Insider Sell: CFO Brett Sandercock Sells 3,000 Shares of ResMed Inc (RMD)

ResMed Inc (NYSE:RMD), a global leader in the development, manufacturing, and marketing of innovative medical products for the treatment and management of respiratory disorders, with a focus on sleep-disordered breathing, has recently witnessed a significant insider sell by its Chief Financial Officer (CFO), Brett Sandercock. On November 27, 2023, the insider sold 3,000 shares of the company, a transaction that has caught the attention of investors and market analysts alike.

Who is Brett Sandercock of ResMed Inc?

Brett Sandercock has been a key figure at ResMed Inc, serving as the company's CFO. With a tenure that has spanned over several years, Sandercock has been instrumental in steering the financial strategies and health of the company. His role involves overseeing the global finance team, managing financial risks, financial planning and reporting, as well as being a strategic partner in the overall growth and direction of the company. His decisions and actions are closely watched by investors as they can provide insights into the company's financial stability and future prospects.

ResMed Inc's Business Description

ResMed Inc is a San Diego-based medical equipment company known for its innovative products in the sleep and respiratory medicine field. The company's offerings include devices such as CPAP machines for the treatment of obstructive sleep apnea, ventilators, and other respiratory support products. ResMed's commitment to improving quality of life for those with sleep apnea, COPD, and other chronic diseases has positioned it as a leader in a growing healthcare market. With a focus on connected care solutions, ResMed leverages technology and data to deliver better clinical outcomes for patients and efficiencies for healthcare providers.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions, particularly those involving high-ranking executives like CFOs, can provide valuable clues about a company's financial health and future performance. Over the past year, Brett Sandercock has sold a total of 33,000 shares and has not made any purchases. This pattern of selling could suggest various things, from personal financial planning to a less optimistic view of the company's valuation or growth prospects.

However, it's important to note that insider sells can be motivated by many factors and do not always indicate a lack of confidence in the company. Executives may sell shares for personal reasons such as diversifying their investment portfolio, funding personal expenses, or tax planning. Therefore, while insider sells can be a red flag, they must be interpreted within a broader context.

When examining the relationship between insider transactions and stock price, it's crucial to consider the overall trend of insider behavior. For ResMed Inc, there have been 39 insider sells and no insider buys over the past year. This trend could be perceived as a lack of insider confidence in the stock's future appreciation.

On the day of Sandercocks recent sell, ResMed Inc shares were trading at $152.62, giving the company a market cap of $23.312 billion. The price-earnings ratio stood at 25.73, which is lower than both the industry median of 30.74 and the companys historical median price-earnings ratio. This could indicate that the stock is undervalued compared to its peers and its own historical valuation.

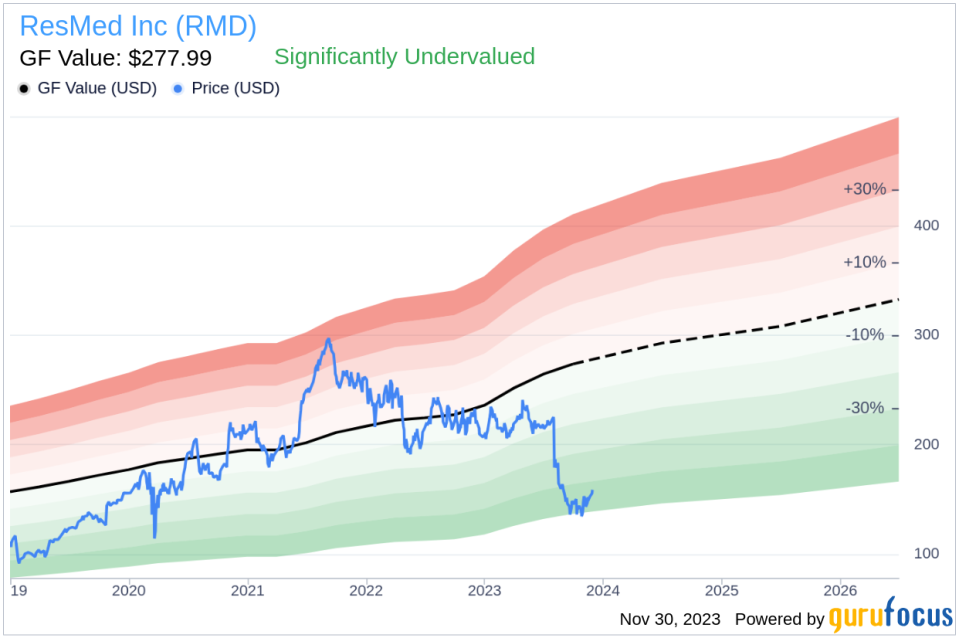

Adding to the valuation analysis, the price-to-GF-Value ratio of 0.55 suggests that ResMed Inc is significantly undervalued based on its GF Value. The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. With a price of $152.62 and a GF Value of $277.99, the stock appears to be trading well below its estimated intrinsic value.

The insider trend image above provides a visual representation of the selling pattern by insiders at ResMed Inc. This consistent selling could be a point of concern for potential investors, as it may signal that those with the most intimate knowledge of the company's workings are choosing to reduce their holdings.

The GF Value image further illustrates the discrepancy between the current stock price and the estimated intrinsic value, reinforcing the notion that the stock may be undervalued.

Conclusion

While the recent insider sell by CFO Brett Sandercock may raise questions among investors, it is essential to consider the broader context of the company's valuation and market performance. ResMed Inc's strong position in the medical equipment industry, combined with its focus on innovation and connected care, provides a solid foundation for future growth. Despite the insider selling trend, the company's current valuation metrics suggest that the stock may be an attractive investment opportunity for those who believe in the company's long-term potential. As always, investors should conduct their own due diligence and consider their investment goals and risk tolerance before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.