Insider Sell: CFO David Mutryn Sells 3,886 Shares of Maximus Inc

On September 29, 2023, David Mutryn, the Chief Financial Officer (CFO) of Maximus Inc (NYSE:MMS), sold 3,886 shares of the company. This move is part of a series of insider transactions that have taken place over the past year.

David Mutryn is a seasoned financial executive with a wealth of experience in the industry. As the CFO of Maximus Inc, he is responsible for the company's financial strategy and operations, including budgeting, forecasting, and financial reporting. His role is crucial in ensuring the financial health and growth of the company.

Maximus Inc is a leading provider of government services worldwide. The company partners with governments to deliver critical health and human services programs to a diverse array of communities. Maximus leverages its extensive experience and expertise to provide innovative solutions that contribute to the success of these programs.

Over the past year, David Mutryn has sold a total of 3,886 shares and purchased 0 shares. This trend is mirrored in the overall insider transaction history for Maximus Inc, which shows 2 insider buys and 9 insider sells over the past year.

The relationship between insider transactions and stock price is often closely watched by investors. In general, insider selling can be seen as a bearish signal, suggesting that insiders may believe the stock is overvalued or that the company's future prospects are not as strong as the current price suggests. However, it's important to note that insiders may sell shares for a variety of reasons, not necessarily related to their outlook on the company's performance.

On the day of the insider's recent sell, shares of Maximus Inc were trading for $74.68 apiece, giving the stock a market cap of $4.514 billion. The price-earnings ratio is 26.53, which is higher than the industry median of 16.81 and higher than the companys historical median price-earnings ratio.

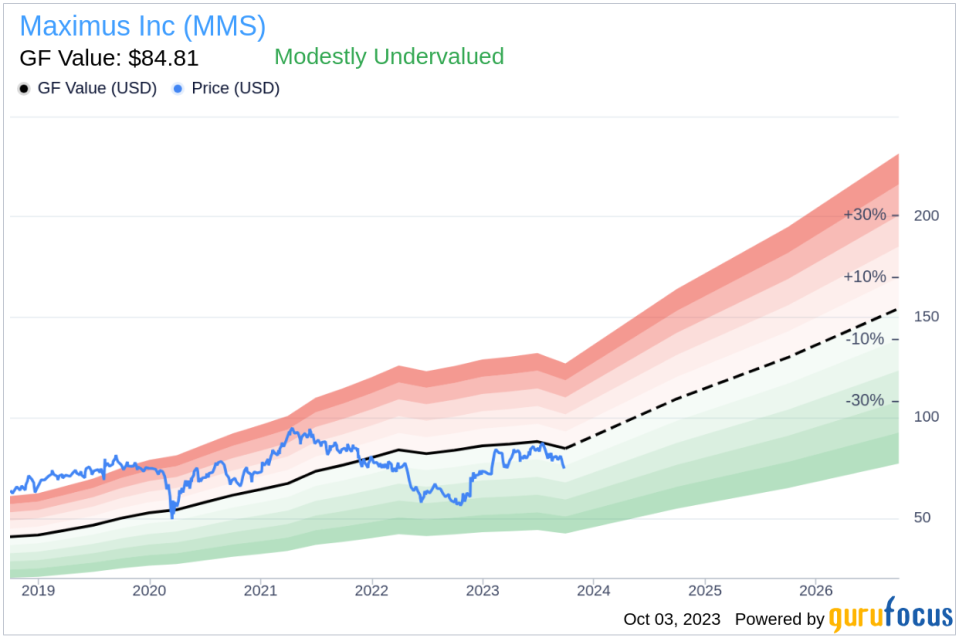

Despite this, Maximus Inc appears to be modestly undervalued based on its GF Value. With a price of $74.68 and a GuruFocus Value of $84.81, the stock has a price-to-GF-Value ratio of 0.88.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, while the insider's recent sell may raise some eyebrows, the overall valuation of Maximus Inc suggests that the stock may still offer value to investors. As always, it's important for investors to do their own research and consider a variety of factors before making investment decisions.

This article first appeared on GuruFocus.