Insider Sell: CFO and Secretary Kyle Beilman Divests 4,188 Shares of Dave Inc (DAVE)

Kyle Beilman, the Chief Financial Officer and Secretary of Dave Inc (NASDAQ:DAVE), sold 4,188 shares of the company on March 14, 2024, according to a recent SEC Filing. The transaction was executed at an average price of $33.26 per share, resulting in a total value of $139,219.68.

Dave Inc (NASDAQ:DAVE) is a financial technology company that offers a range of financial products and services designed to help customers manage their personal finances. The company's offerings include budgeting tools, predictive account monitoring, and a cash advance service to help users cover upcoming expenses without incurring overdraft fees. Dave Inc aims to provide an alternative to traditional banking and help customers achieve financial stability.

Over the past year, the insider has sold a total of 8,526 shares of Dave Inc (NASDAQ:DAVE) and has not made any purchases of the stock. The recent sale by the insider is part of a series of transactions that have taken place over the last twelve months.

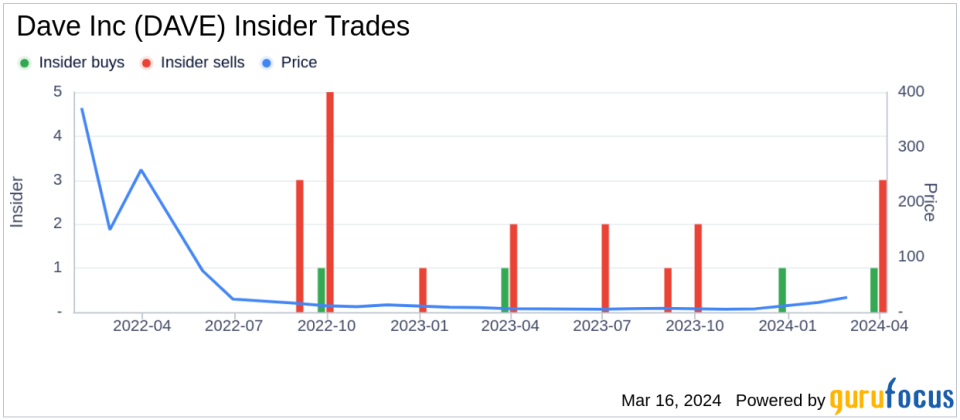

The insider transaction history for Dave Inc (NASDAQ:DAVE) indicates a pattern of insider activity. There have been 2 insider buys and 9 insider sells over the past year. This trend can be visualized in the following insider trend image:

On the valuation front, Dave Inc (NASDAQ:DAVE) shares were trading at $33.26 on the day of the insider's recent transaction. The company's market capitalization stood at $419.551 million at that time.

For more information on insider trades at Dave Inc (NASDAQ:DAVE), interested individuals can refer to the company's insider trading history available on public databases and financial information websites.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.