Insider Sell: CEO Steven Chapman Sells Shares of Natera Inc (NTRA)

In a recent transaction on November 20, 2023, Steven Chapman, the CEO and President of Natera Inc, sold 2,566 shares of the company. This move has caught the attention of investors and analysts, as insider transactions can often provide valuable insights into a company's prospects. In this article, we will delve into who Steven Chapman is, the business of Natera Inc, and analyze the implications of this insider sell.

Who is Steven Chapman of Natera Inc?

Steven Chapman is known for his role as the CEO and President of Natera Inc, a leader in the field of genetic testing and diagnostics. Chapman has been at the helm of the company, guiding it through various stages of growth and development. His leadership has been instrumental in Natera's mission to transform the management of genetic diseases and conditions.

Natera Inc's Business Description

Natera Inc is a pioneering genetic testing company that specializes in the analysis of DNA. The company's innovative technology provides comprehensive insights into genetic information, aiding in the diagnosis and management of genetic diseases. Natera's offerings include prenatal testing, cancer screening, and organ health monitoring, which are crucial in making informed medical decisions for patients and healthcare providers alike.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions, such as the recent sale by Steven Chapman, can be a strong indicator of a company's health and future performance. Over the past year, Chapman has sold a total of 97,928 shares and has not made any purchases. This pattern of selling could suggest that the insider may perceive the stock's current price as being on the higher end of its value spectrum, or it could be part of a personal financial strategy.

It is important to note that there have been 63 insider sells and no insider buys over the past year at Natera Inc. This trend of insider selling could potentially raise questions about the insiders' confidence in the company's future growth. However, it is also essential to consider the context of these sales, as they may not always be indicative of a lack of confidence in the company.

On the day of Chapman's recent sale, shares of Natera Inc were trading at $55, giving the company a market cap of $6.566 billion. This valuation places the stock within the realm of fairly valued according to the GuruFocus Value, with a price-to-GF-Value ratio of 0.93.

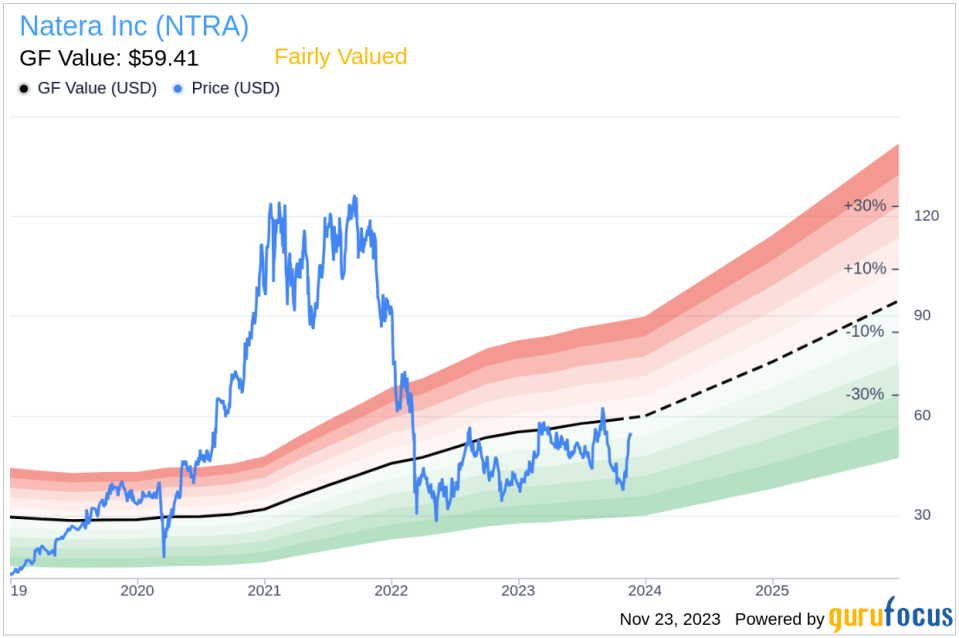

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. With a GF Value of $59.41, Natera Inc's stock appears to be fairly valued, suggesting that the insider's decision to sell may not necessarily be based on an overvaluation of the stock.

The insider trend image above provides a visual representation of the selling and buying patterns of insiders at Natera Inc. The absence of buys and the prevalence of sells could be a point of consideration for investors when evaluating the stock.

The GF Value image further illustrates the stock's valuation in relation to its intrinsic value. As the stock is currently trading close to its GF Value, it suggests that the market is pricing Natera Inc's shares in line with their fair value, based on the factors considered in the GF Value calculation.

Conclusion

Steven Chapman's recent sale of shares in Natera Inc is a significant event that warrants attention from investors. While the insider selling trend and the fairly valued status of the stock based on the GF Value may not provide a clear directional signal, they do offer valuable context for investors. It is crucial for investors to consider the broader picture, including the company's growth prospects, industry trends, and overall market conditions, when interpreting insider transactions. As always, insider activity is just one piece of the puzzle in the complex decision-making process of investing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.