Insider Sell: CFO William Zerella Sells 17,500 Shares of ACV Auctions Inc (ACVA)

On October 10, 2023, William Zerella, the Chief Financial Officer (CFO) of ACV Auctions Inc (NASDAQ:ACVA), sold 17,500 shares of the company. This move is part of a series of insider sell transactions that have been occurring over the past year.

But who is William Zerella? Zerella is a seasoned financial executive with a wealth of experience in the tech industry. As the CFO of ACV Auctions Inc, he is responsible for the company's financial strategy and operations. His decision to sell a significant portion of his shares in the company is a move that has caught the attention of investors and market watchers.

ACV Auctions Inc is a leading online automotive marketplace. The company's platform connects used car dealers across the United States, providing them with a simple and efficient way to buy and sell vehicles. ACV Auctions Inc has revolutionized the used car industry, offering transparency, speed, and convenience to its users.

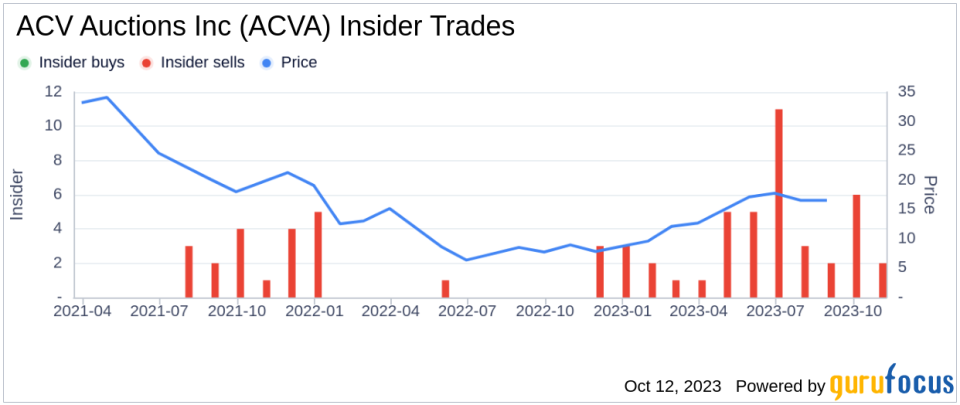

The insider's trading activities over the past year show a clear trend. William Zerella has sold a total of 190,000 shares and purchased 0 shares. This trend is mirrored in the broader insider transaction history for ACV Auctions Inc, which shows 0 insider buys and 44 insider sells over the past year.

The relationship between insider sell transactions and the stock price is often complex. In some cases, insider selling can be a bearish signal, indicating that those with intimate knowledge of the company's operations believe that the stock is overvalued. However, it's also important to note that insiders may sell shares for a variety of reasons unrelated to the company's performance or prospects, such as personal financial planning needs.

On the day of the insider's recent sell, shares of ACV Auctions Inc were trading for $15.08 apiece. This gives the stock a market cap of $2.35 billion. Despite the insider's sell, the company's valuation remains robust, reflecting investor confidence in its business model and growth prospects.

In conclusion, while the insider's recent sell transaction is noteworthy, it's essential for investors to consider the broader context. The company's strong market position, innovative business model, and robust valuation suggest that it remains well-positioned for future growth.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.