Insider Sell: Chemed Corp's EVP & CFO David Williams Sells 5,000 Shares

Chemed Corp (NYSE:CHE), a diversified company that operates in the healthcare and chemical industries, has recently seen a notable insider transaction. Executive Vice President & Chief Financial Officer David Williams sold 5,000 shares of the company on November 10, 2023. This move has caught the attention of investors and market analysts, as insider transactions can often provide valuable insights into a company's financial health and future prospects.

Who is David Williams of Chemed Corp?

David Williams has been serving as the Executive Vice President and Chief Financial Officer of Chemed Corp. His role within the company is crucial, overseeing financial operations, reporting, and strategic planning. Williams's decisions and insights are integral to the financial stewardship of Chemed, making his trading activities particularly noteworthy to investors and analysts alike.

Chemed Corp's Business Description

Chemed Corp, with a market cap of $8.748 billion, operates through two main segments: VITAS Healthcare and Roto-Rooter. VITAS Healthcare is a major provider of end-of-life care services, while Roto-Rooter is a well-known name in plumbing and water cleanup services. The company's diverse operations allow it to tap into different market dynamics, with healthcare providing a steady demand due to the essential nature of its services, and home services benefiting from residential and commercial maintenance needs.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

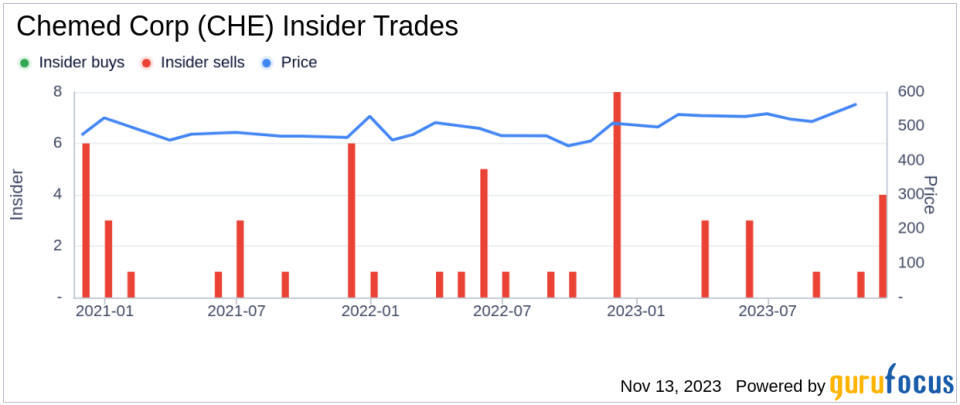

Insider transactions, particularly those involving high-ranking executives, can be a strong indicator of a company's internal perspective on its stock's value. In the case of Chemed Corp, the insider, David Williams, has sold 20,000 shares over the past year without purchasing any shares. This pattern of behavior could suggest that the insider believes the stock may be fully valued or that there may be limited upside potential in the near term.

On the day of the insider's recent sale, Chemed Corp shares were trading at $580.79. This price point gives the company a price-earnings ratio of 36.10, which is above both the industry median of 26.82 and the company's historical median. A higher price-earnings ratio can indicate that the stock is priced optimistically relative to its earnings, which may be another factor influencing the insider's decision to sell.

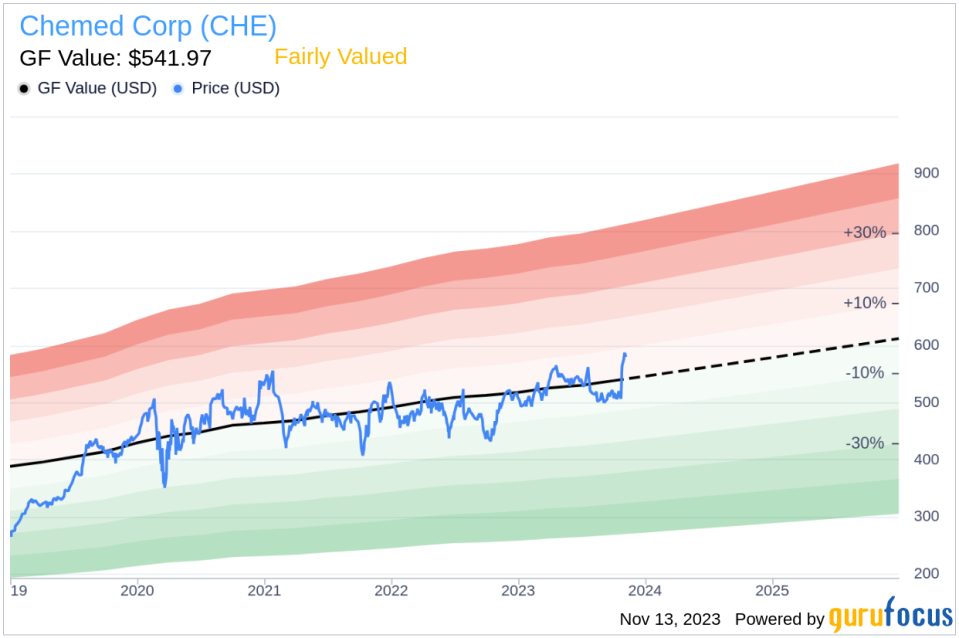

When considering the GF Value, which stands at $541.97, Chemed Corp's stock is currently Fairly Valued with a price-to-GF-Value ratio of 1.07. The GF Value is a proprietary metric developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. While the stock is not significantly overvalued, the insider's sale could still be interpreted as a signal that there may not be significant room for price appreciation in the short term.

The insider trend image above illustrates the recent history of insider transactions for Chemed Corp. The absence of insider buys and the presence of multiple insider sells over the past year could be indicative of a consensus among insiders that the stock's current valuation adequately reflects its prospects.

The GF Value image provides a visual representation of Chemed Corp's stock price relative to its intrinsic value estimate. The proximity of the current stock price to the GF Value suggests that the stock is not significantly undervalued or overvalued, which may partly explain the insider's decision to sell at this time.

Conclusion

David Williams's recent sale of 5,000 shares of Chemed Corp is a transaction that warrants attention. While the company's stock is deemed Fairly Valued according to the GF Value, the higher price-earnings ratio compared to industry and historical medians, combined with the pattern of insider selling, could suggest that insiders like Williams view the current stock price as reflective of the company's value. Investors should consider these insider transactions as part of a broader analysis when making investment decisions regarding Chemed Corp.

It is important to note that insider transactions are just one piece of the puzzle when it comes to evaluating a stock. Other factors such as company performance, industry trends, and broader market conditions should also be taken into account. As always, investors are encouraged to conduct their own due diligence and consult with financial advisors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.