Insider Sell: CFO Shai Shahar Sells Shares of FormFactor Inc (FORM)

In a notable insider transaction, Shai Shahar, the CFO and SVP Global Finance of FormFactor Inc (NASDAQ:FORM), sold 16,618 shares of the company on November 20, 2023. This move has caught the attention of investors and market analysts, as insider sales can provide valuable insights into a company's financial health and future prospects.

Who is Shai Shahar of FormFactor Inc?

Shai Shahar has been serving as the Chief Financial Officer and Senior Vice President of Global Finance at FormFactor Inc. With a significant role in the company's financial operations, Shahar's decisions and actions are closely monitored by investors. His insider transactions, in particular, are scrutinized for indications of the company's internal confidence and potential future performance.

FormFactor Inc's Business Description

FormFactor Inc is a leading provider of essential test and measurement technologies along the full IC life cycle from characterization, modeling, reliability, and design de-bug, to qualification and production test. The company's semiconductor wafer probe cards are used in the manufacturing of integrated circuits and are essential for ensuring the quality and reliability of semiconductor devices. With a focus on innovation and customer satisfaction, FormFactor plays a critical role in the advancement of today's most sophisticated electronics.

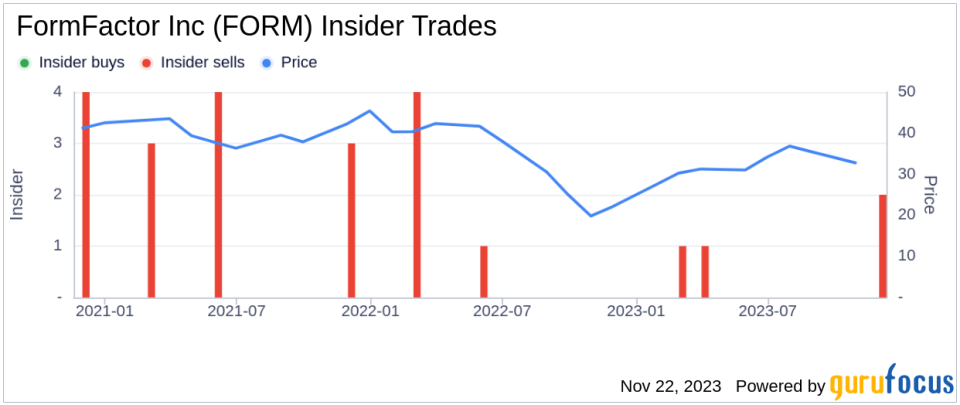

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions, particularly those involving high-ranking executives like CFOs, can be a strong indicator of a company's internal perspective. In the case of FormFactor Inc, the insider, Shai Shahar, has sold a total of 45,737 shares over the past year without purchasing any shares. This pattern of behavior could suggest that the insider may perceive the stock's current price as being on the higher side, potentially overvalued, or it could be part of a personal financial planning strategy.

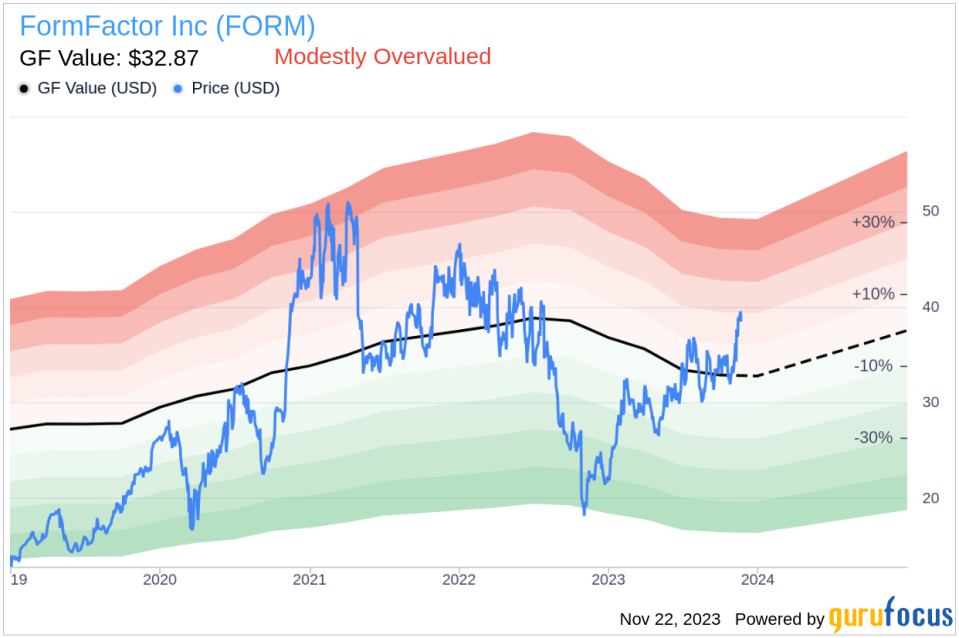

On the day of the insider's recent sale, shares of FormFactor Inc were trading at $39.49, giving the company a market cap of $2.999 billion. This price point is above the GuruFocus Value (GF Value) of $32.87, indicating that the stock is modestly overvalued with a price-to-GF-Value ratio of 1.2.

The GF Value is a proprietary metric developed by GuruFocus, which takes into account historical trading multiples, an adjustment factor based on the company's past performance, and future business performance estimates provided by Morningstar analysts. When the stock trades above this value, it suggests that investors are paying a premium compared to the stock's estimated intrinsic value.

It is important to consider that insider sales can be motivated by various factors and do not always signal a lack of confidence in the company. Insiders might sell shares for personal financial reasons, such as diversifying their investment portfolio, funding personal expenses, or tax planning. Therefore, while insider sales can provide context, they should not be the sole basis for investment decisions.

Insider Trends

The insider transaction history for FormFactor Inc shows a lack of insider purchases over the past year, with a total of 5 insider sells during the same period. This trend could be interpreted as a lack of bullish sentiment among insiders, as they have chosen to reduce their holdings rather than acquire more shares.

Valuation

With the stock trading at a premium to its GF Value, investors should consider whether the current stock price reflects the company's future growth prospects and financial performance. The modest overvaluation suggests that the market may be expecting higher growth or profitability that may or may not materialize.

It is also crucial to analyze the company's fundamentals, including its revenue growth, profit margins, and competitive position in the market, to determine if the current stock price is justified. A thorough analysis will help investors decide if the premium is warranted or if the stock's valuation is stretched.

In conclusion, the insider sale by CFO Shai Shahar of FormFactor Inc is a significant event that warrants attention. While the stock appears modestly overvalued based on the GF Value, investors should conduct a comprehensive analysis, considering both insider trends and the company's fundamental performance, before making any investment decisions. As always, insider transactions are just one piece of the puzzle, and a holistic approach to investment analysis is recommended.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.