Insider Sell: CFO Preto Del Sells 1,500 Shares of Sprout Social Inc

On August 7, 2023, Preto Del, the CFO and Treasurer of Sprout Social Inc (NASDAQ:SPT), sold 1,500 shares of the company. This move is part of a series of transactions made by Del over the past year, during which he sold a total of 25,565 shares and made no purchases.

Preto Del has been with Sprout Social Inc for several years, serving in various financial roles before becoming CFO and Treasurer. His insider knowledge of the company's financial health and strategic direction makes his stock transactions particularly noteworthy for investors.

Sprout Social Inc is a leading provider of social media management and optimization solutions for business. The company's platform enables businesses to manage their social media presence, engage with their audience, and analyze social media data to make informed business decisions. With a market cap of $2.601 billion, Sprout Social Inc is a significant player in the social media management industry.

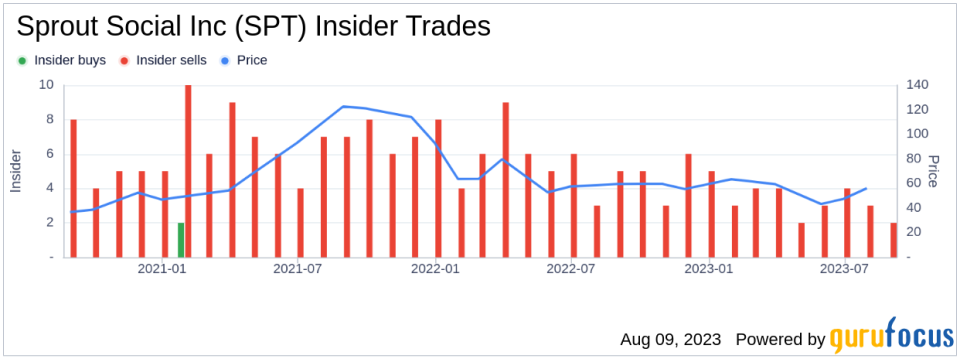

The insider transaction history for Sprout Social Inc shows a trend of more sells than buys over the past year. There have been 48 insider sells and 0 insider buys in total. This could indicate that insiders believe the stock is currently overvalued, or it could simply reflect personal financial decisions by the insiders.

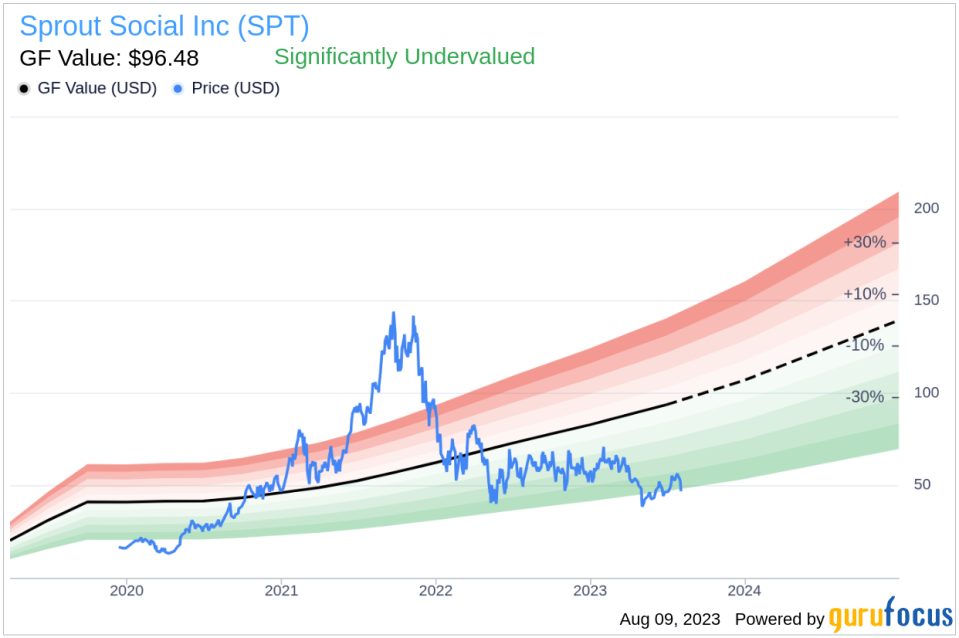

On the day of Del's recent sell, Sprout Social Inc's shares were trading at $46.62. This gives the stock a price-to-GF-Value ratio of 0.48, indicating that it is significantly undervalued according to the GuruFocus Value of $96.48.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts. In the case of Sprout Social Inc, the GF Value suggests that the stock has significant upside potential.

However, investors should also consider the insider sell trend when making investment decisions. While the GF Value indicates that the stock is undervalued, the fact that insiders, including CFO Preto Del, have been selling shares could suggest that they believe the stock's current price is more than fair.

As always, it's important for investors to do their own research and consider multiple factors before making investment decisions.

This article first appeared on GuruFocus.