Insider Sell: CFO Shai Shahar Sells 24,360 Shares of FormFactor Inc (FORM)

In a notable insider transaction, Shai Shahar, the CFO and SVP Global Finance of FormFactor Inc (NASDAQ:FORM), sold 24,360 shares of the company on November 10, 2023. This sale has caught the attention of investors and analysts, as insider transactions can provide valuable insights into a company's financial health and future prospects.

Who is Shai Shahar of FormFactor Inc?

Shai Shahar has been serving as the Chief Financial Officer and Senior Vice President of Global Finance at FormFactor Inc. His role at the company involves overseeing the financial operations, including financial planning and analysis, accounting, and investor relations. Shahar's financial expertise and strategic decision-making are crucial for FormFactor's growth and stability. His insider transactions are closely monitored, as they can reflect his confidence in the company's financial strategies and market position.

FormFactor Inc's Business Description

FormFactor Inc is a leading provider of essential test and measurement technologies along the full IC life cycle from wafer to characterization to reliability and failure analysis. The company's products and services are utilized by semiconductor manufacturers to advance their technology roadmaps and improve yields, while reducing time to market. FormFactor's innovative probe cards, analytical probes, probe stations, and thermal sub-systems offer a comprehensive approach to enhance the performance of electronic devices. The company's market cap of $2.981 billion reflects its significant role in the semiconductor industry.

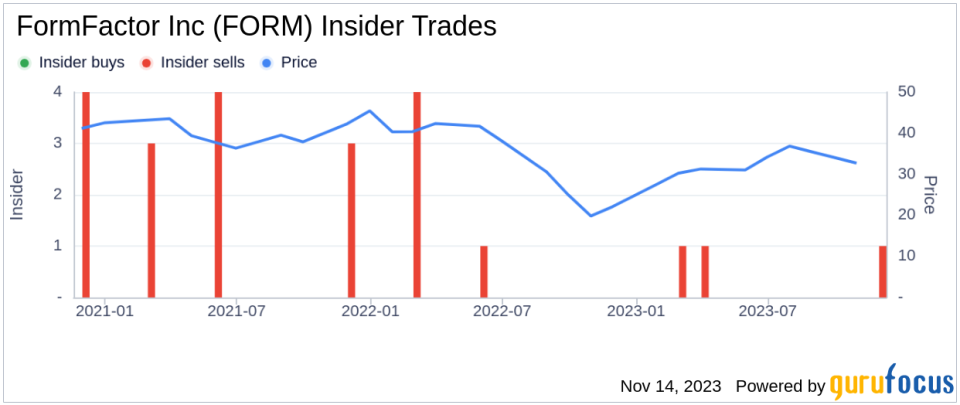

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions, particularly those involving high-ranking executives like CFOs, can be a strong indicator of a company's internal perspective on its stock's value. In the case of FormFactor Inc, the insider, Shai Shahar, has been on a selling streak over the past year, having sold a total of 29,119 shares without purchasing any. This pattern of behavior could suggest that the insider may perceive the stock's current price as being on the higher end of its value spectrum, or it could be part of a personal financial planning strategy.

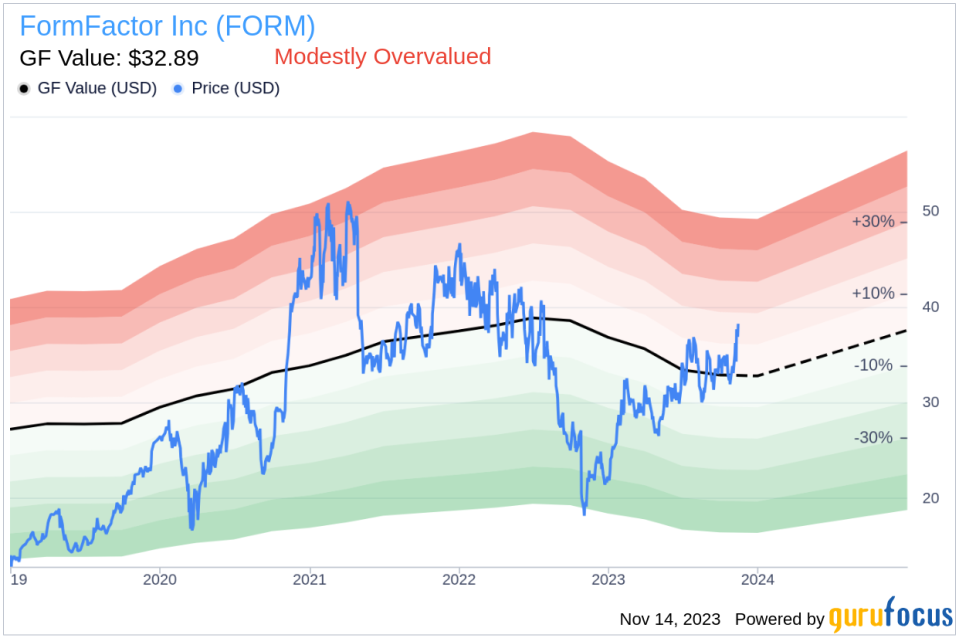

On the day of the insider's recent sale, shares of FormFactor Inc were trading at $36.4, which gives the company a market cap of approximately $2.981 billion. This price point is above the GuruFocus Value (GF Value) of $32.89, indicating that the stock is modestly overvalued with a price-to-GF-Value ratio of 1.11.

The GF Value is a proprietary intrinsic value estimate used by GuruFocus, which is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts. When an insider sells shares at a price above the GF Value, it may raise questions about the stock's potential for near-term growth.

However, it's important to consider that insider sales can be motivated by various factors unrelated to the company's performance, such as personal financial management or diversification. Therefore, while insider sales can provide context, they should not be the sole factor in investment decisions.

The insider trend image above illustrates the recent selling activity by insiders at FormFactor Inc. The absence of insider purchases over the past year, coupled with the consistent selling, could be interpreted as a lack of bullish sentiment among those with intimate knowledge of the company's operations and financials.

The GF Value image provides a visual representation of the stock's valuation in relation to its intrinsic value. The current modest overvaluation suggests that investors may want to exercise caution and conduct further analysis before making investment decisions.

Conclusion

The recent insider sale by Shai Shahar at FormFactor Inc is a significant event that warrants attention from investors. While the sale could suggest a belief that the stock is currently overvalued, it is essential to consider all possible motivations behind the transaction. Investors should analyze the company's financials, industry trends, and broader market conditions, along with insider activity, to make informed investment decisions. As always, a diversified investment approach is recommended to mitigate risks associated with reliance on single data points such as insider transactions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.