Insider Sell: CFO Jason Lublin Sells 52,080 Shares of Endeavor Group Holdings Inc (EDR)

Jason Lublin, the Chief Financial Officer of Endeavor Group Holdings Inc, has recently sold a significant number of shares in the company. On November 13, 2023, the insider executed a sale of 52,080 shares of Endeavor Group Holdings Inc (NYSE:EDR), a notable transaction that has caught the attention of investors and market analysts alike.

Who is Jason Lublin?

Jason Lublin serves as the CFO of Endeavor Group Holdings Inc, a global entertainment, sports, and content company. In his role, Lublin oversees the financial operations and strategies of the company, playing a crucial part in its financial planning and economic modeling. His expertise in finance and strategic planning is vital to the company's success in the competitive landscape of media and entertainment.

Endeavor Group Holdings Inc's Business Description

Endeavor Group Holdings Inc is a powerhouse in the realm of entertainment and media, with a diverse portfolio that includes talent agency representation, sports management, and a variety of media services. The company operates through several segments, including Entertainment & Sports, which manages live events, media rights, and talent representation; and Owned Sports Properties, which includes a range of professional sports leagues and events. Endeavor's influence extends across various platforms and industries, making it a significant player in the global market for entertainment and sports content.

Analysis of Insider Buy/Sell and Relationship with Stock Price

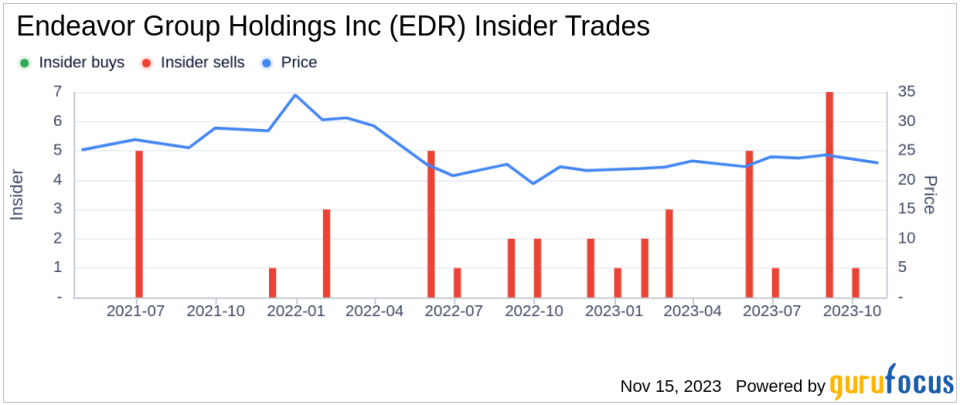

Insider transactions can provide valuable insights into a company's financial health and future prospects. In the case of Endeavor Group Holdings Inc, the insider transaction history over the past year shows a trend of more insider selling than buying. Specifically, there have been 23 insider sells and no insider buys, indicating that insiders may believe the stock is fully valued or potentially overvalued at current prices.

Jason Lublin's recent sale of 52,080 shares is part of a larger pattern of his trading activities. Over the past year, Lublin has sold a total of 174,417 shares and has not made any purchases. This consistent selling could suggest that the insider is taking advantage of the stock's current market price or reallocating personal investment portfolios.

On the day of Lublin's recent sale, shares of Endeavor Group Holdings Inc were trading at $24.48, giving the company a market cap of $7.391 billion. The price-earnings ratio of 68.33 is significantly higher than the industry median of 17.2 and above the company's historical median, suggesting a premium valuation compared to its peers.

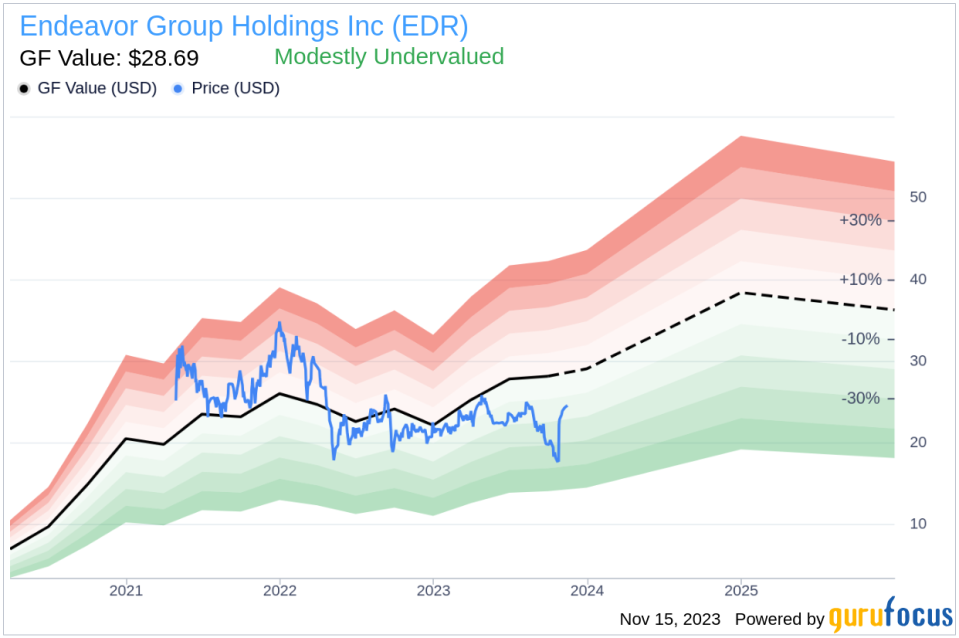

However, with a price of $24.48 and a GuruFocus Value of $28.69, Endeavor Group Holdings Inc has a price-to-GF-Value ratio of 0.85, indicating that the stock is modestly undervalued based on its GF Value. The GF Value is an intrinsic value estimate that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above reflects the recent selling activity by insiders, which could be interpreted in various ways by investors. While some may view this as a negative signal, others might consider the stock's modest undervaluation as an opportunity for investment.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value. The current price-to-GF-Value ratio under 1 suggests that the stock may be undervalued, offering a potential margin of safety for investors.

Conclusion

The recent insider sell by CFO Jason Lublin is a significant event for Endeavor Group Holdings Inc and its investors. While the insider's consistent selling over the past year could raise questions about the stock's future performance, the company's current valuation metrics provide a mixed picture. The high price-earnings ratio contrasts with the GF Value's suggestion of modest undervaluation, presenting a complex scenario for potential investors.

As with any insider transaction, it is essential for investors to consider the broader context, including the company's financial health, industry trends, and overall market conditions. While insider sells can be a red flag, they are just one piece of the puzzle in the comprehensive analysis of a stock's investment potential.

Investors are encouraged to conduct their own due diligence and consider the implications of insider transactions in conjunction with other financial data and market research. Endeavor Group Holdings Inc's position in the dynamic entertainment and sports sectors, along with its current market valuation, will continue to be key factors in assessing its attractiveness as an investment opportunity.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.