Insider Sell: Chief Strategist Jason Wudi Sells 15,000 Shares of Jamf Holding Corp (JAMF)

In a notable insider transaction, Chief Strategist Jason Wudi sold 15,000 shares of Jamf Holding Corp (NASDAQ:JAMF) on December 14, 2023. This sale has caught the attention of investors and analysts, as insider transactions can provide valuable insights into a company's prospects and the confidence level of its executives.

Who is Jason Wudi of Jamf Holding Corp?

Jason Wudi serves as the Chief Strategist at Jamf Holding Corp, a company that specializes in Apple infrastructure and security platform solutions. Wudi's role involves guiding the company's strategic direction, innovation, and product development. His insights and decisions are crucial for the company's growth and adaptation to the ever-evolving tech landscape. With a deep understanding of the company's operations and market position, Wudi's trading activities are closely monitored by investors.

Jamf Holding Corp's Business Description

Jamf Holding Corp is a leader in the field of enterprise management software for the Apple ecosystem. The company's suite of products and services is designed to empower organizations to manage Apple devices and ensure their security while providing a seamless user experience. Jamf's solutions are used by businesses, educational institutions, and government agencies worldwide to facilitate device deployment, inventory, security, and compliance with IT policies.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions, particularly sales, can be interpreted in various ways. While some may view insider selling as a lack of confidence in the company's future, it is also common for insiders to sell shares for personal financial planning or diversification reasons. In the case of Jason Wudi, the insider has sold 62,488 shares over the past year without purchasing any shares. This pattern of selling could raise questions among investors about the insider's long-term belief in the company's stock performance.

On the day of the insider's recent sale, shares of Jamf Holding Corp were trading at $18.48, giving the company a market cap of $2.375 billion. This price point is significantly below the GuruFocus Value (GF Value) of $36.97, suggesting that the stock may be undervalued.

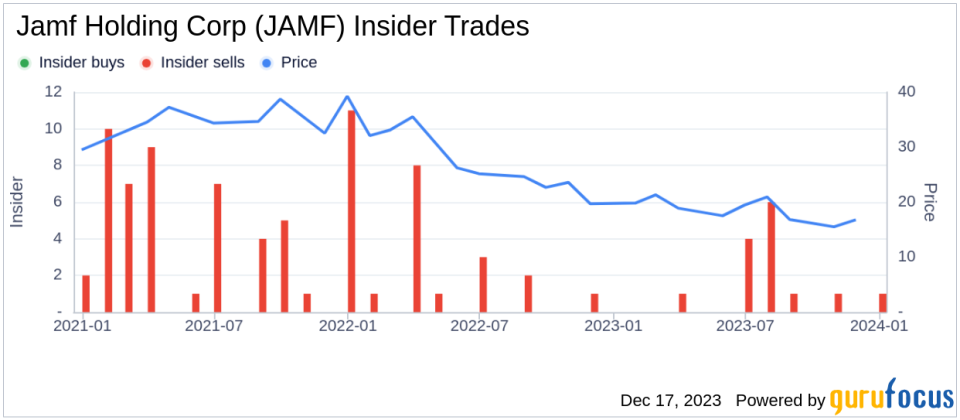

The insider trend image above shows a clear pattern of insider selling over the past year, with no insider buys recorded. This trend could indicate that insiders, including Jason Wudi, may not perceive the stock as undervalued enough to warrant buying at current prices, despite the low price-to-GF-Value ratio.

The GF Value image provides an intrinsic value estimate that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. With a price-to-GF-Value ratio of 0.5, Jamf Holding Corp is categorized as a "Possible Value Trap, Think Twice," indicating that investors should be cautious. The discrepancy between the stock's current price and its GF Value could be a signal for potential investors to conduct a more thorough analysis before making investment decisions.

Insider Trends

Over the past year, Jamf Holding Corp has seen a total of 15 insider sells and no insider buys. This one-sided activity suggests that insiders have been consistently cashing out rather than increasing their stakes in the company. While this could be a red flag for potential investors, it is essential to consider the broader context, including the company's performance, market conditions, and individual insider circumstances.

Valuation

With a market cap of $2.375 billion and a trading price of $18.48, Jamf Holding Corp's valuation requires careful consideration. The low price-to-GF-Value ratio may attract value investors looking for potential bargains. However, the classification as a possible value trap indicates that the stock's low price may not necessarily translate into a good investment opportunity. Investors should weigh the insider selling trend, the company's fundamentals, and market dynamics before making investment decisions.

In conclusion, the recent insider sale by Chief Strategist Jason Wudi is a significant event that warrants attention. While the sale itself does not necessarily predict the future direction of Jamf Holding Corp's stock price, it is a piece of the puzzle that investors must consider as part of their overall analysis. The insider selling trend, combined with the company's valuation metrics, presents a complex picture that requires a nuanced approach to stock evaluation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.