Insider Sell: CFO Michael Brophy Sells 2,291 Shares of Natera Inc

On September 29, 2023, Michael Brophy, the Chief Financial Officer of Natera Inc (NASDAQ:NTRA), sold 2,291 shares of the company. This move is part of a larger trend of insider selling at Natera Inc, which we will explore in this article.

Michael Brophy has been with Natera Inc for several years, serving as the company's CFO. His role involves overseeing the company's financial operations, including budgeting, financial planning, and risk management. His insider trades provide valuable insights into the company's financial health and future prospects.

Natera Inc is a global leader in cell-free DNA testing. The company's mission is to change the management of disease worldwide. Natera operates an ISO 13485-certified and CAP-accredited laboratory certified under the Clinical Laboratory Improvement Amendments (CLIA) in San Carlos, California. It offers proprietary genetic testing services to inform obstetricians, transplant physicians, oncologists, and cancer researchers, including biopharmaceutical companies, about the simple, non-invasive, prenatal, post-transplant, and cancer diagnostics.

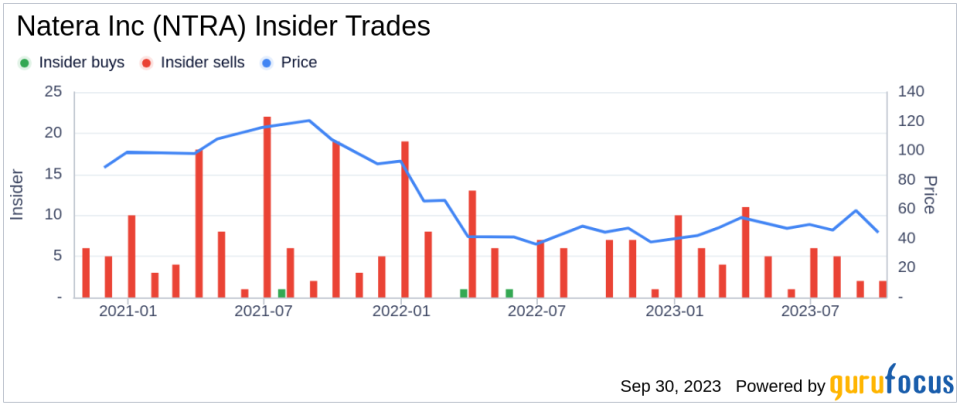

Over the past year, Michael Brophy has sold a total of 131,505 shares and purchased 0 shares. This trend of selling without any insider buying raises questions about the company's future prospects.

The insider transaction history for Natera Inc shows a total of 0 insider buys and 64 insider sells over the past year. This trend suggests that insiders may be less confident in the company's future performance.

On the day of the insider's recent sell, shares of Natera Inc were trading for $45.91 apiece, giving the stock a market cap of $5.27 billion. Despite the insider selling, the stock's price remains relatively stable.

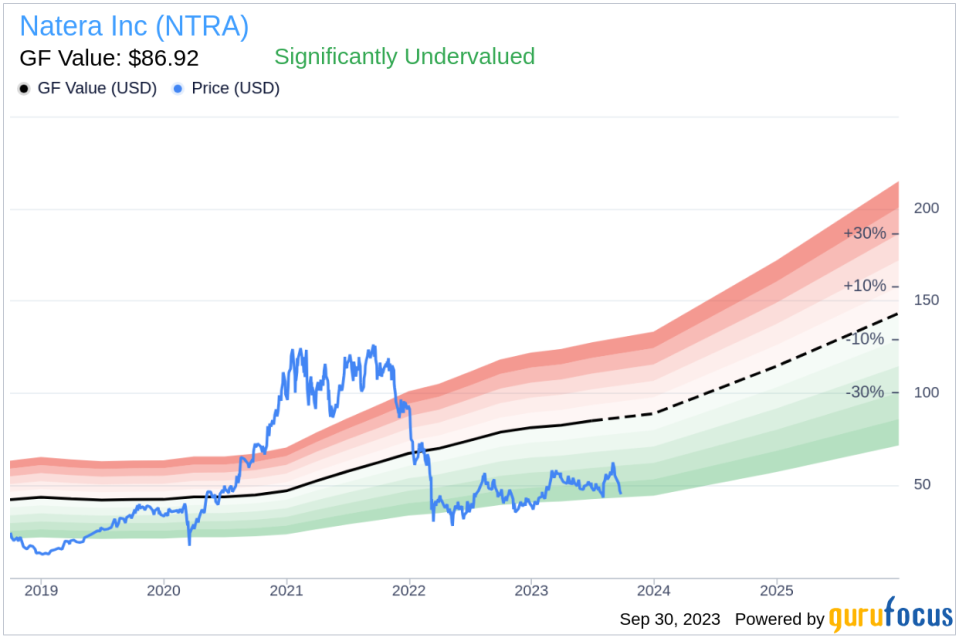

According to GuruFocus Value, Natera Inc is significantly undervalued. With a price of $45.91 and a GuruFocus Value of $86.92, the stock has a price-to-GF-Value ratio of 0.53. This suggests that the stock is undervalued and could be a good investment opportunity.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, while the insider's recent sell and the overall trend of insider selling at Natera Inc may raise some concerns, the stock's current undervaluation suggests that it could still be a good investment opportunity. However, potential investors should conduct their own research and consider other factors before making an investment decision.

This article first appeared on GuruFocus.