Insider Sell: CFO Stephen Vintz Sells 3,411 Shares of Tenable Holdings Inc (TENB)

Stephen Vintz, the Chief Financial Officer of Tenable Holdings Inc, has recently sold 3,411 shares of the company's stock, according to a Form 4 filed with the Securities and Exchange Commission. The transaction took place on November 27, 2023, and has caught the attention of investors and analysts alike, as insider activity can often provide valuable insights into a company's financial health and future prospects.

Who is Stephen Vintz of Tenable Holdings Inc?

Stephen Vintz is a seasoned financial executive with a track record of leading finance operations and strategy. As the CFO of Tenable Holdings Inc, Vintz is responsible for overseeing the company's financial functions, including accounting, treasury, financial planning and analysis, tax, and investor relations. His role is crucial in shaping the company's financial strategy and ensuring that Tenable remains financially healthy and well-positioned for growth.

Tenable Holdings Inc's Business Description

Tenable Holdings Inc is a cybersecurity company that specializes in vulnerability management. The company's platform, Tenable.io, helps organizations understand and reduce their cybersecurity risk by identifying, investigating, and prioritizing vulnerabilities. Tenable's solutions are used by a wide range of customers, including many Fortune 500 companies, government agencies, and mid-sized businesses across various industries. The company's commitment to innovation and customer success has made it a respected name in the cybersecurity space.

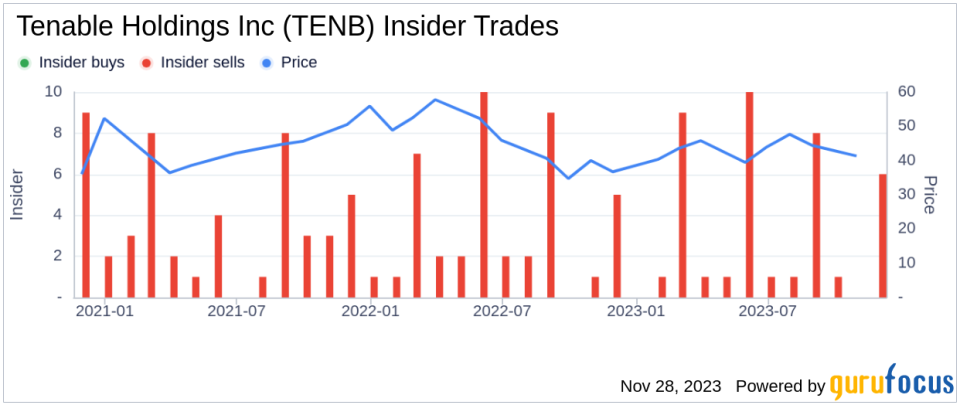

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions are closely monitored by investors as they can provide clues about a company's internal view of its stock's value. Over the past year, Stephen Vintz has sold a total of 50,835 shares and has not made any purchases. This pattern of selling without corresponding buys could signal that insiders might believe the stock is fully valued or potentially overvalued at current levels.

However, it's important to consider the context of these sales. Insiders may sell shares for various reasons unrelated to their outlook on the company, such as diversifying their personal portfolio, tax planning, or other personal financial considerations. Without additional information, it's difficult to draw definitive conclusions from these transactions alone.

When examining the relationship between insider selling and the stock price, it's noteworthy that Tenable Holdings Inc's shares were trading at $40.02 on the day of Vintz's recent sale. With a market cap of $4.879 billion, the company's valuation is significant in the cybersecurity sector.

The stock's price-to-GF-Value ratio stands at 0.68, indicating that the stock is modestly undervalued based on its GF Value of $58.99. This suggests that despite the insider selling, the market may not be fully recognizing the company's intrinsic value as estimated by GuruFocus.

The GF Value is a proprietary intrinsic value estimate that considers historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The fact that Tenable's stock is trading below its GF Value could imply that the stock has room to grow, potentially offering an attractive entry point for investors.

The insider trend image above provides a visual representation of the insider selling pattern at Tenable Holdings Inc. With 41 insider sells and no insider buys over the past year, the trend suggests that insiders have been consistently reducing their holdings.

The GF Value image further illustrates the stock's current valuation in relation to its estimated intrinsic value. The modestly undervalued status could be an indicator for potential investors that the stock might be a good buy, despite the recent insider selling activity.

Conclusion

While the insider's recent sale of shares could raise questions among investors, it's essential to look at the broader picture. Tenable Holdings Inc's position as a leader in the cybersecurity industry, combined with its current valuation below the GF Value, suggests that the company may still present a compelling investment opportunity. Investors should consider the insider selling trends in the context of the company's overall financial health, market position, and future growth prospects before making investment decisions.

As always, it's recommended that investors conduct their own due diligence and consider multiple factors, including insider transactions, financial performance, industry trends, and broader market conditions, before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.