Insider Sell: Chief Services Officer Mark Anderson Sells 6,650 Shares of Model N Inc

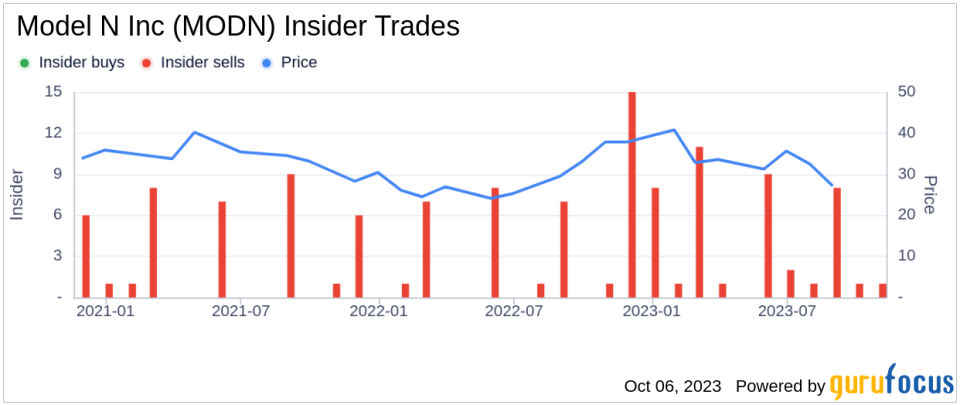

On October 3, 2023, Mark, Anderson, the Chief Services Officer of Model N Inc (NYSE:MODN), sold 6,650 shares of the company. This move is part of a larger trend of insider selling at Model N Inc, which we will explore in this article.

Model N Inc is a leading provider of cloud-based revenue management solutions for life sciences and high tech companies. Its software helps companies manage, analyze and optimize revenue activities, from pricing and contract creation through to settlements and compliance.

Over the past year, the insider has sold a total of 33,320 shares and purchased none. This trend is mirrored in the wider company, with 58 insider sells and no insider buys over the same period. This could be a signal that insiders believe the stock is currently overvalued.

On the day of the insider's recent sale, shares of Model N Inc were trading at $23.83, giving the company a market cap of $906.747 million.

However, according to the GuruFocus Value, the intrinsic value of the stock is $39.91. This gives Model N Inc a price-to-GF-Value ratio of 0.6, indicating that the stock may be undervalued. This is a surprising contrast to the insider selling activity, which typically suggests that insiders believe the stock is overpriced.

The GF Value is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts. In this case, the GF Value suggests that despite the insider selling activity, Model N Inc may still be a good investment opportunity.

However, investors should be cautious. The discrepancy between the insider selling activity and the GF Value could indicate a possible value trap. Therefore, potential investors should think twice before investing in Model N Inc and conduct further research to understand the reasons behind the insider's selling activity.

In conclusion, while the insider selling activity at Model N Inc may raise some red flags, the GF Value suggests that the stock may still be undervalued. As always, potential investors should conduct their own research and consider multiple factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.