Insider Sell: CFO Michael Brophy Sells 3,940 Shares of Natera Inc

On October 23, 2023, Michael Brophy, the Chief Financial Officer of Natera Inc (NASDAQ:NTRA), sold 3,940 shares of the company. This move is part of a broader trend of insider selling at Natera Inc, which we will explore in more detail.

Michael Brophy has been with Natera Inc for several years, serving in the crucial role of Chief Financial Officer. His responsibilities include overseeing the company's financial operations and strategy, making his trading activities particularly noteworthy for investors.

Natera Inc is a pioneer in the field of genetic testing. The company provides a host of services, including prenatal testing, oncology testing, and organ transplant assessment. With its innovative technology and comprehensive services, Natera Inc has established a strong presence in the healthcare sector.

Over the past year, the insider has sold a total of 132,957 shares and has not purchased any shares. This trend is mirrored in the broader insider trading activity at Natera Inc, with 61 insider sells and no insider buys over the same period.

The high volume of insider selling could be a cause for concern for some investors. However, it's important to note that insider selling does not necessarily indicate a lack of confidence in the company. Insiders may sell shares for a variety of reasons, including personal financial planning or portfolio diversification.

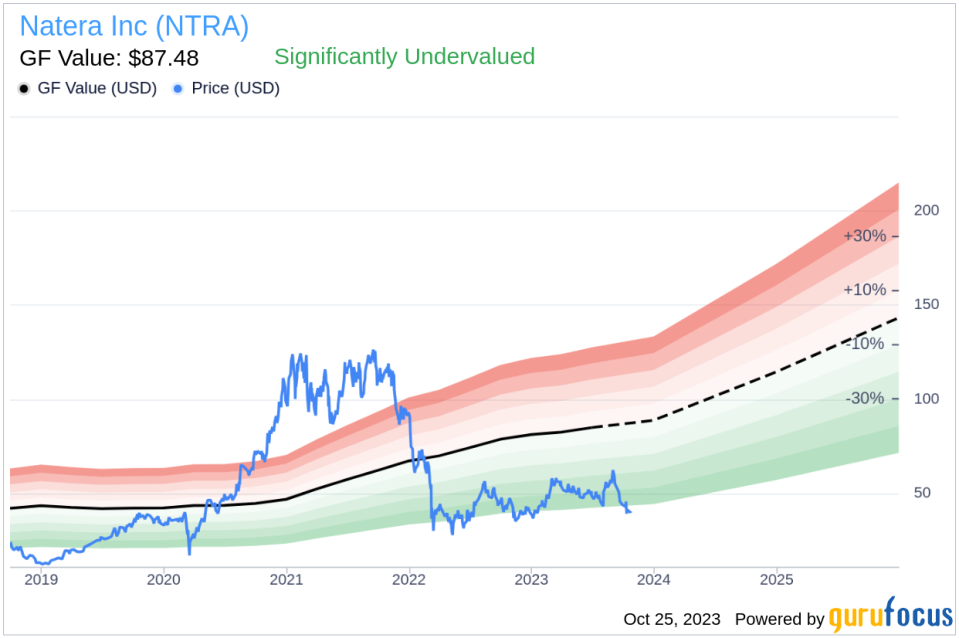

On the day of the insider's recent sell, shares of Natera Inc were trading at $40.4, giving the company a market cap of $4.86 billion. Despite the insider selling, the stock appears to be significantly undervalued based on its GuruFocus Value of $87.48.

The GF Value is a proprietary estimate of intrinsic value developed by GuruFocus. It takes into account historical multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. With a price-to-GF-Value ratio of 0.46, Natera Inc's stock is significantly undervalued according to this measure.

In conclusion, while the insider's recent sell and the broader trend of insider selling at Natera Inc may raise some eyebrows, the stock's current valuation suggests that it could still be an attractive investment opportunity. As always, investors should conduct their own due diligence and consider multiple factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.