Insider Sell: Chief Strategy Officer David Mcglinchey Sells 109,881 Shares of Sprouts Farmers ...

Sprouts Farmers Market Inc (NASDAQ:SFM), a leading grocery chain specializing in fresh, natural, and organic products, has recently witnessed a significant insider sell by its Chief Strategy Officer, David Mcglinchey. On December 7, 2023, the insider sold a substantial number of shares, totaling 109,881, which has caught the attention of investors and market analysts alike.

Who is David Mcglinchey?

David Mcglinchey is a key executive at Sprouts Farmers Market Inc, holding the position of Chief Strategy Officer. In his role, Mcglinchey is responsible for shaping the company's strategic direction, identifying growth opportunities, and ensuring that Sprouts remains competitive in the ever-evolving grocery industry. His insights and decisions are crucial for the company's long-term success and sustainability.

Sprouts Farmers Market Inc's Business Description

Sprouts Farmers Market Inc is a health-oriented grocery store chain that offers a unique shopping experience where consumers can find a variety of fresh produce, bulk foods, vitamins and supplements, packaged groceries, meat and seafood, baked goods, dairy products, frozen foods, natural body care, and household items. The company prides itself on its farm-fresh produce, which is central to its offerings, and its commitment to providing healthful food at affordable prices. With its focus on wellness and sustainability, Sprouts has carved out a niche in the grocery market that appeals to health-conscious consumers.

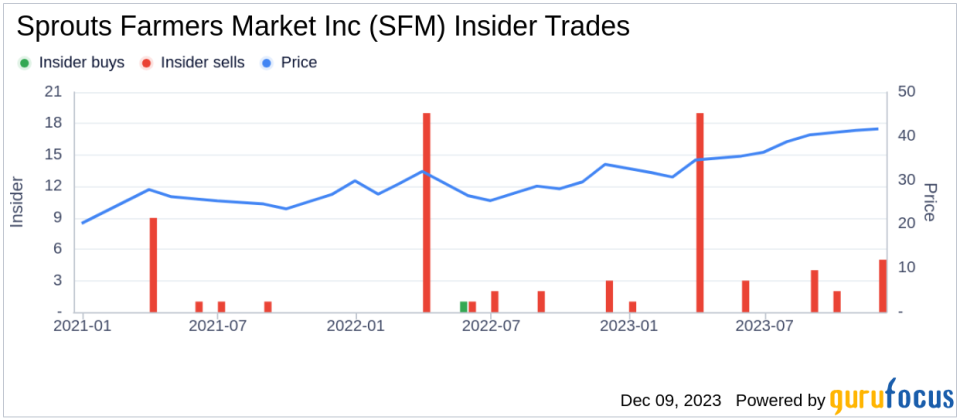

Analysis of Insider Buy/Sell and Relationship with Stock Price

The recent transaction by David Mcglinchey is part of a broader pattern of insider activity at Sprouts Farmers Market Inc. Over the past year, Mcglinchey has sold a total of 141,111 shares and has not made any purchases. This could signal a lack of confidence in the company's short-term growth prospects or simply a personal financial decision by the insider. It's important to note that insider sells can be motivated by various factors and do not always indicate a negative outlook for the company.

The insider trend image above shows that there have been no insider buys and 35 insider sells over the past year. This trend could suggest that insiders, including Mcglinchey, may believe that the stock is currently overvalued or that they are taking profits after a period of stock appreciation.

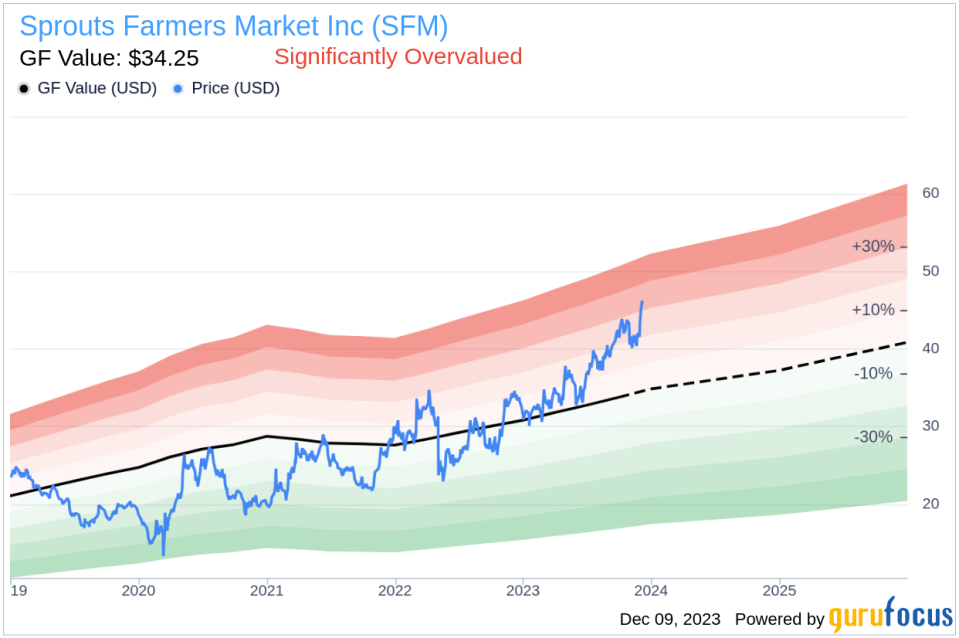

Valuation and Market Reaction

On the day of Mcglinchey's sell, Sprouts Farmers Market Inc's shares were trading at $46.17, giving the company a market cap of $4.673 billion. The price-earnings ratio of 18.86 is higher than the industry median of 16.24 and also higher than the company's historical median price-earnings ratio. This indicates that the stock may be trading at a premium compared to its peers and its own historical valuation.

The GF Value image above provides further insight into the stock's valuation. With a price of $46.17 and a GuruFocus Value of $34.25, Sprouts Farmers Market Inc has a price-to-GF-Value ratio of 1.35, which classifies the stock as Significantly Overvalued based on its GF Value. The GF Value is calculated considering historical multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

Conclusion

The insider sell by David Mcglinchey at Sprouts Farmers Market Inc is a significant event that warrants attention from investors. While insider sells are not always indicative of a company's health, the consistent pattern of sells over buys among insiders could be a signal for investors to proceed with caution. Additionally, the current valuation metrics suggest that the stock may be overpriced, which could be a contributing factor to the insider's decision to sell. Investors should consider these factors, along with their own research and investment goals, when making decisions regarding Sprouts Farmers Market Inc's stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.