Insider Sell: Chief Legal Officer Robert Hickey Sells 8,000 Shares of Bowman Consulting Group Ltd

On September 18, 2023, Robert Hickey, the Chief Legal Officer of Bowman Consulting Group Ltd (NASDAQ:BWMN), sold 8,000 shares of the company. This move is part of a series of insider transactions that have been taking place over the past year.

Robert Hickey is a key figure in the Bowman Consulting Group Ltd. As the Chief Legal Officer, he plays a crucial role in the company's legal affairs and strategic decisions. His insider trading activities, therefore, provide valuable insights into the company's internal perspective on its stock's value.

Bowman Consulting Group Ltd is a leading provider of professional services to customers who own, develop, and maintain the built environment. The company offers a broad range of planning, engineering, construction management, commissioning, environmental consulting, geomatics, survey, land procurement and other technical services to over 2,200 customers. The company operates in four segments: Commercial, Road & Infrastructure, Land and Other.

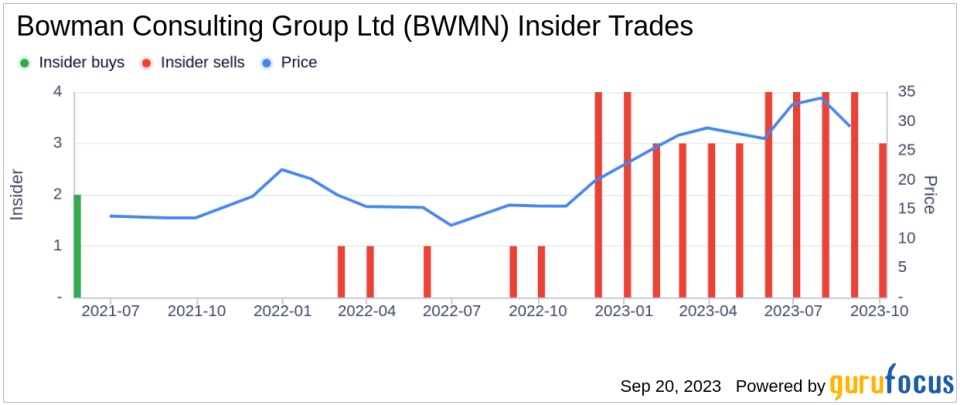

Over the past year, Robert Hickey has sold a total of 31,000 shares and has not purchased any shares. This trend is consistent with the overall insider transaction history for Bowman Consulting Group Ltd, which shows zero insider buys and 39 insider sells over the past year.

The insider's recent sell took place when the shares of Bowman Consulting Group Ltd were trading at $26.77 apiece. This gives the stock a market cap of $410.481 million. The price-earnings ratio is 104.11, which is higher than the industry median of 14.55 and lower than the companys historical median price-earnings ratio. This suggests that the stock is currently overvalued compared to its peers but undervalued based on its own historical standards.

The insider's sell-off could be interpreted in several ways. It could be a signal that the insider believes the stock is overvalued and is likely to experience a price correction. Alternatively, it could simply be a personal financial decision unrelated to the company's stock performance. Regardless, potential investors should consider this insider activity as part of their overall analysis of Bowman Consulting Group Ltd's stock.

It's also worth noting that the company's stock price has not shown a clear correlation with the insider's sell-off activities. This could be due to a variety of factors, including market conditions, company performance, and other macroeconomic factors. Therefore, while the insider's sell-off is an important piece of information, it should not be the sole basis for investment decisions.

In conclusion, the insider's recent sell-off of Bowman Consulting Group Ltd shares provides an interesting perspective on the company's stock. While the reasons behind the sell-off are not entirely clear, it is an important factor to consider when analyzing the company's stock. As always, potential investors should conduct thorough research and consider a variety of factors before making investment decisions.

This article first appeared on GuruFocus.