Insider Sell: CFO Stephen Vintz Sells 89,995 Shares of Tenable Holdings Inc (TENB)

Tenable Holdings Inc (NASDAQ:TENB), a company specializing in cybersecurity solutions, including vulnerability assessment and management, has reported an insider sell according to a recent SEC filing. The company's Chief Financial Officer, Stephen Vintz, sold 89,995 shares of the company on March 21, 2024. The transaction was disclosed in an SEC Filing.

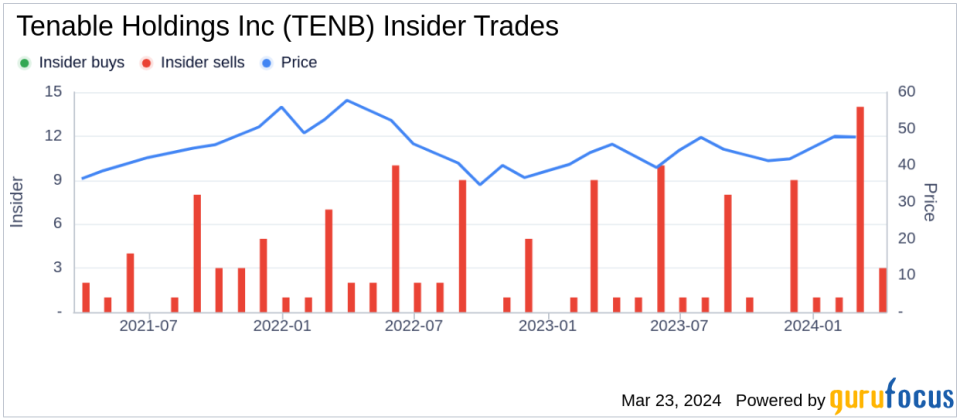

Over the past year, the insider has sold a total of 341,862 shares and has not made any purchases of the company's stock. This latest transaction continues a trend of insider sells at Tenable Holdings Inc, with a total of 52 insider sells and no insider buys reported over the same timeframe.

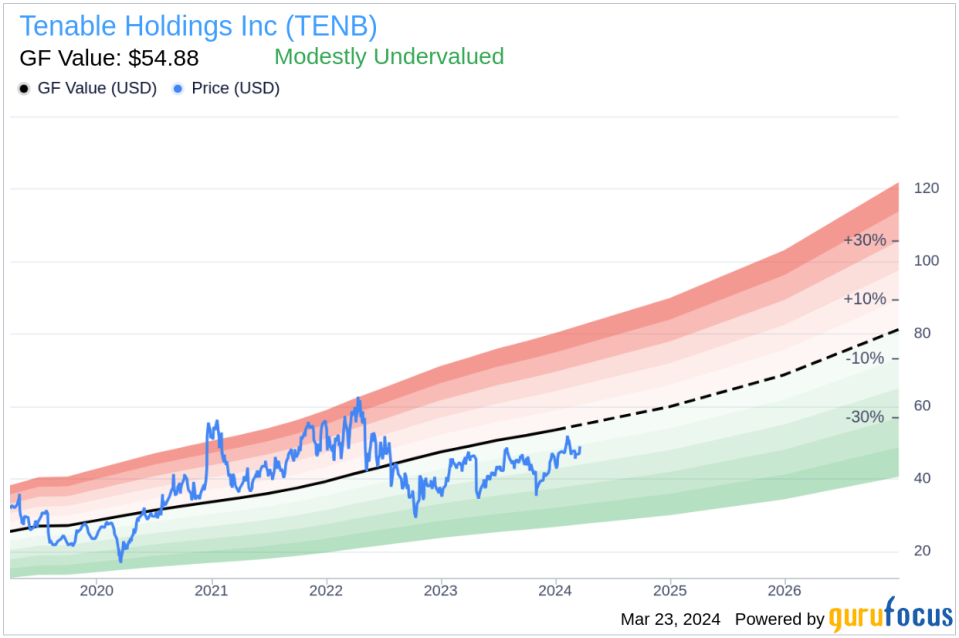

On the day of the sale, shares of Tenable Holdings Inc were trading at $49.08, giving the company a market capitalization of $5.719 billion. The stock's price-to-GF-Value ratio stands at 0.89, indicating that Tenable Holdings Inc is modestly undervalued according to the GF Value, which is set at $54.88. The GF Value is a proprietary intrinsic value estimate from GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor based on the company's historical returns and growth, and future business performance estimates from Morningstar analysts.

The insider's recent sell may attract the attention of investors who track insider behaviors as an indicator of a company's future performance. However, it is important to consider the broader context of the company's financial health, market position, and industry trends when evaluating the significance of insider transactions.

Investors and analysts often monitor insider sells to gain insights into a company's internal perspective. While a single insider sell may not be indicative of the company's trajectory, a pattern of insider selling, as seen with Tenable Holdings Inc, could suggest that insiders might believe the shares are fully valued or that they are taking profits after a period of stock appreciation.

It is also worth noting that insider transactions are subject to various motivations and may not always be directly related to the company's performance. Insiders might sell shares for personal financial planning, diversification, or other reasons that do not necessarily reflect their outlook on the company's future.

Tenable Holdings Inc continues to be a key player in the cybersecurity space, providing critical solutions to help organizations assess, manage, and reduce their cyber risk. The company's financial performance, market trends, and the broader economic environment will likely be more significant factors for potential investors to consider.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.