Insider Sell: CFO/EVP Marci Basich Sells 1,000 Shares of Timberland Bancorp Inc

On August 11, 2023, Marci Basich, the CFO and EVP of Timberland Bancorp Inc (NASDAQ:TSBK), sold 1,000 shares of the company. This move is part of a broader trend of insider selling at the company over the past year.

Marci Basich has been with Timberland Bancorp Inc for several years, serving in various financial roles before becoming the CFO and EVP. Her insider perspective and financial acumen make her trading activities particularly noteworthy for investors.

Timberland Bancorp Inc is a Washington-based holding company for Timberland Bank. The bank provides a wide range of banking solutions, including business and personal loans, deposit products, and wealth management, targeting small and medium-sized businesses and professionals.

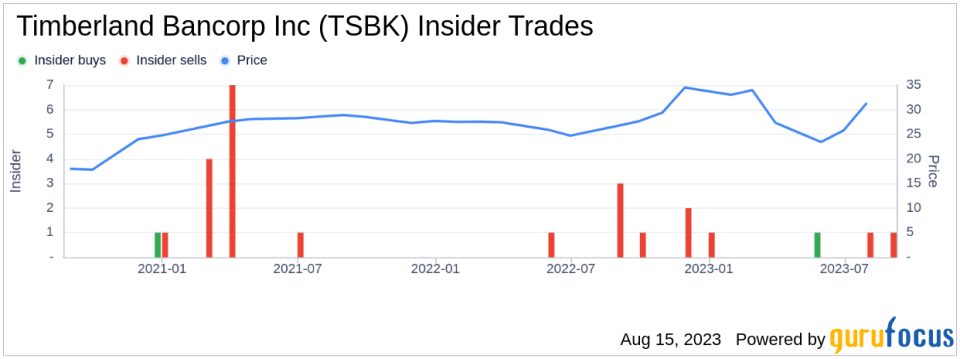

Over the past year, Basich has sold a total of 1,000 shares and has not made any purchases. This selling trend is consistent with the overall insider activity at Timberland Bancorp Inc, which has seen 9 insider sells and only 1 insider buy over the same period.

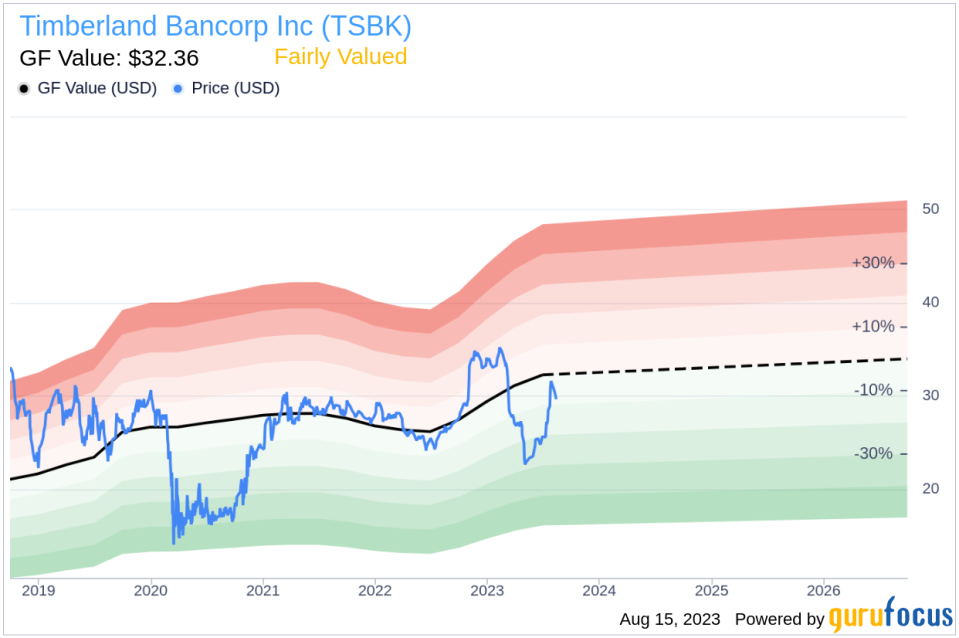

The stock was trading at $30.1 per share on the day of Basich's recent sale, giving the company a market cap of $239.294 million. The price-earnings ratio stands at 8.90, slightly higher than the industry median of 8.65 but lower than the company's historical median price-earnings ratio.

According to the GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, Timberland Bancorp Inc is fairly valued. The stock's price-to-GF-Value ratio is 0.93, with a GF Value of $32.36.

The correlation between insider selling and stock price can be complex. While it's common to interpret insider selling as a negative signal, it's important to consider the context. In this case, the selling trend among insiders at Timberland Bancorp Inc, including Basich, may be a factor for investors to consider. However, with the stock being fairly valued according to the GF Value, it suggests that the stock's current price accurately reflects its intrinsic value.

As always, investors should consider a range of factors when making investment decisions, including the company's financial health, market conditions, and their own risk tolerance.

This article first appeared on GuruFocus.