Insider Sell: CEO Thomas Vetter Sells 38,932 Shares of Cars.com Inc

In a notable insider transaction, CEO Thomas Vetter sold 38,932 shares of Cars.com Inc (NYSE:CARS) on November 14, 2023. This move has caught the attention of investors and analysts who closely monitor insider behaviors as indicators of a company's financial health and future performance.

Who is Thomas Vetter of Cars.com Inc?

Thomas Vetter is a key executive at Cars.com Inc, serving as the company's CEO. His role at the helm of the organization places him in a position of significant influence, overseeing the strategic direction and operational execution of the company's business plan. Vetter's decisions, including those related to stock transactions, are often scrutinized for insights into his confidence in the company's future prospects.

Cars.com Inc's Business Description

Cars.com Inc is a leading digital marketplace and solutions provider for the automotive industry, connecting car shoppers with sellers. The platform offers a robust suite of tools and resources that facilitate the research, pricing, and selling of vehicles, creating a comprehensive ecosystem for consumers and dealers alike. With a focus on innovation and user experience, Cars.com Inc strives to streamline the car buying and selling process, making it more efficient and accessible.

Analysis of Insider Buy/Sell and Relationship with Stock Price

The insider transaction history for Cars.com Inc reveals a pattern of insider selling over the past year, with 14 insider sells and no insider buys. This could be interpreted in various ways; however, consistent selling by insiders, particularly by high-level executives like Thomas Vetter, may signal their personal assessment that the stock may not appreciate significantly in the near future or that they are diversifying their personal holdings.On the day of the insider's recent sell, shares of Cars.com Inc were trading at $19.15, giving the company a market cap of $1.294 billion. This price point is particularly interesting when considering the company's valuation metrics.

The price-earnings ratio of Cars.com Inc stands at 11.11, which is lower than the industry median of 15.87 and also lower than the company's historical median price-earnings ratio. This suggests that the stock is trading at a discount compared to its peers and its own historical valuation, which could be seen as an attractive entry point for value investors.However, when we consider the GF Value, which is an intrinsic value estimate developed by GuruFocus, the picture becomes slightly more nuanced.

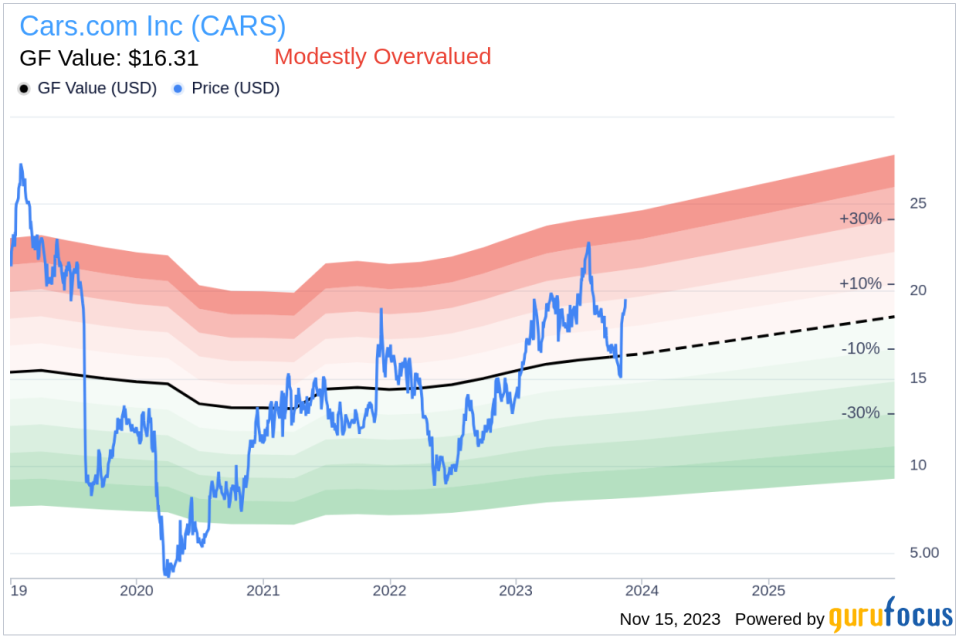

With a price of $19.15 and a GuruFocus Value of $16.31, Cars.com Inc has a price-to-GF-Value ratio of 1.17, indicating that the stock is modestly overvalued based on its GF Value. The GF Value is calculated considering historical multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.The divergence between the traditional price-earnings ratio and the GF Value suggests that while the stock may seem undervalued from a historical earnings perspective, its future growth prospects and returns may not justify a higher valuation at this time.

Insider Trends and Market Reaction

The insider's recent sell-off of 38,932 shares follows a year-long trend of insider selling, with Thomas Vetter having sold a total of 211,914 shares over the past year without any recorded purchases. This consistent selling pattern could be a red flag for potential investors, as it may imply that insiders are not confident in the stock's growth potential or are simply taking profits.The market often reacts to insider transactions, with selling sometimes leading to negative sentiment among investors. However, it's important to note that insider selling can occur for many reasons unrelated to a company's performance, such as personal financial planning or diversifying assets.In conclusion, the insider sell activity by CEO Thomas Vetter at Cars.com Inc presents a mixed signal to the market. While the company's lower price-earnings ratio compared to the industry might suggest an undervalued opportunity, the GF Value indicates that the stock is modestly overvalued. Investors should consider these factors alongside the broader market conditions and the company's strategic initiatives before making investment decisions. As always, insider transactions are just one piece of the puzzle when it comes to evaluating a stock's potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.