Insider Sell: CFO Jason Peterson Sells Shares of EPAM Systems Inc

In the realm of stock market movements, insider trading activity is often a significant indicator that investors and analysts closely monitor. Recently, Jason Peterson, the Chief Financial Officer (CFO) of EPAM Systems Inc (EPAM), sold 750 shares of the company on December 14, 2023. This transaction has caught the attention of market watchers, as insider sales can provide insights into a company's financial health and future prospects.

Before delving into the analysis of this insider activity, it is essential to understand who Jason Peterson is within EPAM Systems Inc. As the CFO, Peterson is responsible for the company's financial functions, including accounting, audit, treasury, corporate finance, and investor relations. His actions and decisions are crucial for the financial strategy and health of the company, making his trading activities particularly noteworthy.

EPAM Systems Inc is a leading global provider of digital platform engineering and software development services. The company assists clients in navigating complex digital transformations, offering services such as consulting, design, and engineering. EPAM's expertise spans various industries, including financial services, healthcare, travel, consumer products, and more, making it a significant player in the tech consulting and services sector.

Now, let's examine the insider trading activity. Over the past year, the insider, Jason Peterson, has sold a total of 1,350 shares and has not made any purchases. This one-sided activity could suggest that the insider is less optimistic about the company's future stock performance or may be diversifying his personal portfolio for other reasons.

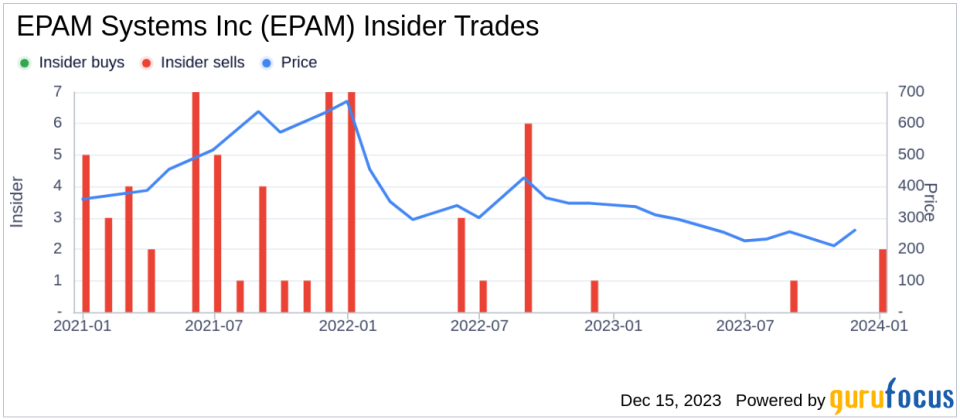

The insider transaction history for EPAM Systems Inc shows a lack of insider buying over the past year, with zero insider buys recorded. However, there have been four insider sells during the same period. This trend might raise questions about the insiders' confidence in the company's stock appreciation potential.

On the valuation front, EPAM Systems Inc's shares were trading at $285 on the day of the insider's recent sale, giving the company a market cap of $16.91 billion. The price-earnings ratio stands at 36.54, which is higher than the industry median of 26.73 but lower than the company's historical median price-earnings ratio. This could indicate that the stock is somewhat overvalued compared to its peers but undervalued in the context of its own trading history.

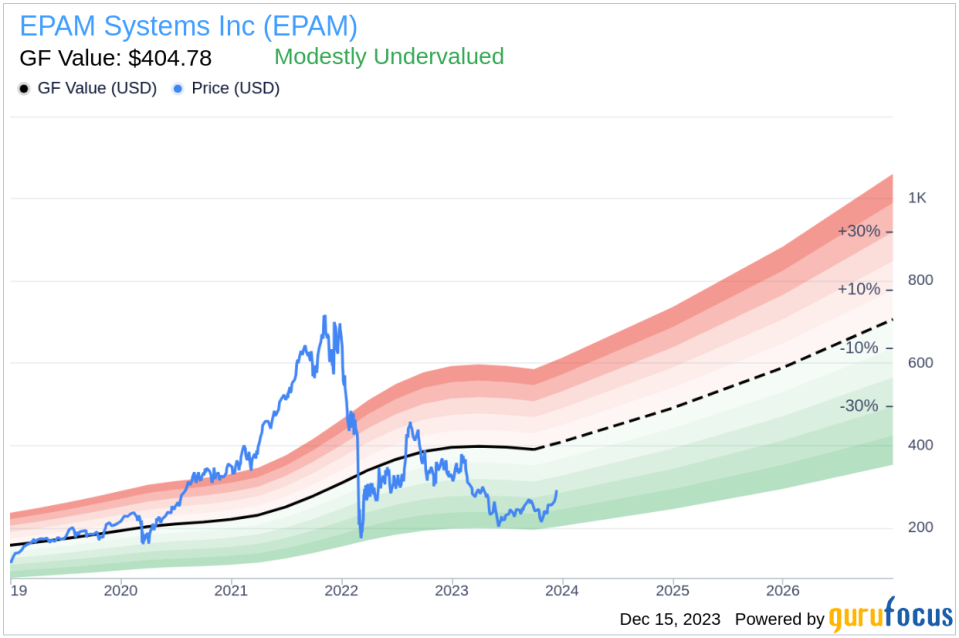

When considering the GuruFocus Value, EPAM Systems Inc has a price-to-GF-Value ratio of 0.7, with a GF Value of $404.78. This suggests that the stock is modestly undervalued based on its intrinsic value estimate, which takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

The insider trend image above provides a visual representation of the insider trading activities, reinforcing the pattern of more sales than purchases over the past year.

The GF Value image further illustrates the stock's current valuation status in relation to its intrinsic value, supporting the notion that EPAM Systems Inc is trading below what GuruFocus considers its fair value.

It is important to note that insider selling does not always indicate a lack of confidence in the company. Insiders might sell shares for various personal reasons, such as portfolio diversification, tax planning, or liquidity needs. However, when insider sales are not accompanied by insider purchases, it can sometimes be interpreted as a bearish signal.

In the case of EPAM Systems Inc, the insider selling activity, particularly by the CFO, could be a point of concern for investors. However, the company's modestly undervalued status according to the GF Value and its solid position in the digital services industry may provide some reassurance. Investors should consider the broader context of the market, the company's performance, and other fundamental factors before making investment decisions based on insider trading activity alone.

Ultimately, while insider trading can provide valuable insights, it is just one piece of the puzzle. A comprehensive analysis that includes financial performance, industry trends, and broader market conditions is essential for making informed investment choices.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.