Insider Sell: Chief Legal Officer Ryan Damon Sells 8,668 Shares of Criteo SA

On August 29, 2023, Ryan Damon, the Chief Legal Officer of Criteo SA (NASDAQ:CRTO), sold 8,668 shares of the company. This move is part of a series of transactions made by Damon over the past year, during which he sold a total of 39,758 shares and made no purchases.

Criteo SA is a global technology company that specializes in digital performance marketing. The company's proprietary technology, coupled with its massive global reach, enables it to serve personalized online display advertisements to consumers on behalf of its clients. Criteo's clients include e-commerce companies, online travel agencies, and classifieds. The company operates in a fast-paced, dynamic industry that is constantly evolving.

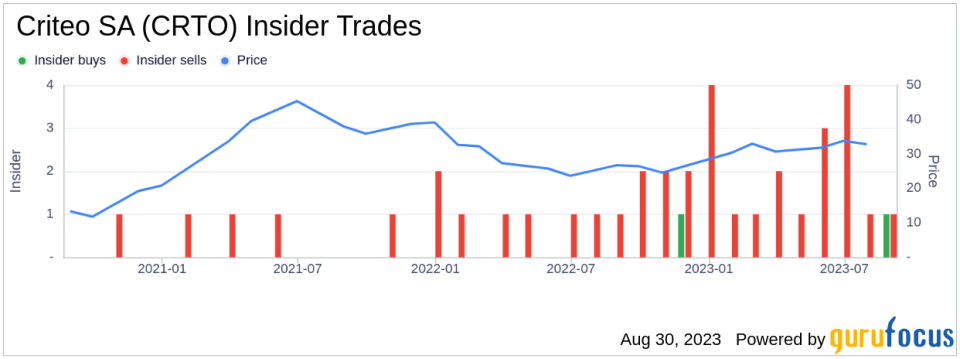

Insider trading activities, such as the recent sell by Damon, can provide valuable insights into a company's health and future prospects. In the case of Criteo SA, the insider transaction history shows a trend towards selling. Over the past year, there have been 24 insider sells and only 2 insider buys.

The insider's selling activities may raise questions about the company's current valuation. On the day of Damon's recent sell, Criteo SA's shares were trading at $28.91, giving the company a market cap of $1.623 billion. This price represents a price-earnings ratio of 323.11, significantly higher than the industry median of 17.23 and the company's historical median price-earnings ratio.

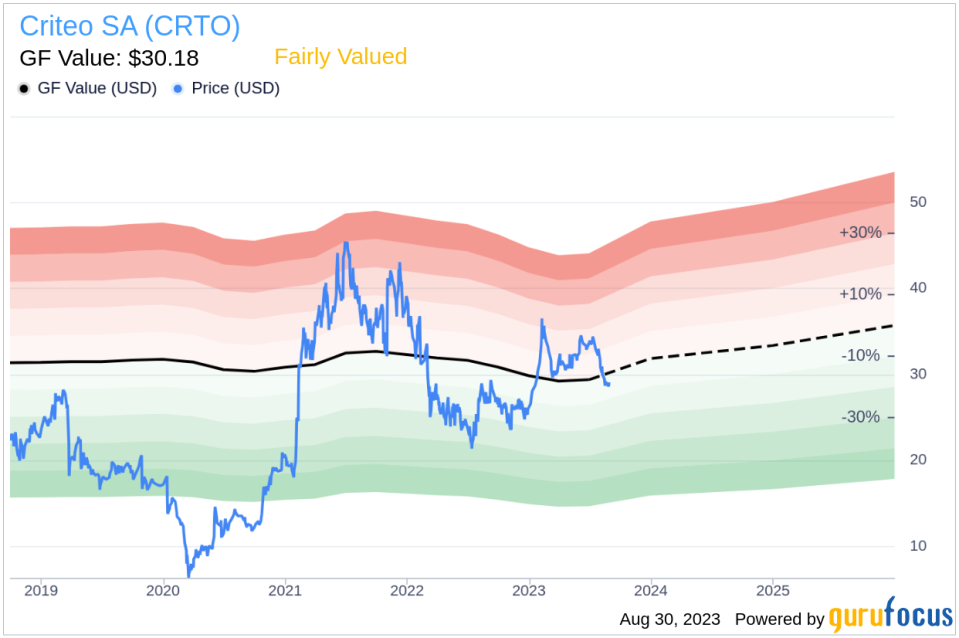

However, according to GuruFocus Value, the stock appears to be fairly valued. With a price of $28.91 and a GuruFocus Value of $30.18, Criteo SA has a price-to-GF-Value ratio of 0.96.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, the recent sell by the insider, Ryan Damon, coupled with the company's high price-earnings ratio, may suggest caution. However, the stock's price-to-GF-Value ratio indicates that it is fairly valued. As always, potential investors should conduct their own thorough research before making investment decisions.

This article first appeared on GuruFocus.