Insider Sell: CEO William Trigg Sells 7,430 Shares of AppFolio Inc (APPF)

AppFolio Inc (NASDAQ:APPF), a leading provider of cloud-based business software solutions, has recently witnessed a significant insider sell by its CEO, William Trigg. On November 20, 2023, the insider executed a sale of 7,430 shares of the company's stock. This transaction has caught the attention of investors and market analysts, as insider activity can often provide valuable insights into a company's financial health and future prospects.

Who is William Trigg of AppFolio Inc?

William Trigg, the CEO of AppFolio Inc, has been at the helm of the company, steering it through various phases of growth and innovation. Under his leadership, AppFolio has expanded its offerings and solidified its position in the market as a provider of industry-specific software solutions. Trigg's tenure has been marked by a focus on customer-centric product development and strategic acquisitions, which have contributed to the company's robust performance.

AppFolio Inc's Business Description

AppFolio Inc specializes in software solutions that serve the property management and legal industries. The company's flagship product, AppFolio Property Manager, is designed to streamline operations for property management professionals, offering capabilities such as online rent collection, maintenance requests, and full accounting functionality. Additionally, AppFolio's MyCase software supports legal professionals with practice management, including case management, billing, and client communication. AppFolio's commitment to innovation and customer service has established it as a trusted name in cloud-based business software.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions are closely monitored by investors as they can provide clues about a company's internal perspective on its stock's value. Over the past year, William Trigg has sold a total of 7,430 shares and has not made any purchases. This one-sided activity could suggest that the insider sees the current stock price as an opportune time to realize gains.

Comparatively, the broader insider transaction history for AppFolio Inc shows a more balanced picture, with 2 insider buys and 3 insider sells over the past year. This mixed activity indicates that while some insiders may see value in holding or increasing their stake, others, including the CEO, are taking profits.

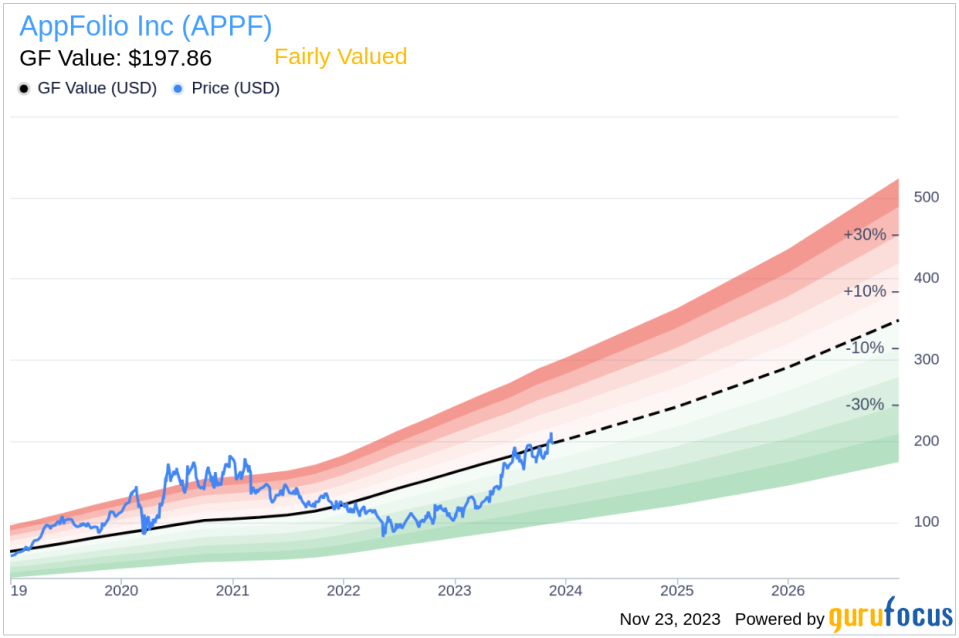

On the day of Trigg's recent sell, AppFolio Inc shares were trading at $200.1, giving the company a market cap of $7.046 billion. This price point is particularly noteworthy when considering the GF Value.

The GF Value, an intrinsic value estimate, suggests that AppFolio Inc is Fairly Valued with a price-to-GF-Value ratio of 1.01. The GF Value is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. This valuation indicates that the stock price is aligned with the company's intrinsic value, which may have influenced the insider's decision to sell at this time.

Conclusion

The recent insider sell by CEO William Trigg could be interpreted in various ways. While it may raise questions about the insider's confidence in the company's near-term growth prospects, it is also important to consider the context of the transaction. With the stock being Fairly Valued according to the GF Value, the insider may have simply decided that it was an appropriate time to liquidate part of his holdings.

Investors should weigh insider activity as one of many factors in their decision-making process. It is essential to look at the broader picture, including the company's financial performance, market position, and growth potential. For AppFolio Inc, with its solid business model and commitment to innovation, the future still holds promise despite the recent insider sell.

As always, individuals should conduct their own research and consult with financial advisors before making investment decisions. Insider transactions are just one piece of the puzzle when evaluating a company's investment potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.