Insider Sell: Chairman Courtemanche Craig F. Jr. ...

On September 6, 2023, Courtemanche Craig F. Jr., Chairman of the Board at Procore Technologies Inc, sold 97,500 shares of the company's stock. This move comes amidst a year where the insider has sold a total of 481,743 shares and purchased none.

Courtemanche Craig F. Jr. is a key figure at Procore Technologies Inc, serving as the Chairman of the Board. His decisions and actions are closely watched by investors and market analysts alike, as they can provide valuable insights into the company's strategic direction and financial health.

Procore Technologies Inc is a leading provider of construction management software. The company's platform connects project teams, applications, and devices in one central hub, helping construction firms manage risk and build quality projects, safely, on time, and within budget. Procore's wide-ranging solutions serve various segments of the construction industry, including general contractors, specialty contractors, owners, and architects.

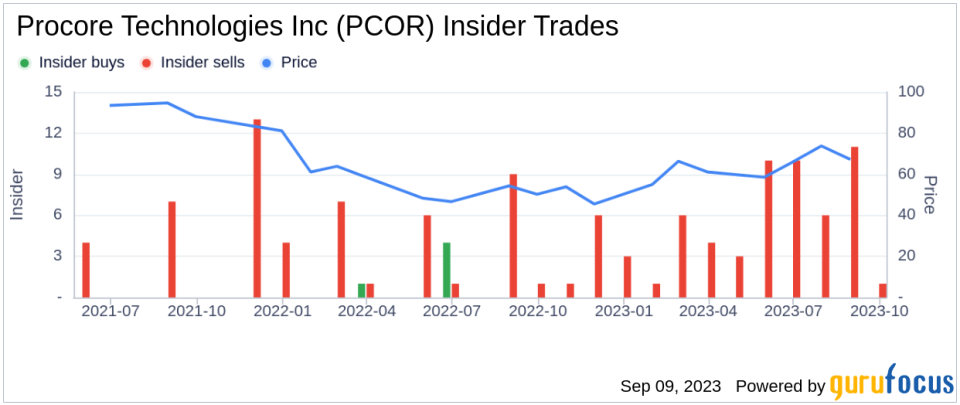

The insider's recent sell-off has raised eyebrows in the investment community. Over the past year, there have been 62 insider sells and zero insider buys at Procore Technologies Inc. This trend is illustrated in the following chart:

The relationship between insider trading activity and stock price performance is often complex. While insider selling can sometimes indicate a lack of confidence in the company's future prospects, it can also be motivated by personal financial planning needs or other factors unrelated to the company's performance. Therefore, it's crucial to consider the broader context when interpreting insider trading activity.

On the day of the insider's recent sell, shares of Procore Technologies Inc were trading at $66.81 each. This gives the company a market cap of $9.36 billion. Despite the insider's sell-off, the stock's market cap remains robust, suggesting that the market still holds a positive view of the company's prospects.

In conclusion, while the insider's recent sell-off is noteworthy, it does not necessarily signal a negative outlook for Procore Technologies Inc. Investors should continue to monitor the company's performance and other relevant factors to make informed investment decisions.

This article first appeared on GuruFocus.