Insider Sell: Chief Regulatory Officer Carol Karp Sells 5,000 Shares of Prothena Corp PLC

On October 4, 2023, Carol Karp, the Chief Regulatory Officer of Prothena Corp PLC (NASDAQ:PRTA), sold 5,000 shares of the company. This move is part of a trend for the insider, who over the past year has sold a total of 40,000 shares and purchased none.

Prothena Corp PLC is a biotechnology company focused on the discovery and development of novel therapies for life-threatening diseases. The company's pipeline includes treatments for neurodegenerative diseases, including rare peripheral amyloidoses and neurodegenerative diseases such as Alzheimer's disease and Parkinson's disease.

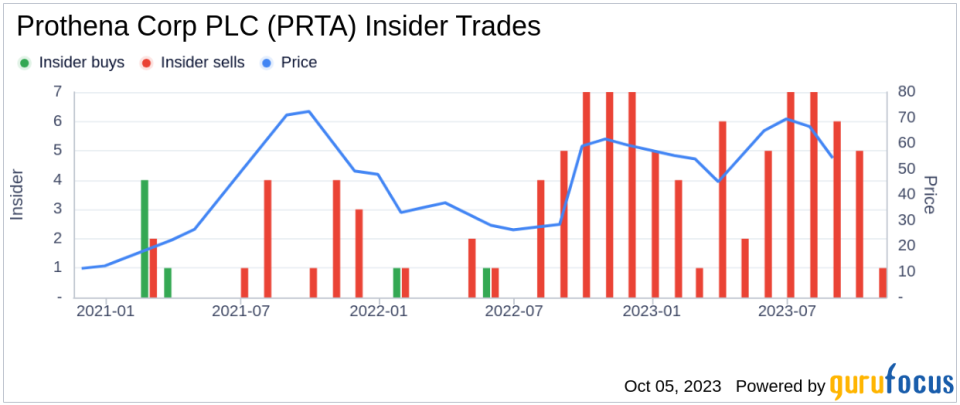

The insider's recent sell comes amidst a backdrop of 61 insider sells over the past year, with no insider buys recorded in the same timeframe. This trend is illustrated in the following image:

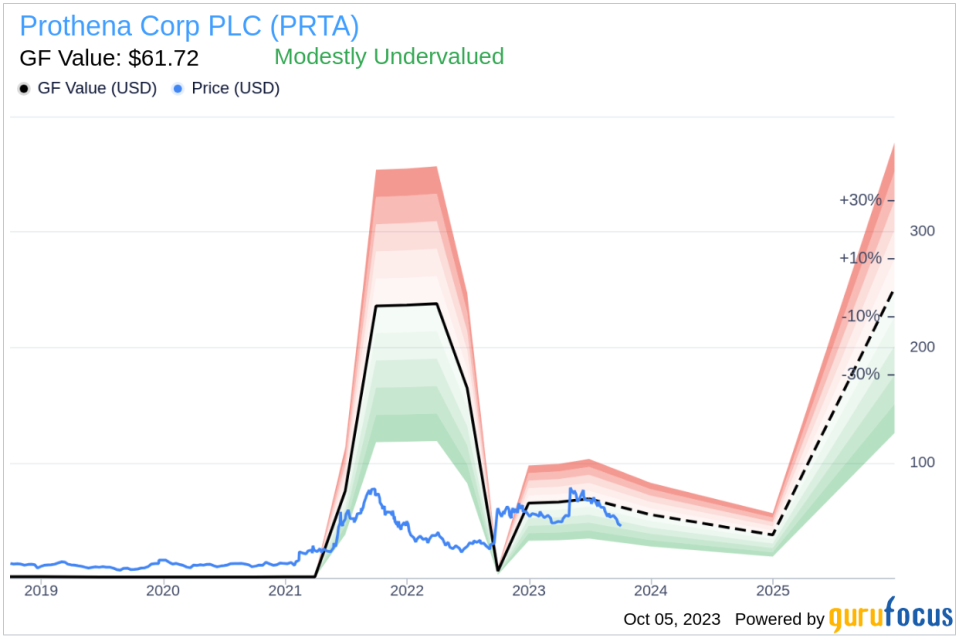

On the day of the insider's recent sell, shares of Prothena Corp PLC were trading at $46.62, giving the company a market cap of $2.424 billion. This price is below the GuruFocus Value of $61.72, indicating that the stock is modestly undervalued. The price-to-GF-Value ratio stands at 0.76.

The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts. The following image provides a visual representation of the GF Value:

The relationship between insider sell/buy trends and the stock price can provide valuable insights. In the case of Prothena Corp PLC, the absence of insider buys and the prevalence of insider sells over the past year could be a signal of caution for potential investors. However, the stock's current undervaluation according to the GF Value might present an opportunity for value investors.

It's important to note that while insider sell/buy trends can provide useful information, they should not be the sole basis for investment decisions. Other factors such as the company's financial health, market conditions, and industry trends should also be considered.

As always, potential investors are advised to do their own due diligence and consult with a financial advisor before making investment decisions.

This article first appeared on GuruFocus.