Insider Sell: CFO William Zerella Sells 17,500 Shares of ACV Auctions Inc (ACVA)

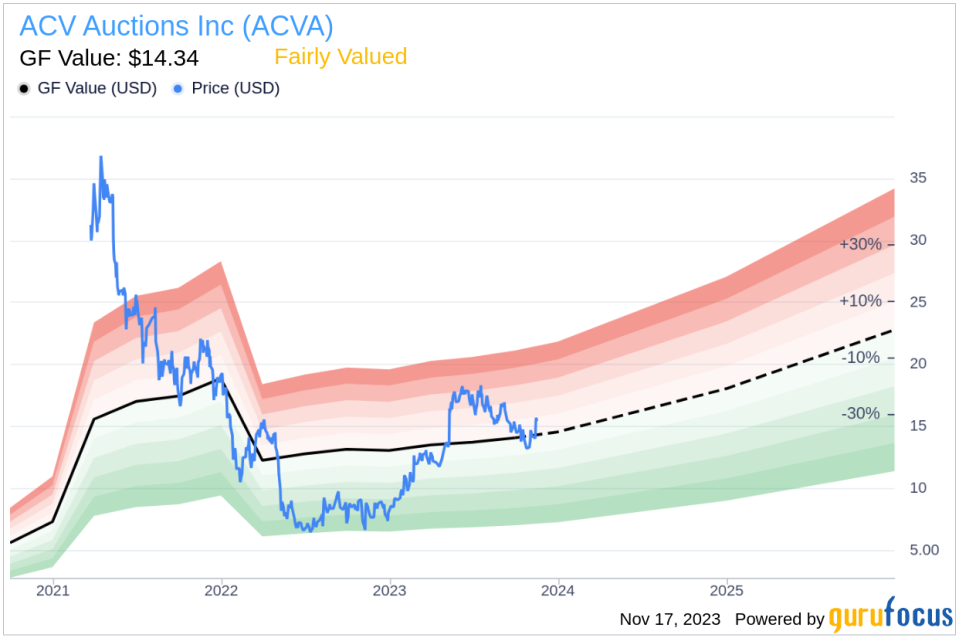

In a notable insider transaction, CFO William Zerella of ACV Auctions Inc (NASDAQ:ACVA) parted with 17,500 shares of the company's stock on November 14, 2023. This sale is part of a series of transactions over the past year, where the insider has sold a total of 207,500 shares, without any recorded purchases in the same period. Such insider activity often garners the attention of investors seeking to understand the implications behind these sales.Who is William Zerella?William Zerella serves as the Chief Financial Officer of ACV Auctions Inc, a role that places him in charge of the company's financial operations, including strategic planning, risk management, and financial reporting. His position gives him a deep understanding of the company's financial health and prospects, making his trading activities particularly noteworthy to investors and market analysts.About ACV Auctions IncACV Auctions Inc operates as a digital automotive marketplace, specializing in dealer-to-dealer wholesale auctions. The company's platform provides a transparent and efficient way for automotive dealers to buy and sell vehicles through 20-minute online auctions. ACV Auctions Inc leverages technology to offer detailed vehicle condition reports, which include comprehensive inspections and proprietary algorithms that predict issues a car might have, thereby instilling trust and confidence among its users.Analysis of Insider Buy/Sell and Relationship with Stock PriceThe recent sale by CFO William Zerella comes at a time when ACV Auctions Inc's stock is trading at $14.68, with a market capitalization of $2.492 billion. The price is closely aligned with the GuruFocus Value (GF Value) of $14.34, suggesting that the stock is Fairly Valued. The GF Value is a proprietary intrinsic value estimate that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

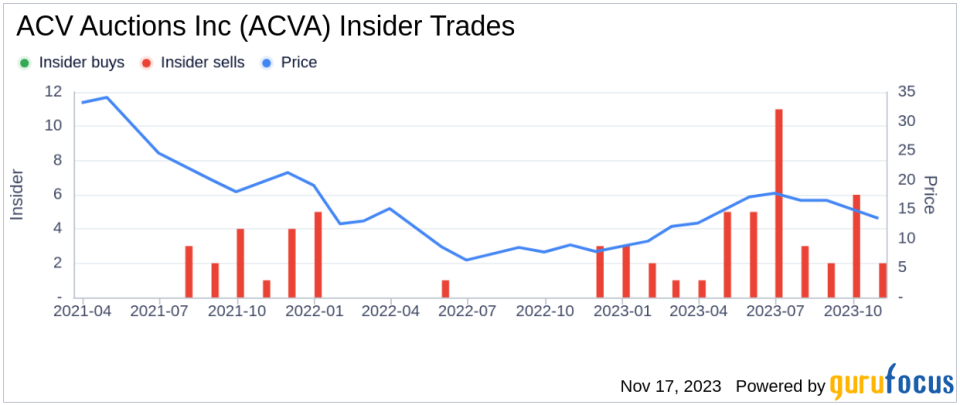

The insider trend image above indicates a lack of insider purchases over the past year, contrasted with 44 insider sells in the same timeframe. This trend could signal that insiders, including CFO William Zerella, may perceive the stock's current valuation as ripe for realizing gains, or it could reflect personal financial management decisions unrelated to their outlook on the company's future performance.

The GF Value image provides further context to the stock's valuation, showing that ACV Auctions Inc is hovering around its estimated fair value. The price-to-GF-Value ratio of 1.02 indicates that the stock is not significantly overvalued or undervalued at the current price level.When analyzing insider transactions, it's important to consider the size and frequency of the trades. The insider's sale of 17,500 shares represents a portion of their overall trading activity, which includes the sale of 207,500 shares over the past year. While this could be interpreted as a lack of confidence in the company's short-term growth prospects, it's also possible that the insider is diversifying their portfolio or addressing personal liquidity needs.Moreover, insider sales can be influenced by various factors, including stock option exercises, tax planning, and estate planning. Without additional context, it's challenging to draw definitive conclusions about the insider's sentiment towards the company's future.ConclusionIn conclusion, the recent insider sell by CFO William Zerella of ACV Auctions Inc does not occur in isolation but is part of a broader pattern of insider selling activity over the past year. While the stock is currently trading at a price close to its GF Value, suggesting fair valuation, the insider transactions may prompt investors to scrutinize the company's financial statements and future growth prospects more closely.Investors should consider the insider trends in conjunction with other financial analyses and market conditions before making investment decisions. As always, insider trading is just one piece of the puzzle when evaluating a stock's potential, and it should be weighed alongside a comprehensive assessment of the company's fundamentals, competitive position, and industry trends.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.