Insider Sell: Chief Legal Officer William Yeung Sells 40,614 Shares of Energy Recovery Inc

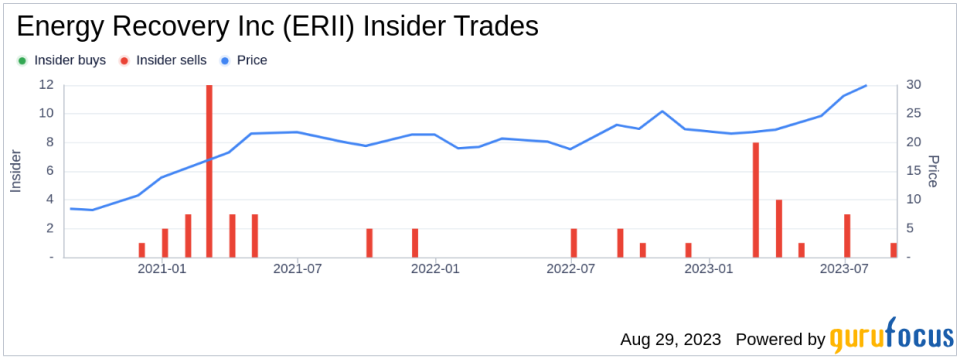

On August 28, 2023, William Yeung, Chief Legal Officer of Energy Recovery Inc (NASDAQ:ERII), sold 40,614 shares of the company. This move is part of a trend observed over the past year, where Yeung has sold a total of 46,921 shares and made no purchases.

Energy Recovery Inc is a global leader in pressure energy technology for industrial fluid flows. The company's technology harnesses underutilized pressure energy inherent in industrial processes and converts it into electricity or uses it in the same process. This reduces energy consumption and costs for industrial water users.

The insider's recent sell-off could be a signal to investors about the company's future prospects. Over the past year, there have been 19 insider sells and no insider buys for Energy Recovery Inc. This trend might indicate that insiders believe the company's stock is overvalued, or they expect its price to decrease in the future.

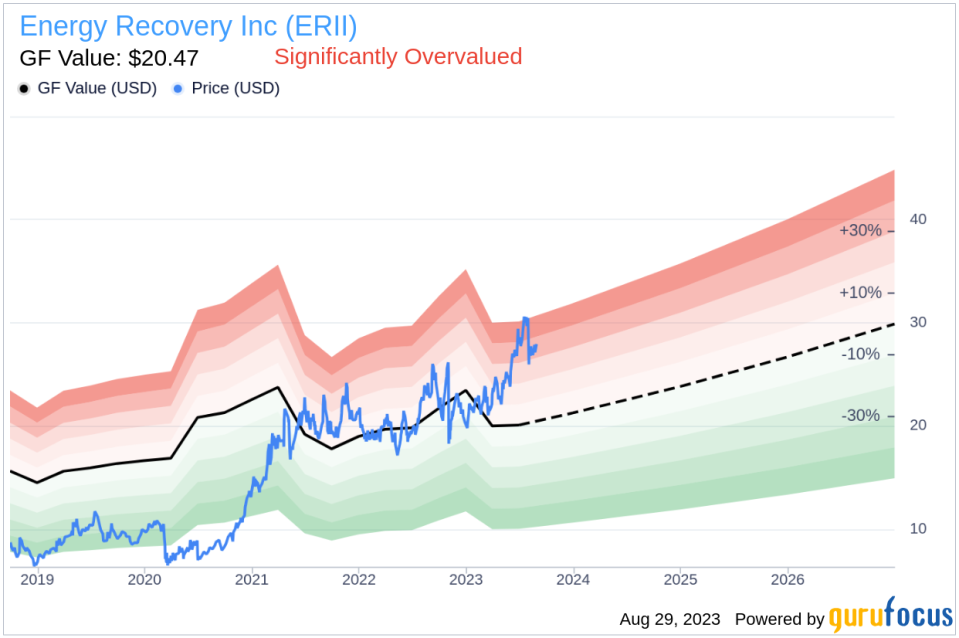

The insider's sell-off coincides with the company's stock trading at $27.75 per share, giving it a market cap of $1.576 billion. The stock's price-earnings ratio is 155.28, significantly higher than the industry median of 22.6 and the company's historical median price-earnings ratio. This high price-earnings ratio could suggest that the stock is overvalued.

Furthermore, the stock's price-to-GF-Value ratio is 1.36, indicating that it is significantly overvalued based on its GF Value. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance.

In conclusion, the insider's recent sell-off, combined with the stock's high price-earnings ratio and price-to-GF-Value ratio, could suggest that Energy Recovery Inc's stock is overvalued. Investors should consider these factors when making investment decisions.

However, it's important to note that insider selling doesn't always indicate a bearish outlook for the company. Insiders might sell shares for personal reasons unrelated to the company's performance. Therefore, investors should also consider other factors, such as the company's financial health and market conditions, when interpreting insider transactions.

This article first appeared on GuruFocus.