Insider Sell: Chief Legal Officer Jason Greene Sells Shares of Berry Global Group Inc

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, Berry Global Group Inc (NYSE:BERY) witnessed a notable insider transaction that has caught the attention of the market. Chief Legal Officer Jason Greene sold a substantial number of shares, which may prompt investors to consider the implications of such a move.

On November 21, 2023, Jason Greene parted with 24,480 shares of Berry Global Group Inc, a leading provider of innovative packaging and protection solutions. This sale has been a part of a series of transactions over the past year, where the insider has sold a total of 45,000 shares and has not made any purchases. Such activity can be a valuable piece of the puzzle when analyzing the company's stock performance and insider sentiment.

Who is Jason Greene of Berry Global Group Inc?

Jason Greene serves as the Chief Legal Officer of Berry Global Group Inc. In his role, Greene is responsible for overseeing the legal affairs of the company, including compliance, corporate governance, and other legal matters that are crucial for the company's operations and strategic initiatives. His position places him in the upper echelons of the company's management, and his actions, particularly in the stock market, are closely monitored for insights into the company's internal perspective.

Berry Global Group Inc's Business Description

Berry Global Group Inc is a global leader in the production of plastic packaging products and engineered materials. The company operates through three segments: Consumer Packaging International, Consumer Packaging North America, and Engineered Materials. Berry Global's products range from containers and bottles to prescription vials, and the company serves a diverse set of end markets, including food, beverage, healthcare, and personal care. With a commitment to sustainability and innovation, Berry Global Group Inc strives to provide value-added solutions to its customers while minimizing its environmental footprint.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

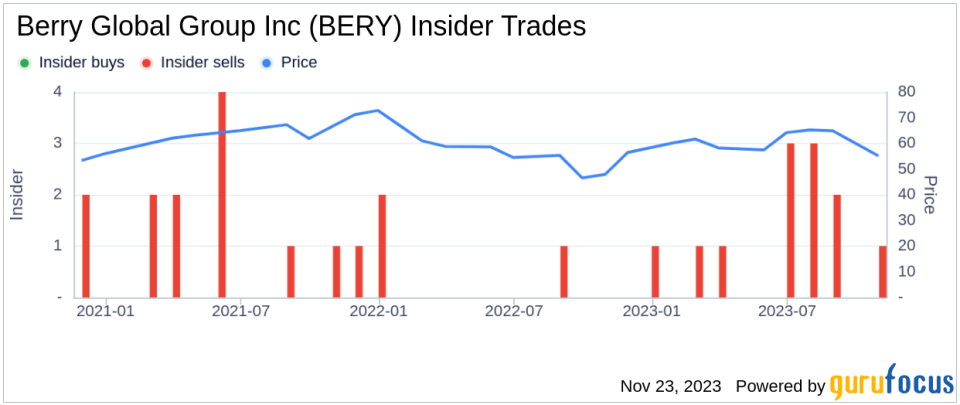

Insider transactions can provide valuable clues about a company's health and future prospects. Over the past year, Berry Global Group Inc has seen a total of 13 insider sells and no insider buys. This trend could suggest that insiders are more inclined to divest their holdings than to increase their stakes at current price levels. However, it is essential to consider the context and reasons behind these sales, as they may not always signal a lack of confidence in the company.

On the day of Jason Greene's recent sale, shares of Berry Global Group Inc were trading at $64.62, giving the company a market cap of $7.402 billion. The price-earnings ratio stood at 12.82, which is lower than both the industry median of 16.75 and the company's historical median price-earnings ratio. This could indicate that the stock is undervalued compared to its peers and its own historical valuation.

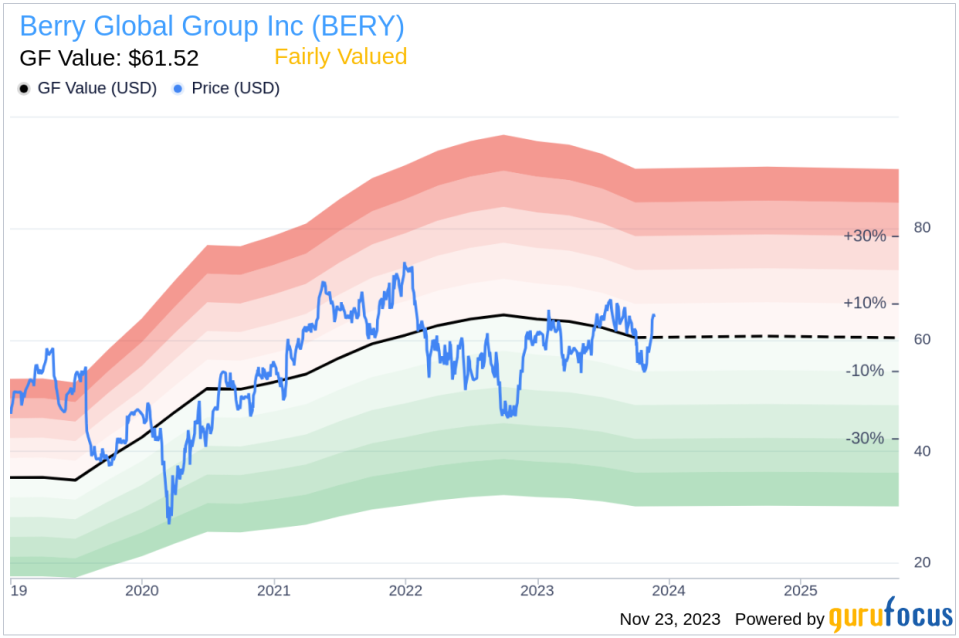

When examining the price-to-GF-Value ratio, which is currently at 1.05, Berry Global Group Inc appears to be Fairly Valued based on its GF Value of $61.52. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

It is worth noting that an insider selling shares does not necessarily mean that the stock is overvalued or that the company is facing imminent challenges. Insiders may sell shares for various personal reasons, such as diversifying their investment portfolio, tax planning, or other financial needs. Therefore, while insider sales can be a piece of the puzzle, they should not be the sole basis for investment decisions.

The insider trend image above provides a visual representation of the insider trading activity over the past year. The absence of insider buys may raise questions among investors, but it is crucial to analyze these trends in conjunction with other financial metrics and market conditions.

The GF Value image offers a snapshot of the stock's valuation relative to its intrinsic value. With the stock being Fairly Valued, investors may find comfort in the notion that the stock is not significantly overpriced, which could be a factor in the insider's decision to sell.

Conclusion

Jason Greene's recent sale of shares in Berry Global Group Inc is a significant event that warrants attention from investors. While the insider's actions may not necessarily reflect a negative outlook on the company, the lack of insider buying over the past year could be a signal worth considering. With Berry Global Group Inc's stock appearing fairly valued based on the GF Value and trading at a lower price-earnings ratio than the industry median, investors should weigh the insider trading activity alongside a comprehensive analysis of the company's financial health, market position, and growth prospects before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.