Insider Sell: CEO Scott Beiser Sells 9,084 Shares of Houlihan Lokey Inc

On November 3, 2023, Scott Beiser, the Chief Executive Officer and 10% owner of Houlihan Lokey Inc (NYSE:HLI), sold 9,084 shares of the company. This move is part of a series of transactions made by the insider over the past year, which have seen a total of 25,451 shares sold and no shares purchased.

Scott Beiser is a key figure at Houlihan Lokey Inc, a global investment bank with expertise in mergers and acquisitions, capital markets, financial restructuring, and valuation. The firm serves corporations, institutions, and governments worldwide with offices in the United States, Europe, the Middle East, and the Asia-Pacific region.

The insider's recent sell-off is part of a broader trend at Houlihan Lokey Inc. Over the past year, there have been eight insider sells and no insider buys. This trend could be a signal to investors about the insider's perspective on the company's future prospects.

On the day of the insider's recent sell, shares of Houlihan Lokey Inc were trading at $105.78, giving the company a market cap of $7.22 billion. The price-earnings ratio stood at 26.89, higher than both the industry median of 18.36 and the company's historical median price-earnings ratio.

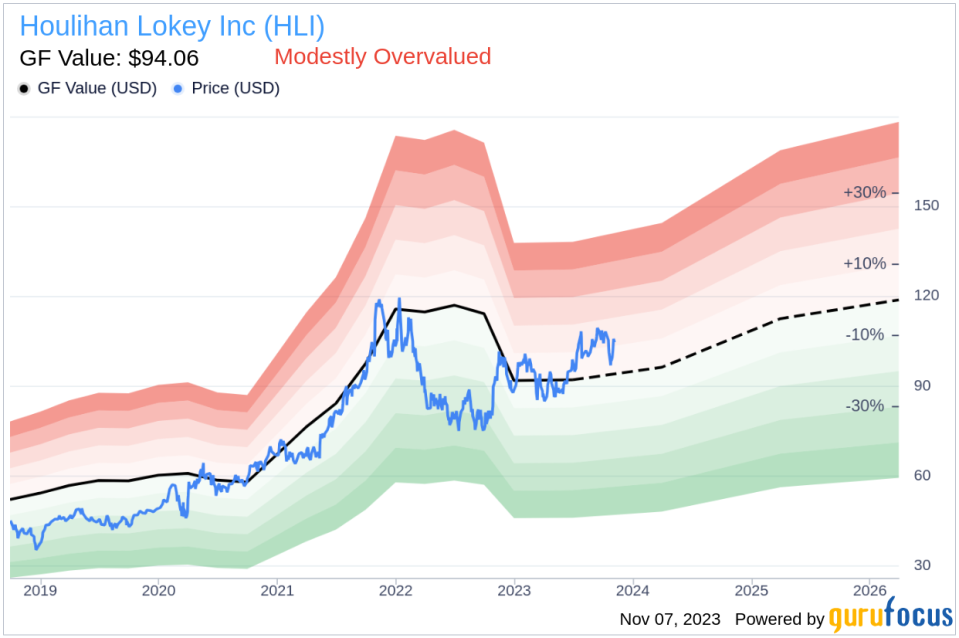

According to the GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, Houlihan Lokey Inc is modestly overvalued. The stock's price-to-GF-Value ratio is 1.12, with a GF Value of $94.06 and a current price of $105.78.

The insider's decision to sell shares could be influenced by this valuation. However, it's important for investors to consider other factors, such as the company's financial health, growth prospects, and market conditions, before making investment decisions.

In conclusion, the insider's recent sell-off, along with the broader insider sell trend at Houlihan Lokey Inc, could be a signal to investors. However, with the stock being modestly overvalued according to the GuruFocus Value, investors should conduct thorough research and consider various factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.