Insider Sell: Chief Mort Fulfillment Off. ...

In a notable insider transaction, Chief Mort Fulfillment Officer James Follette has parted with 21,742 shares of PennyMac Financial Services Inc (NYSE:PFSI) on December 11, 2023. This sale has caught the attention of investors and analysts, as insider activity can often provide valuable insights into a company's prospects and the sentiment of its top executives.

Who is James Follette of PennyMac Financial Services Inc?

James Follette serves as the Chief Mortgage Fulfillment Officer at PennyMac Financial Services Inc, a role that places him at the helm of the company's mortgage production operations. His responsibilities include overseeing the fulfillment of mortgage services and ensuring the company's offerings meet the evolving needs of the market. Follette's position gives him a deep understanding of the company's operational efficiencies and growth strategies, making his trading activities particularly noteworthy to investors.

PennyMac Financial Services Inc's Business Description

PennyMac Financial Services Inc is a specialty financial services firm that operates in the mortgage finance industry. The company's core business includes the production and servicing of U.S. residential mortgage loans. PennyMac is known for its robust mortgage banking services, which encompass loan origination and loan servicing capabilities. The company caters to the needs of the American housing market by providing a range of mortgage solutions, including conventional, FHA, VA, and investment property loans.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

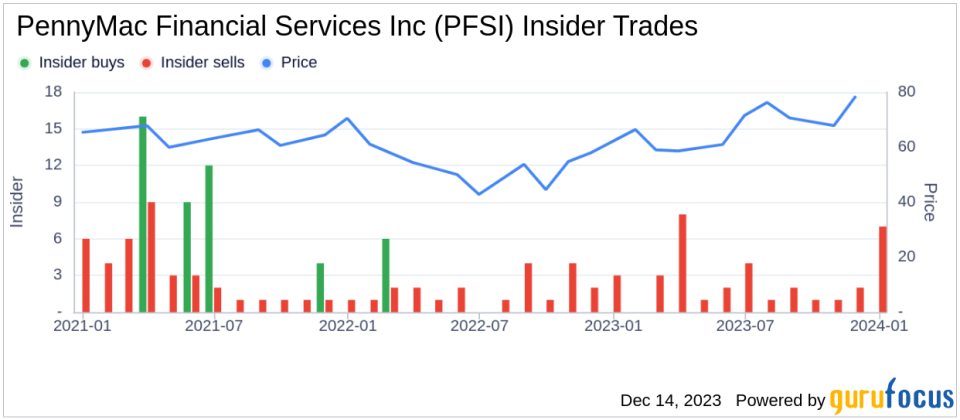

The recent sale by James Follette is part of a broader pattern of insider selling at PennyMac Financial Services Inc. Over the past year, Follette has sold a total of 37,407 shares, without making any purchases. This one-sided transaction history could signal a lack of confidence among insiders in the company's near-term growth prospects or could simply reflect personal financial planning decisions.The broader insider transaction history for PennyMac Financial Services Inc shows a total absence of insider buys over the past year, contrasted with 33 insider sells during the same period. This trend suggests that insiders, including executives and directors, may believe that the stock is fully valued or potentially overvalued at current levels.

On the day of Follette's recent sale, shares of PennyMac Financial Services Inc were trading at $80.42, giving the company a market cap of $4,319.077 billion. This valuation places the stock at a price-earnings ratio of 20.80, which is higher than both the industry median of 8.74 and the company's historical median price-earnings ratio. This elevated P/E ratio could be a contributing factor to the insider's decision to sell, as it may suggest that the stock is trading at a premium compared to its peers and historical standards.

Valuation and GF Value Analysis

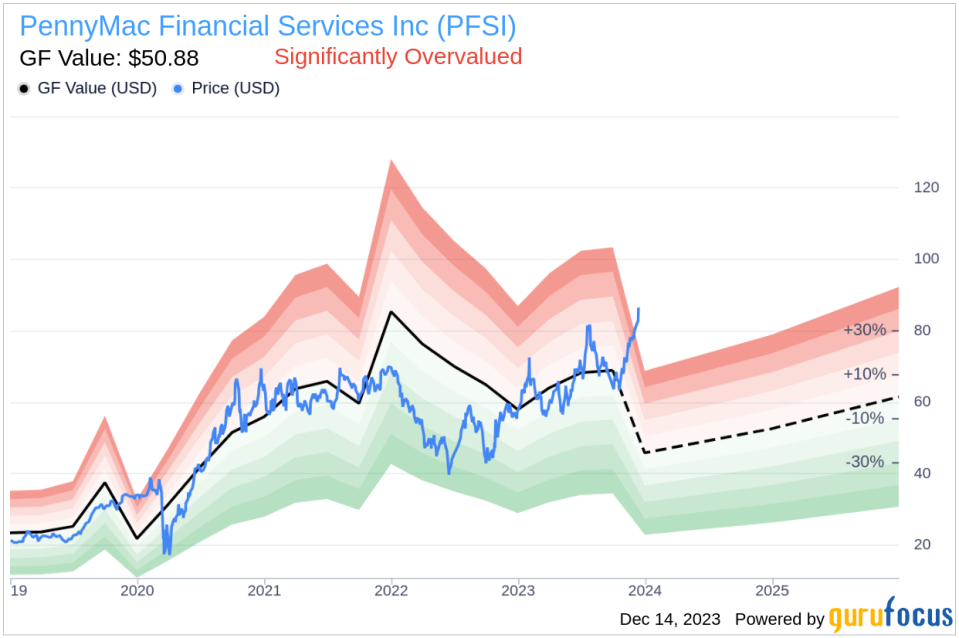

The stock's current price also exceeds the GuruFocus Value (GF Value) of $50.88, resulting in a price-to-GF-Value ratio of 1.58. According to GuruFocus, this indicates that PennyMac Financial Services Inc is significantly overvalued based on its intrinsic value estimate.

The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. The significant divergence between the stock's trading price and its GF Value could be a red flag for value-oriented investors and may have influenced the insider's decision to reduce their holdings.

Conclusion

In conclusion, the recent insider sell by James Follette at PennyMac Financial Services Inc aligns with a broader pattern of insider selling at the company. While insider transactions are not always indicative of a company's future performance, the lack of insider buying and the high price-earnings ratio, coupled with the stock's significant overvaluation based on the GF Value, could suggest that insiders view the stock's current price with caution.Investors should consider these insider trading signals in the context of their own investment strategy and risk tolerance. While insider activity can provide valuable insights, it is also important to conduct thorough research and consider a wide range of factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.