Insider Sell: Chief People Officer Carmen Orr Sells 4,326 Shares of Yelp Inc (YELP)

In the dynamic world of the stock market, insider transactions often draw significant attention from investors seeking to understand the internal perspectives of a company's executives and directors. Recently, Yelp Inc (NYSE:YELP), a company well-known for its online platform that helps people find local businesses through reviews and ratings, witnessed a notable insider sell by its Chief People Officer, Carmen Orr.Carmen Orr, who plays a pivotal role in shaping the company's culture and workforce, sold 4,326 shares of Yelp Inc on November 13, 2023. This transaction has sparked interest in the investment community, as insider sells can sometimes provide insights into an insider's view of the company's future prospects.Before delving into the analysis of this insider sell and its potential implications, let's explore who Carmen Orr is within Yelp Inc and the company's business description.Who is Carmen Orr?Carmen Orr is the Chief People Officer at Yelp Inc, a position that places her at the heart of the company's human resources and organizational development. Her responsibilities likely include overseeing talent acquisition, employee engagement, performance management, and leadership development. Orr's role is crucial in ensuring that Yelp maintains a productive and positive work environment, which is essential for the company's growth and success.Yelp Inc's Business DescriptionYelp Inc operates a platform that connects people with great local businesses, providing a space for users to share their experiences and for businesses to engage with their customers. The platform includes a wide range of business categories, including restaurants, shopping, nightlife, and financial services, among others. Yelp's business model is primarily based on advertising revenue from businesses that want to promote their services to Yelp's large user base.Analysis of Insider Buy/Sell and Relationship with Stock PriceCarmen Orrs trades over the past year show a pattern of selling, with 24,794 shares sold and no shares purchased. This could be interpreted in various ways; however, without additional context, it is difficult to draw a definitive conclusion about the insider's sentiment towards the company's future.The insider transaction history for Yelp Inc shows a lack of insider buys over the past year, with 38 insider sells recorded. This trend might raise questions among investors about the confidence insiders have in the company's stock performance.On the day of Orr's recent sell, shares of Yelp Inc were trading at $43.83, giving the company a market cap of $3.084 billion. The price-earnings ratio of 35.75 is higher than the industry median of 20.27 but lower than the company's historical median price-earnings ratio. This suggests that while Yelp's stock may be priced higher than many of its industry peers, it is trading at a level consistent with its own historical valuation.

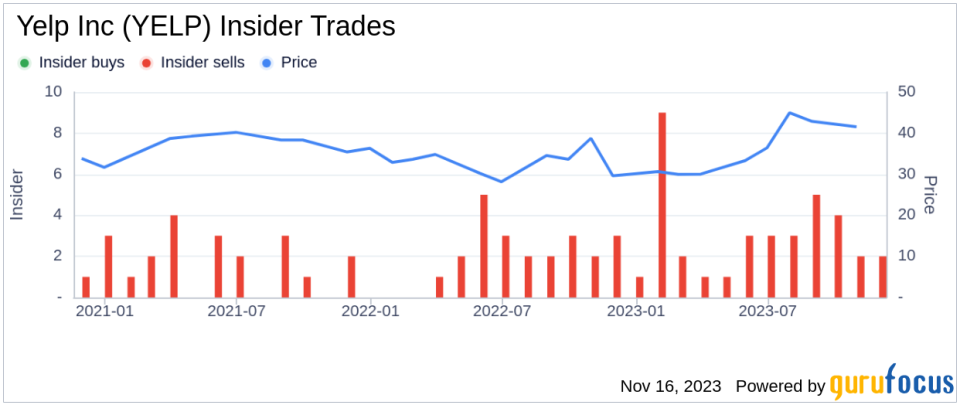

The above insider trend image provides a visual representation of the selling pattern among Yelp's insiders, which could be a point of consideration for potential investors.Regarding valuation, with a stock price of $43.83 and a GuruFocus Value (GF Value) of $44.93, Yelp Inc has a price-to-GF-Value ratio of 0.98, indicating that the stock is Fairly Valued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts.ConclusionThe recent insider sell by Carmen Orr, the Chief People Officer of Yelp Inc, is a transaction that warrants attention. While the insider's selling activity over the past year has been consistent, it is not necessarily indicative of a negative outlook on the company. Yelp's stock is currently trading at a fair value according to the GF Value, and the price-earnings ratio suggests that the stock is not overvalued relative to its historical performance.Investors should consider the broader context of the market, the company's performance, and other insider transactions when interpreting insider sells. As always, insider trading is just one piece of the puzzle when it comes to making informed investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.