Insider Sell: CFO Richard Riggsbee Sells 30,000 Shares of Myriad Genetics Inc

On November 1, 2023, Richard Riggsbee, the Chief Financial Officer (CFO) of Myriad Genetics Inc (NASDAQ:MYGN), sold 30,000 shares of the company. This move is part of a series of transactions made by the insider over the past year, which have seen a total of 75,000 shares sold and no shares purchased.

Myriad Genetics Inc is a leading global company in the field of molecular diagnostics and personalized medicine. The company is dedicated to saving lives and improving the quality of life of patients worldwide through the discovery and commercialization of novel, transformative diagnostic products and services across major diseases.

The insider's recent sell-off has raised eyebrows among investors and market watchers, prompting a closer look at the company's stock performance and insider trading trends.

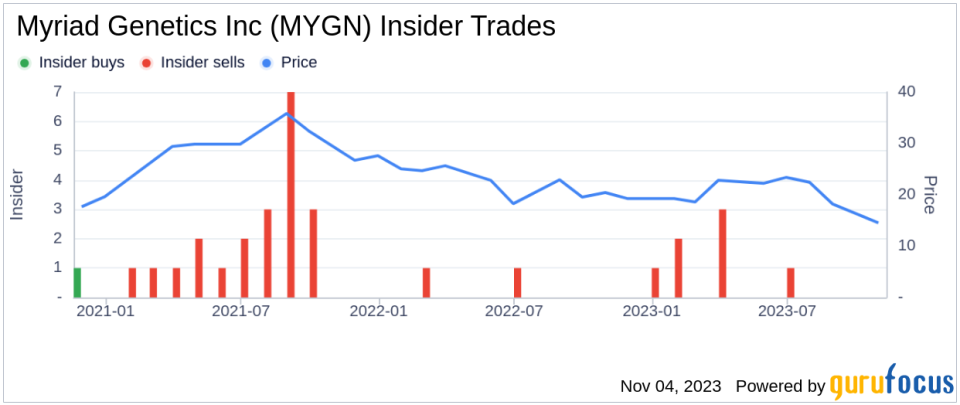

The insider transaction history for Myriad Genetics Inc shows a clear trend of insider selling over the past year. There have been 8 insider sells in total, with no insider buys recorded. This trend could be a signal to investors about the insider's confidence in the company's future performance. However, it's important to note that insider selling does not necessarily indicate a negative outlook. Insiders may sell shares for personal reasons or to diversify their investment portfolio.

On the day of the insider's recent sell, shares of Myriad Genetics Inc were trading at $15.69, giving the company a market cap of $1.39 billion.

According to the GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, Myriad Genetics Inc has a GF Value of $24.30. With a price of $15.69, the stock has a price-to-GF-Value ratio of 0.65. This suggests that the stock is a possible value trap, and investors should think twice before making a decision.

In conclusion, the insider's recent sell-off of Myriad Genetics Inc shares, coupled with the company's valuation and insider trading trends, provides valuable insights for investors. While the insider's actions may raise concerns, it's crucial for investors to consider the broader market context and the company's fundamentals before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.