Insider Sell: Chief Strategy/Transf. Officer Paul Linton Sells 3,920 Shares of FTI Consulting Inc

On October 31, 2023, Paul Linton, the Chief Strategy and Transformation Officer of FTI Consulting Inc (NYSE:FCN), sold 3,920 shares of the company. This move is part of a series of insider transactions that have taken place over the past year.

Paul Linton is a key figure in FTI Consulting Inc, a global business advisory firm dedicated to helping organizations manage change, mitigate risk and resolve disputes: financial, legal, operational, political & regulatory, reputational and transactional. With more than 6,200 employees located in 28 countries, FTI Consulting professionals work closely with clients to anticipate, illuminate and overcome complex business challenges and opportunities.

Over the past year, Linton has sold a total of 4,920 shares and has not made any purchases. This recent sale represents a continuation of the insider's trading pattern.

The insider trend image above shows a clear pattern of insider selling over the past year. There have been 18 insider sells and 0 insider buys in total. This could be an indication of the insider's confidence in the company's current stock price or future prospects.

On the day of the insider's recent sale, shares of FTI Consulting Inc were trading for $214.29 apiece, giving the stock a market cap of $7.73 billion. The price-earnings ratio is 32.22, which is higher than the industry median of 16.29 and higher than the companys historical median price-earnings ratio.

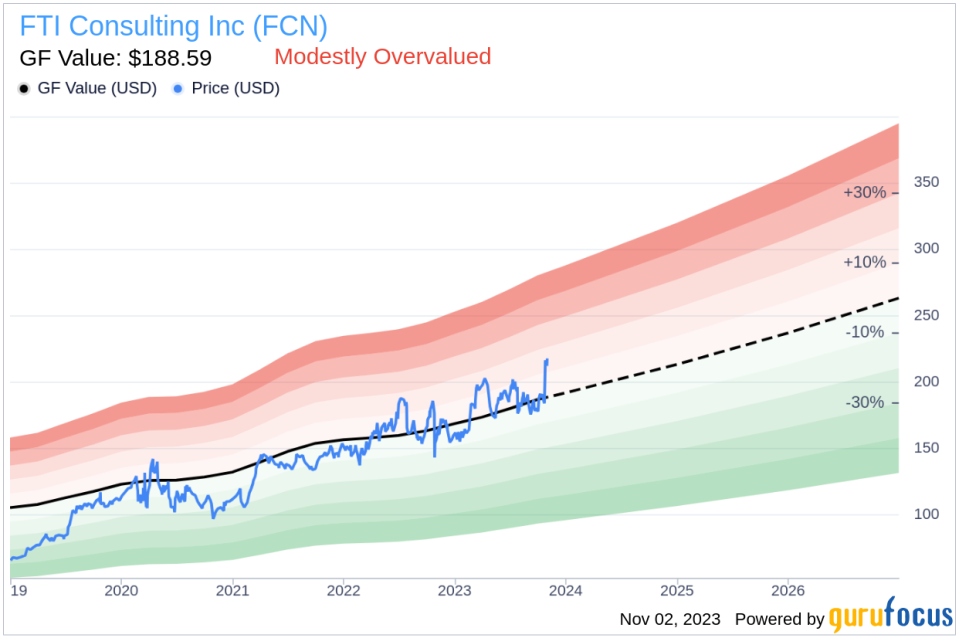

The GF Value image above shows that with a price of $214.29 and a GuruFocus Value of $188.59, FTI Consulting Inc has a price-to-GF-Value ratio of 1.14. This means the stock is modestly overvalued based on its GF Value. The GF Value is an intrinsic value estimate developed by GuruFocus that is calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance from Morningstar analysts.

The insider's decision to sell shares could be influenced by a variety of factors. It could be a personal financial decision, or it could be based on the insider's assessment of the company's current valuation and future prospects. Regardless, investors should always consider insider transactions as one of many factors when making investment decisions.

As always, it's important to do your own research and consider a variety of factors when making investment decisions. Insider transactions can provide valuable insights, but they are just one piece of the puzzle.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.