio stands at 0.51, suggesting that the stock might be a possible value trap and warrants a cautious approach from investors.

The GF Value is a composite metric that incorporates historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. The disparity between the current trading price and the GF Value raises questions about the stock's true worth and whether the market has undervalued MannKind Corp's potential.

Conclusion

The insider's decision to sell a significant portion of shares in MannKind Corp is a development that merits attention. While the reasons behind Michael Castagna's sale are not publicly disclosed, the transaction adds a layer of complexity to the investment thesis for MannKind Corp. The company's innovative approach to diabetes treatment and its proprietary technologies position it as a key player in the biopharmaceutical space. However, the insider selling trend and the current price-to-GF-Value ratio suggest that investors should exercise due diligence and consider the broader market context when evaluating the stock's potential.As with any insider activity, it is crucial to view these transactions as part of a larger investment framework, taking into account the company's financial health, growth prospects, and industry dynamics. Investors are encouraged to conduct thorough research and consult with financial advisors to make informed decisions in the ever-evolving landscape of the stock market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.