Insider Sell: Chief Legal Officer Bruce Posey Sells 1,579 Shares of Qualys Inc

On September 20, 2023, Bruce Posey, the Chief Legal Officer of Qualys Inc (NASDAQ:QLYS), sold 1,579 shares of the company. This move is part of a trend observed over the past year, where the insider has sold a total of 17,871 shares and made no purchases.

Bruce Posey is a key figure in Qualys Inc, a leading provider of cloud-based security and compliance solutions. The company offers a wide range of services, including vulnerability management, policy compliance, web application scanning, malware detection, and more. With its robust suite of tools, Qualys Inc helps businesses protect their IT infrastructures from potential threats and comply with security standards.

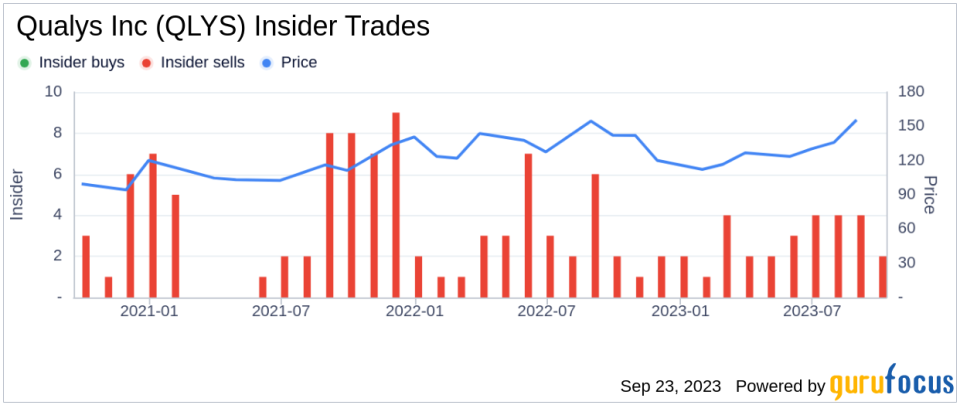

The insider's recent sell-off has raised some eyebrows among investors and market watchers. Over the past year, there have been 31 insider sells and no insider buys at Qualys Inc. This trend is illustrated in the following chart:

On the day of the insider's recent sell, shares of Qualys Inc were trading at $152.74, giving the company a market cap of $5.621 billion. The stock's price-earnings ratio stood at 47.63, higher than the industry median of 27.11 but lower than the company's historical median price-earnings ratio.

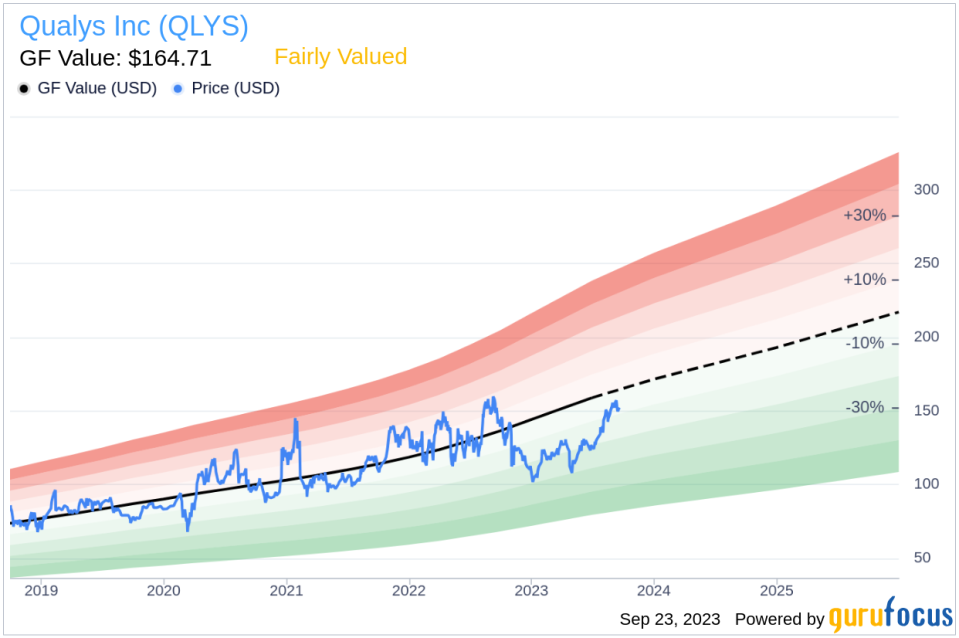

According to the GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, Qualys Inc is fairly valued. The stock's price-to-GF-Value ratio is 0.93, with a GF Value of $164.71 and a current price of $152.74. The GF Value is illustrated in the following chart:

The insider's sell-off, coupled with the stock's valuation, suggests that the insider believes the stock is fairly valued at its current price. However, investors should not solely rely on insider transactions when making investment decisions. It's crucial to consider other factors such as the company's financial health, market conditions, and growth prospects.

In conclusion, while the insider's recent sell-off may raise some concerns, it's important to note that insider transactions are just one piece of the puzzle. Investors should conduct thorough research and consider multiple factors before making investment decisions.

This article first appeared on GuruFocus.