Insider Sell: CEO William Pate Sells 150,000 Shares of Par Pacific Holdings Inc (PARR)

In a notable insider transaction, CEO William Pate of Par Pacific Holdings Inc (NYSE:PARR) sold 150,000 shares of the company's stock on November 28, 2023. This sale has caught the attention of investors and analysts, as insider transactions can provide valuable insights into a company's prospects and the confidence level of its top executives.

Who is William Pate?

William Pate is the Chief Executive Officer of Par Pacific Holdings Inc, a company that operates in the energy sector. Pate has been at the helm of the company, guiding it through the complex landscape of refining, marketing, and logistics within the energy industry. His leadership has been instrumental in steering the company's strategic direction and operational performance.

Par Pacific Holdings Inc's Business Description

Par Pacific Holdings Inc is an energy company that specializes in the refining, distribution, and marketing of petroleum products. The company's operations are primarily focused in the United States, with a significant presence in Hawaii, Washington, and Wyoming. Par Pacific owns and operates refineries with a combined capacity of processing crude oil into a variety of products, including gasoline, diesel fuel, and jet fuel. Additionally, the company has a logistics network that includes pipelines, terminals, and trucking operations to distribute its products.

Analysis of Insider Buy/Sell and Relationship with Stock Price

The recent sale by CEO William Pate of 150,000 shares is part of a larger pattern of insider selling activity at Par Pacific Holdings Inc. Over the past year, Pate has sold a total of 265,099 shares and has not made any purchases. This could be interpreted as a lack of confidence in the company's future prospects or simply a personal financial decision by the insider.

The insider transaction history shows no insider buys over the past year, with a total of 5 insider sells during the same period. This trend of insider selling may raise questions among investors about the long-term value of the stock.

Valuation and Market Reaction

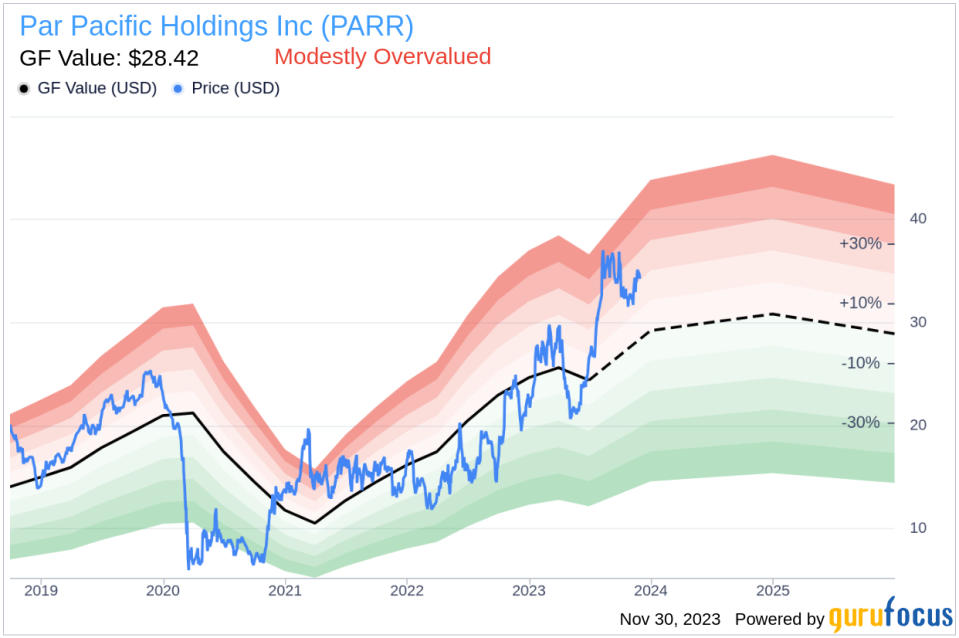

On the day of the insider's recent sale, shares of Par Pacific Holdings Inc were trading at $34.88, giving the company a market cap of $2.072 billion. The price-earnings ratio of 3.99 is lower than both the industry median of 9.19 and the company's historical median, suggesting that the stock may be undervalued based on earnings.However, with a price of $34.88 and a GuruFocus Value of $28.42, Par Pacific Holdings Inc has a price-to-GF-Value ratio of 1.23, indicating that the stock is modestly overvalued based on its GF Value.

The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The current price-to-GF-Value ratio suggests that the market has priced in some optimism about the company's future performance.

Conclusion

The recent insider sell by CEO William Pate may prompt investors to scrutinize Par Pacific Holdings Inc's valuation and future growth prospects. While the low price-earnings ratio could be attractive, the price-to-GF-Value ratio suggests that the stock is not undervalued. Investors should consider the insider selling trend, the company's business fundamentals, and industry conditions when making investment decisions. As always, insider transactions are just one piece of the puzzle, and a comprehensive analysis should be undertaken before drawing any conclusions about the stock's potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.