Insider Sell: Chief Medical Officer Wildon Farwell Sells 1,707 Shares of Dyne Therapeutics Inc

On September 12, 2023, Wildon Farwell, the Chief Medical Officer of Dyne Therapeutics Inc (NASDAQ:DYN), sold 1,707 shares of the company. This move is part of a series of insider transactions that have been taking place at Dyne Therapeutics Inc over the past year.

Wildon Farwell is a key figure in Dyne Therapeutics Inc, serving as the Chief Medical Officer. His role involves overseeing the company's medical strategies and ensuring that they align with the company's overall goals. His decision to sell shares in the company is therefore significant and warrants further analysis.

Dyne Therapeutics Inc is a pioneering company in the field of genetic medicines. The company is focused on developing life-transforming therapies for patients with serious muscle diseases. Dyne Therapeutics Inc uses its proprietary FORCE platform to overcome current limitations of muscle tissue delivery and advance modern medicines for muscle diseases.

Over the past year, the insider has sold a total of 11,474 shares and has not made any purchases. This recent sale of 1,707 shares is part of this larger trend. The insider's decision to sell shares could be influenced by a variety of factors, including personal financial needs or a belief that the company's stock is currently overvalued.

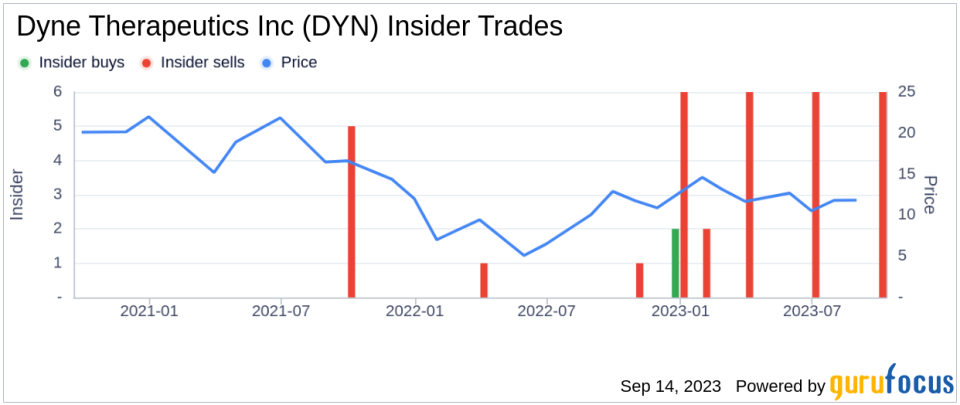

The insider transaction history for Dyne Therapeutics Inc shows a trend of more sells than buys over the past year. There have been 2 insider buys and 27 insider sells in total. This could potentially indicate that insiders believe the stock is overvalued at its current price.

On the day of the insider's recent sell, shares of Dyne Therapeutics Inc were trading for $10.41 apiece. This gives the stock a market cap of $536.979 million. While this is not in the billion range, it still represents a substantial value for the company.

The relationship between insider transactions and stock price is complex. While insider selling can sometimes be a bearish signal, it is important to consider the context of the sell. In this case, the insider has been selling shares over the past year, which could suggest a belief that the stock is overvalued. However, it is also possible that the insider's sells are motivated by personal financial needs rather than a negative outlook on the company.

In conclusion, while the insider's recent sell of 1,707 shares is noteworthy, it is just one piece of the puzzle. Investors should consider this information in the context of other factors, such as the company's financial health, market conditions, and other insider transactions.

This article first appeared on GuruFocus.