Insider Sell: CEO Phil Horlock Sells 30,000 Shares of Blue Bird Corp (BLBD)

Blue Bird Corp (NASDAQ:BLBD), a leading manufacturer of school buses, has recently witnessed a significant insider sell by its CEO, Phil Horlock. On December 14, 2023, the insider executed a sale of 30,000 shares of the company's stock. This transaction has caught the attention of investors and market analysts, as insider activity, particularly from high-ranking executives, can provide valuable insights into a company's financial health and future prospects.

Who is Phil Horlock of Blue Bird Corp?

Phil Horlock has been at the helm of Blue Bird Corp as the Chief Executive Officer, steering the company through the competitive landscape of the school bus manufacturing industry. Under his leadership, Blue Bird has been committed to innovation and sustainability, with a focus on producing environmentally friendly buses, including electric and propane-powered models. Horlock's tenure has been marked by strategic decisions aimed at enhancing the company's market position and driving shareholder value.

Blue Bird Corp's Business Description

Blue Bird Corp is renowned for its iconic yellow school buses that have been a staple on American roads for decades. The company prides itself on its reputation for safety, quality, and reliability. Blue Bird's product line includes a variety of school buses designed to meet the diverse needs of its customers, ranging from traditional internal combustion engines to alternative fuel options. The company's commitment to innovation is evident in its push towards zero-emission vehicles, aligning with global trends towards cleaner transportation solutions.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

The recent sale by CEO Phil Horlock of 30,000 shares is part of a broader pattern of insider selling at Blue Bird Corp. Over the past year, Horlock has sold a total of 44,749 shares without making any purchases. This one-sided transaction history could signal a lack of confidence from the insider in the company's short-term growth potential or simply a personal financial decision. However, it's important to consider this activity in the context of the company's overall performance and market conditions.

On the day of the sale, Blue Bird Corp's shares were trading at $25.97, giving the company a market cap of $800.592 million. This valuation places the stock's price-earnings ratio at 33.64, which is higher than both the industry median of 17.1 and the company's historical median. Such a high price-earnings ratio could suggest that the stock is overvalued compared to its peers, potentially justifying the insider's decision to sell.

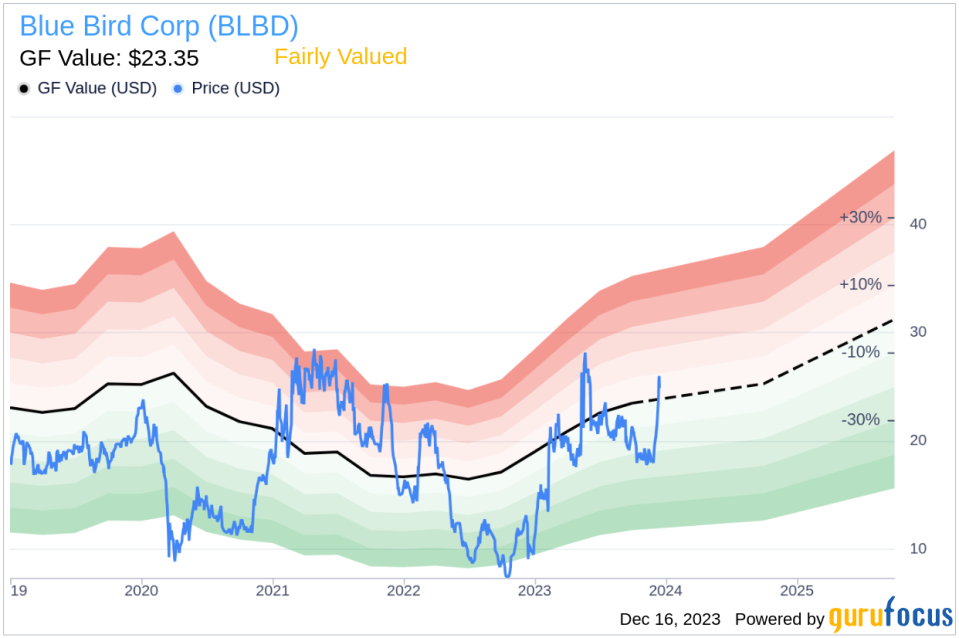

When assessing the stock's valuation, the price-to-GF-Value ratio stands at 1.11, indicating that Blue Bird Corp is Fairly Valued based on its GF Value of $23.35. The GF Value is a proprietary metric developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. While the stock is not considered overvalued by this measure, it doesn't present a significant margin of safety for potential investors.

The insider trend image above illustrates the lack of insider buying over the past year, juxtaposed against a consistent pattern of selling. This trend can often be interpreted as a bearish signal, as insiders may be expected to buy shares when they believe the stock is undervalued or poised for growth.

The GF Value image provides a visual representation of the stock's current price in relation to its intrinsic value estimate. The proximity of the current price to the GF Value suggests that the market has adequately priced in the company's fundamentals and growth prospects.

Conclusion

The recent insider sell by CEO Phil Horlock is a noteworthy event for Blue Bird Corp's investors. While the sale does not necessarily indicate a fundamental weakness in the company, it does raise questions about the insider's perspective on the stock's future performance. Given the company's higher-than-average price-earnings ratio and the Fairly Valued status based on GF Value, investors should closely monitor the company's financial results and market trends to make informed decisions. As always, insider transactions are just one piece of the puzzle, and a comprehensive analysis should include a review of the company's financial health, competitive position, and growth strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.