Insider Sell: CFO W Hill Sells 25,000 Shares of Alkami Technology Inc (ALKT)

Alkami Technology Inc (NASDAQ:ALKT), a leading provider of cloud-based digital banking solutions, has recently witnessed a significant insider transaction. The company's Chief Financial Officer, W Hill, sold 25,000 shares on November 22, 2023. This move has caught the attention of investors and market analysts, as insider transactions can often provide valuable insights into a company's financial health and future prospects.

Who is W Hill of Alkami Technology Inc?

W Hill serves as the Chief Financial Officer of Alkami Technology Inc. With a background in finance and strategic planning, Hill has been instrumental in steering the financial direction of the company. The insider's role is critical in managing Alkami's financial operations, including capital structure, investments, and risk management. Hill's transactions in the company's stock are closely monitored, as they can reflect the insider's confidence in the company's future performance.

Alkami Technology Inc's Business Description

Alkami Technology Inc is a tech company that specializes in providing cloud-based platforms for financial institutions. The company's digital banking solutions are designed to empower banks and credit unions with a seamless, secure, and intuitive interface for their customers. Alkami's products include retail banking, business banking, and digital account opening, among others. The company's innovative approach to digital banking has positioned it as a leader in the industry, catering to the evolving needs of modern financial consumers.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions, particularly those involving high-ranking executives like CFOs, can be a strong indicator of a company's internal perspective on its stock's value. In the case of Alkami Technology Inc, the insider's recent sale of 25,000 shares could signal various things. It's important to consider the context of this transaction, including the insider's past trading history, the company's performance, and the overall market conditions.

Over the past year, W Hill has sold a total of 50,000 shares and purchased 40,000 shares. This activity suggests a balanced approach to portfolio management by the insider, possibly aligning with personal financial planning or diversification strategies. However, the recent sale is substantial and may prompt investors to delve deeper into the potential reasons behind it.

The insider transaction history for Alkami Technology Inc shows a trend of more insider sells than buys over the past year, with 1 insider buy and 7 insider sells. This pattern could indicate that insiders, on balance, see the stock's current price as favorable for selling rather than buying. However, without additional context, it's difficult to draw definitive conclusions from this data alone.

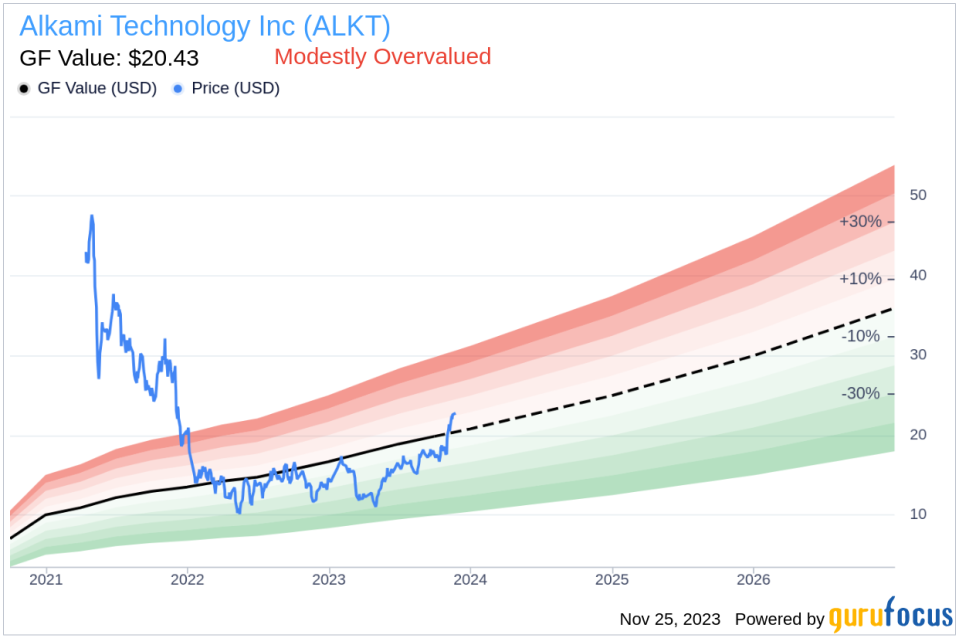

On the day of the insider's recent sale, shares of Alkami Technology Inc were trading at $22.69, giving the company a market cap of $2.172 billion. This valuation places the stock in the modestly overvalued category according to the GuruFocus Value, which is set at $20.43. The price-to-GF-Value ratio of 1.11 further supports this assessment.

The GF Value is a proprietary metric developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. When insiders sell at prices above the GF Value, it could suggest that they believe the stock is fully valued or that market conditions are favorable for realizing gains.

It's also important to consider the broader market environment and sector performance when analyzing insider transactions. If the tech sector or the market as a whole is experiencing bullish trends, insiders might choose to sell shares to capitalize on high valuations. Conversely, if the market is bearish, an insider sale could be seen as a lack of confidence in the company's ability to weather a downturn.

The insider trend image above provides a visual representation of the buying and selling patterns of Alkami Technology Inc insiders. This chart can help investors identify trends and potential signals that may inform investment decisions.

The GF Value image offers a snapshot of Alkami Technology Inc's valuation relative to its intrinsic value estimate. This comparison can be a useful tool for investors considering whether the stock is trading at a discount or premium to its estimated fair value.

Conclusion

Insider transactions, such as the recent sale by CFO W Hill, are important events that can provide insights into a company's internal perspective on its stock's valuation. While the sale of 25,000 shares by the insider at Alkami Technology Inc may raise questions among investors, it's essential to consider the broader context, including the insider's historical trading activity, the company's valuation metrics, and market conditions. As with any investment decision, investors should use insider trading data as one of many factors in their analysis and consult with financial advisors or conduct their own research before making investment choices.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.