Insider Sell: CFO Martin Connor Sells 5,000 Shares of Toll Brothers Inc (TOL)

Martin Connor, Chief Financial Officer of Toll Brothers Inc (NYSE:TOL), a leading builder of luxury homes, sold 5,000 shares of the company on March 20, 2024. The transaction was filed with the SEC and can be found in the following SEC Filing.

Toll Brothers Inc (NYSE:TOL) specializes in constructing luxury residential single-family detached homes, townhomes, and high-rise condominiums. The company operates in several major metropolitan areas in the United States.

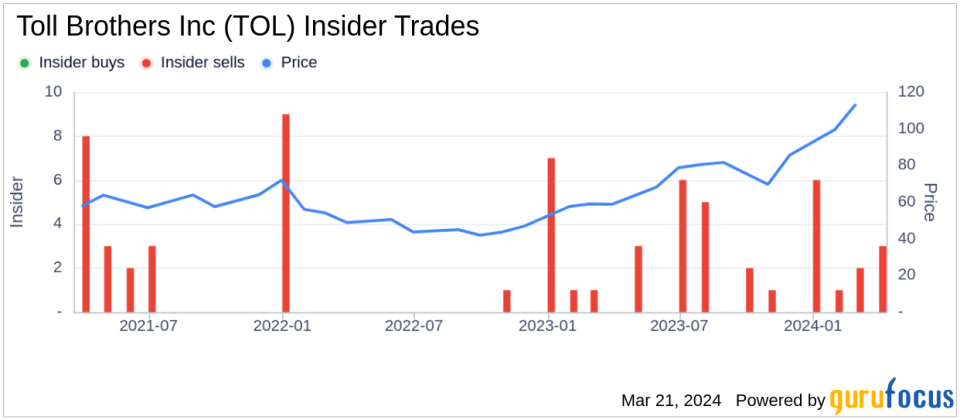

Over the past year, the insider has sold a total of 62,550 shares and has not made any purchases of the company's stock. The recent sale of 5,000 shares is part of this ongoing trend of share disposals by the insider.

The insider transaction history for Toll Brothers Inc (NYSE:TOL) indicates a pattern of insider sales, with 29 insider sells recorded over the past year and no insider buys during the same period.

On the date of the insider's recent sale, shares of Toll Brothers Inc (NYSE:TOL) were trading at $123.9, resulting in a market capitalization of $13.180 billion.

The company's price-earnings ratio stands at 9.78, which is below both the industry median of 10.96 and the historical median price-earnings ratio for the company.

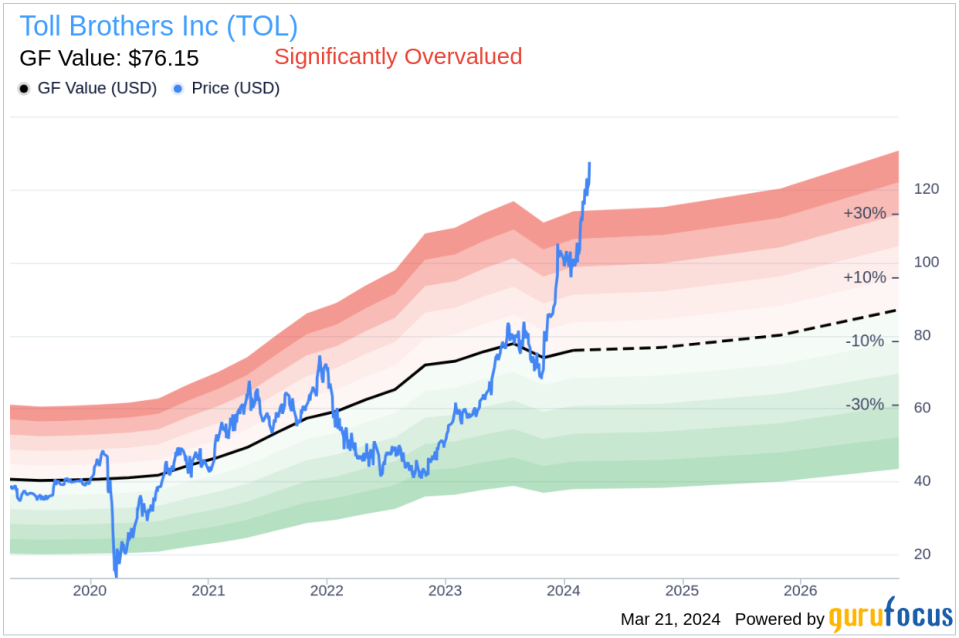

Toll Brothers Inc (NYSE:TOL) has a price-to-GF-Value ratio of 1.63, with the stock trading at $123.9 and a GuruFocus Value of $76.15. This indicates that the stock is considered Significantly Overvalued according to the GF Value metric.

The GF Value is calculated based on historical trading multiples, a GuruFocus adjustment factor related to the company's past performance, and future business performance estimates provided by Morningstar analysts.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.