Insider Sell: CFO Kevin Miller Sells 40,000 Shares of RCM Technologies Inc (RCMT)

RCM Technologies Inc (NASDAQ:RCMT), a provider of business and technology solutions designed to enhance and maximize the operational performance of its customers through the adaptation and deployment of advanced information technology and engineering services, has witnessed a significant insider sell by its Chief Financial Officer (CFO), Kevin Miller. On December 1, 2023, the insider executed a sale of 40,000 shares of the company's stock.

Who is Kevin Miller of RCM Technologies Inc?

Kevin Miller serves as the CFO of RCM Technologies Inc, a role that places him in charge of the company's financial operations, including financial planning and record-keeping, as well as financial reporting to higher management. The CFO's actions, especially in terms of stock transactions, are closely monitored by investors as they can provide insights into the insider's perspective on the company's financial health and future prospects.

RCM Technologies Inc's Business Description

RCM Technologies Inc is a premier provider of business and technology solutions. The company operates through three segments: Engineering, Specialty Health Care, and Information Technology. These services are critical in helping its clients to improve efficiency, reduce costs, and increase revenue. With a focus on innovation and quality, RCM Technologies Inc has established itself as a trusted partner for businesses seeking to leverage technology and engineering expertise to achieve strategic objectives.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

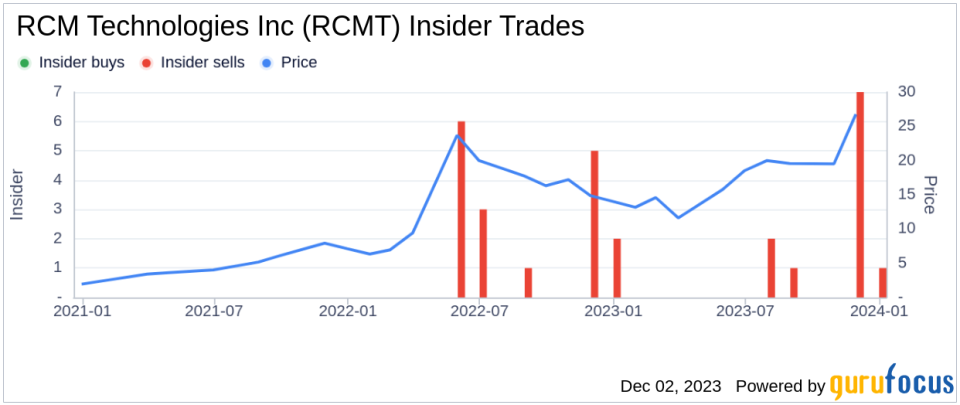

Over the past year, Kevin Miller has sold a total of 70,196 shares and has not made any purchases of the company's stock. This pattern of behavior could suggest that the insider may believe that the shares are fully valued or potentially overvalued at current prices, or it could be part of a personal financial planning strategy unrelated to the insider's outlook on the company.

The insider transaction history for RCM Technologies Inc shows a lack of insider buys over the past year, with a total of 12 insider sells during the same period. This trend can sometimes be interpreted as a lack of confidence among insiders about the company's future performance, although it is essential to consider the broader context and individual circumstances of each transaction.

On the day of the insider's recent sell, shares of RCM Technologies Inc were trading at $27.01, giving the company a market cap of $211.945 million. The price-earnings ratio stood at 14.87, which is higher than the industry median of 12 but lower than the company's historical median price-earnings ratio. This indicates that, while the stock is trading at a premium compared to the industry, it is trading at a discount relative to its own historical valuation.

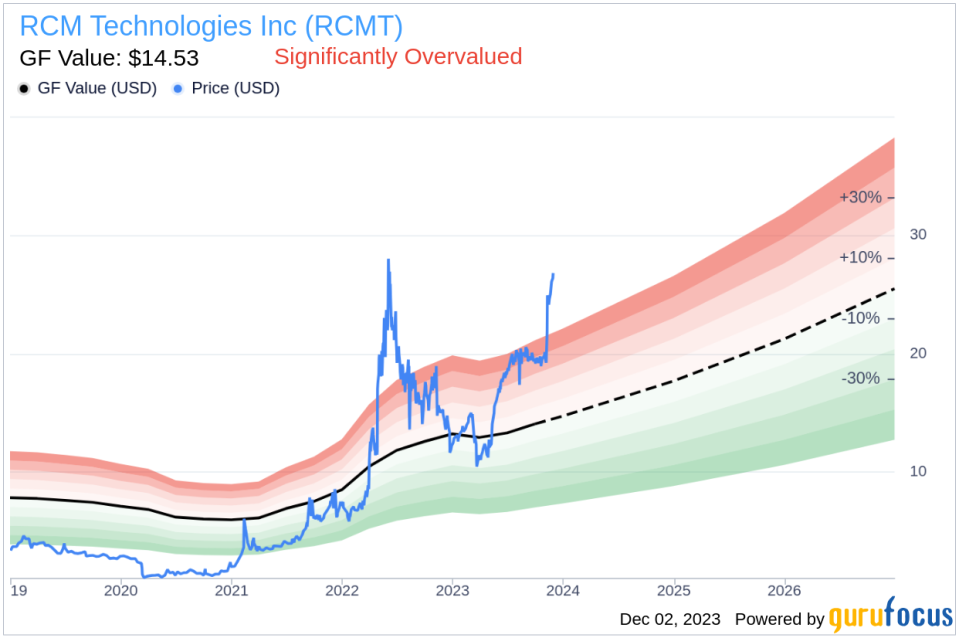

However, with a price of $27.01 and a GuruFocus Value of $14.53, RCM Technologies Inc has a price-to-GF-Value ratio of 1.86, suggesting that the stock is Significantly Overvalued based on its GF Value. The GF Value is an intrinsic value estimate that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above provides a visual representation of the selling and buying activities of insiders over time. A consistent pattern of insider selling, as seen in the case of RCM Technologies Inc, can sometimes lead to negative market sentiment, as investors may perceive that insiders are not confident in the stock's future appreciation.

The GF Value image above illustrates the disparity between the current stock price and the estimated intrinsic value. When the stock price significantly exceeds the GF Value, as it does in the case of RCM Technologies Inc, it may suggest that the stock is overpriced, and investors should exercise caution.

Conclusion

The recent insider sell by CFO Kevin Miller of RCM Technologies Inc, amounting to 40,000 shares, is a notable event that warrants attention from investors. While insider selling can have various motivations, the lack of insider buying over the past year, combined with the stock's high price-to-GF-Value ratio, could be a signal for potential overvaluation. Investors should consider these factors alongside comprehensive analysis of the company's financials, market position, and growth prospects before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.