Insider Sell: CFO Stephen Gordon Sells 5,000 Shares of TransMedics Group Inc

On October 2, 2023, Stephen Gordon, the Chief Financial Officer of TransMedics Group Inc (NASDAQ:TMDX), sold 5,000 shares of the company. This move is part of a larger trend, as over the past year, the insider has sold a total of 45,000 shares and purchased none.

TransMedics Group Inc is a commercial-stage medical technology company transforming organ transplant therapy for end-stage heart, lung, and liver failure patients. The company's Organ Care System (OCS) is a revolutionary technology that allows organs to be preserved and optimized in a near-physiologic condition outside the body, increasing the potential for successful transplantation.

The insider's recent sell has raised questions among investors and analysts about the company's future prospects. The relationship between insider trading and stock price is often seen as a barometer of a company's health. Insiders usually sell their shares for various reasons, but they buy them for only one: they think the price will rise.

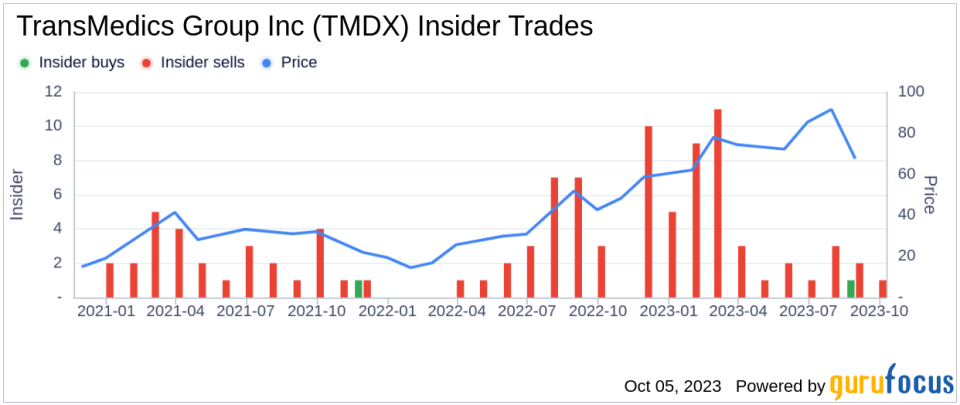

The insider transaction history for TransMedics Group Inc shows a trend of more sells than buys over the past year. There have been 49 insider sells and only 1 insider buy during this period. This could be a signal that insiders believe the company's stock is overvalued, or it could simply reflect personal financial decisions by the insiders.

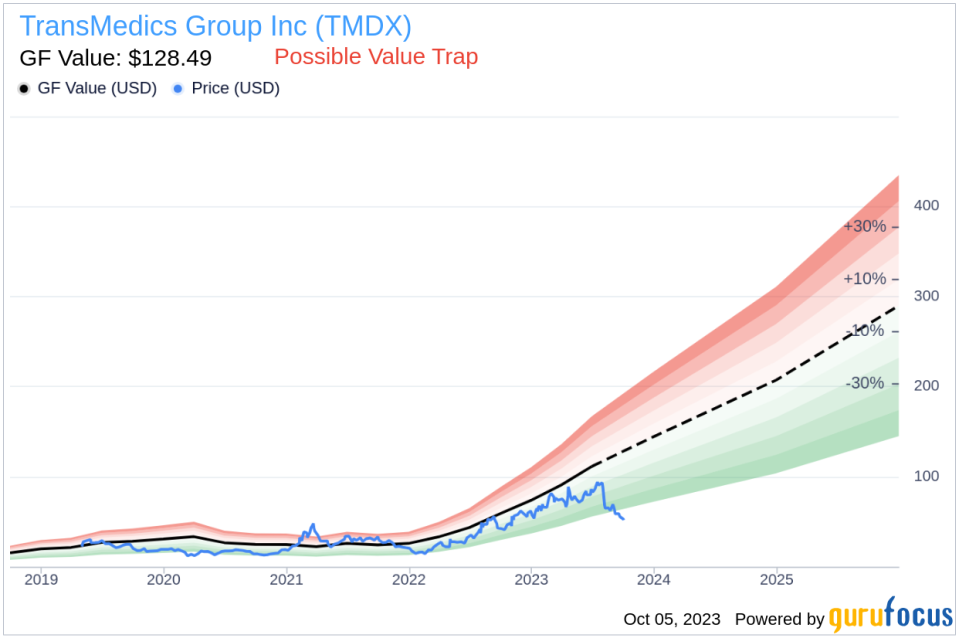

On the day of the insider's recent sell, shares of TransMedics Group Inc were trading at $54.22, giving the company a market cap of $1.713 billion.

With a price of $54.22 and a GuruFocus Value of $128.49, TransMedics Group Inc has a price-to-GF-Value ratio of 0.42. This suggests that the stock is a possible value trap, and investors should think twice before investing. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

In conclusion, the recent sell by the insider, coupled with the company's valuation, suggests that investors should exercise caution when considering TransMedics Group Inc. While the company's revolutionary technology holds promise, the insider's sell activity and the stock's valuation indicate potential risks.

This article first appeared on GuruFocus.