Insider Sell: CEO Virginia Drosos Sells 10,000 Shares of Signet Jewelers Ltd (SIG)

Signet Jewelers Ltd (NYSE:SIG), a leading name in the world of specialty jewelry retail, has recently witnessed a significant insider sell by its CEO, Virginia Drosos. On November 14, 2023, Drosos sold 10,000 shares of the company, a move that has caught the attention of investors and market analysts alike. This transaction is part of a series of sales by the insider over the past year, totaling 110,000 shares, with no recorded purchases in the same period.

Who is Virginia Drosos?

Virginia Drosos is the Chief Executive Officer of Signet Jewelers Ltd, a position she has held since August 2017. With a career spanning over 30 years, Drosos has a wealth of experience in the beauty and consumer goods industries. Prior to joining Signet, she served as President & CEO of Assurex Health and held various leadership roles at Procter & Gamble. Under her leadership, Signet has embarked on a path of transformation, focusing on customer experience, digital innovation, and a culture of agility and efficiency.

About Signet Jewelers Ltd

Signet Jewelers Ltd is the world's largest retailer of diamond jewelry, with a presence in the United States, Canada, and the United Kingdom. The company operates through well-known brands such as Kay Jewelers, Zales, Jared, H.Samuel, Ernest Jones, Peoples, and Piercing Pagoda. Signet is committed to delivering a superior omnichannel experience to its customers, offering a wide range of jewelry products and services. The company's business model encompasses the entire jewelry lifecycle, including design, manufacture, distribution, and retail.

Analysis of Insider Buy/Sell and Relationship with Stock Price

The recent sell by CEO Virginia Drosos is part of a broader trend of insider selling at Signet Jewelers Ltd. Over the past year, there have been 43 insider sells and no insider buys. This pattern of insider activity can sometimes raise questions about the insiders' confidence in the company's future prospects. However, it is also important to consider that insiders may sell shares for various reasons, such as diversifying their portfolios, tax planning, or personal financial management, which are not necessarily indicative of their outlook on the company's performance.

On the day of the insider's recent sell, Signet Jewelers Ltd's shares were trading at $75.96, giving the company a market cap of $3.475 billion. The price-earnings ratio stood at 8.81, which is lower than both the industry median of 16.67 and the company's historical median price-earnings ratio. This suggests that the stock may be undervalued compared to its peers and its own historical valuation.

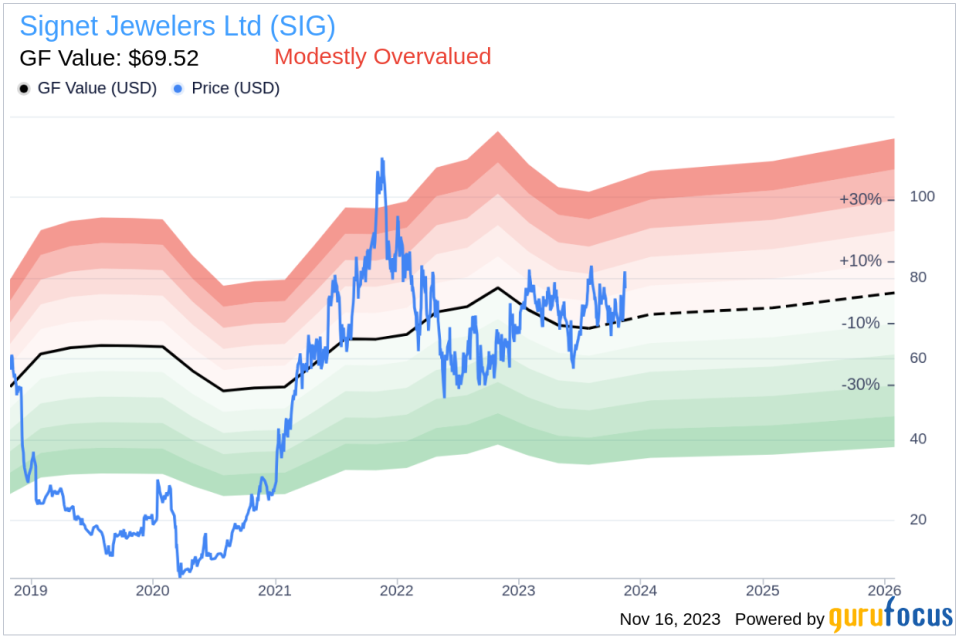

However, with a price-to-GF-Value ratio of 1.09, Signet Jewelers Ltd is considered modestly overvalued based on its GF Value. The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. This valuation metric indicates that the stock's current price is slightly above what is considered its fair value.

The insider trend image above reflects the recent selling activity by insiders, which could be a point of analysis for potential investors. While insider sells are more prevalent than buys, it is crucial to contextualize this information within the broader market and company-specific developments.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value. As shown, the stock is currently trading above the GF Value line, indicating a modest overvaluation.

Conclusion

The sale of 10,000 shares by CEO Virginia Drosos is a notable event for Signet Jewelers Ltd, especially considering the broader pattern of insider selling over the past year. While the stock appears undervalued based on its price-earnings ratio, the GF Value suggests a slight overvaluation. Investors should weigh these factors, along with the company's strategic initiatives and market position, when considering their investment decisions. As always, insider transactions are just one piece of the puzzle, and a comprehensive analysis should include a review of the company's financials, growth prospects, and industry trends.

For those interested in following insider transactions and gaining insights into company valuations, gurufocus.com provides a wealth of data and analysis tools to help investors make informed decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.