Insider Sell: CEO & President Sumedh Thakar Sells 5,005 Shares of Qualys Inc

On October 16, 2023, Sumedh Thakar, the CEO and President of Qualys Inc (NASDAQ:QLYS), sold 5,005 shares of the company. This move is part of a series of transactions made by the insider over the past year, during which Thakar has sold a total of 114,250 shares and made no purchases.

Sumedh Thakar has been with Qualys Inc, a leading provider of cloud-based security and compliance solutions, for over a decade. He has served in various leadership roles, including Chief Product Officer and Chief Technology Officer, before assuming his current position as CEO and President. His deep understanding of the company and its market position makes his stock transactions noteworthy for investors.

Qualys Inc offers a wide range of solutions that help organizations streamline their security and compliance solutions. The company's cloud-based platform and integrated suite of solutions help businesses simplify security operations and lower the cost of compliance by delivering critical security intelligence on demand and automating the full spectrum of auditing, compliance, and protection for IT systems and web applications.

The insider's recent sell-off is part of a broader trend within the company. Over the past year, there have been 32 insider sells and no insider buys. This trend is illustrated in the following chart:

The relationship between insider transactions and the stock price is complex. While insider selling can sometimes indicate a lack of confidence in the company's future prospects, it can also be a personal decision based on the insider's financial needs or investment strategies. Therefore, it's crucial to consider the context of the transactions and the company's overall performance.

On the day of the insider's recent sell, shares of Qualys Inc were trading at $162.62, giving the company a market cap of $5.99 billion. The price-earnings ratio was 51.50, higher than the industry median of 26.18 but lower than the companys historical median price-earnings ratio.

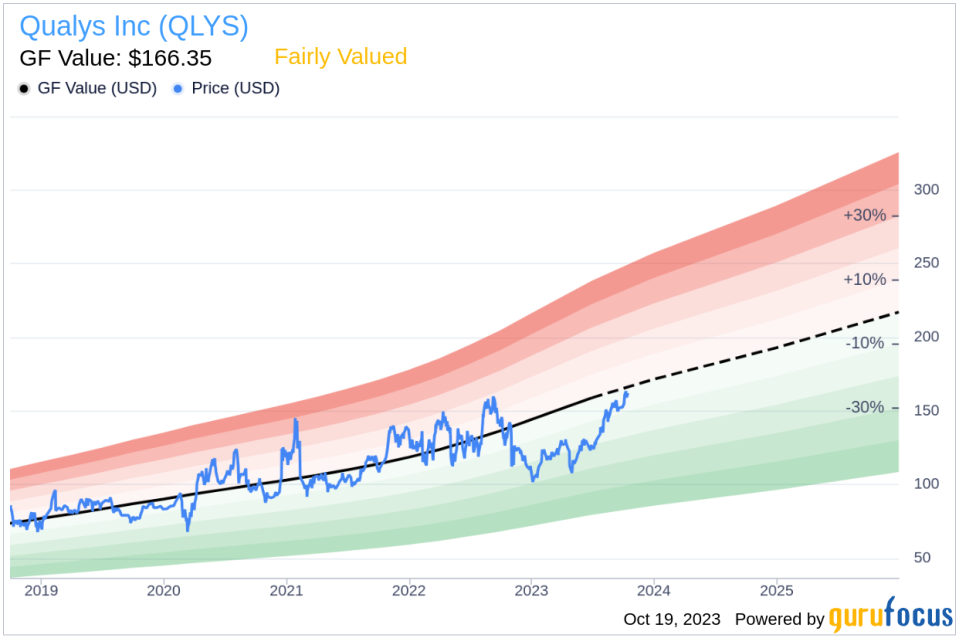

According to the GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, Qualys Inc is fairly valued. The stock's price-to-GF-Value ratio is 0.98, as shown in the following image:

In conclusion, while the insider's recent sell-off may raise some eyebrows, it's important to consider the broader context. The company's solid market position, combined with its fair valuation, suggests that Qualys Inc remains a viable investment option.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.