Insider Sell: Christopher Edmonds Offloads Shares of Intercontinental Exchange Inc

Intercontinental Exchange Inc (NYSE:ICE), a leading operator of global exchanges and clearing houses and provider of mortgage technology, data and listings services, has witnessed a recent insider sell that has caught the attention of market analysts and investors. Christopher Edmonds, the Chief Development Officer of Intercontinental Exchange Inc, sold 1,266 shares of the company on December 11, 2023. This transaction has prompted a closer look into the insider's trading behavior and its potential implications for the stock's performance.

Who is Christopher Edmonds?

Christopher Edmonds is a key executive at Intercontinental Exchange Inc, holding the position of Chief Development Officer. In his role, Edmonds is responsible for overseeing strategic initiatives and business development opportunities, which may include mergers and acquisitions, partnerships, and other growth strategies. His insights into the company's operations and future prospects make his trading activities particularly noteworthy to investors seeking to understand insider sentiment.

Intercontinental Exchange Inc's Business Description

Intercontinental Exchange Inc is a Fortune 500 company that operates an ecosystem of regulated exchanges, clearing houses, and listings venues, as well as providing data services and technology solutions to the financial industry. The company is known for its ownership of the New York Stock Exchange, one of the world's largest stock exchanges, and for its role in facilitating global markets in commodities, derivatives, and equities. ICE's comprehensive services help market participants to invest, hedge, trade, and raise capital with transparency and efficiency.

Analysis of Insider Buy/Sell and Relationship with Stock Price

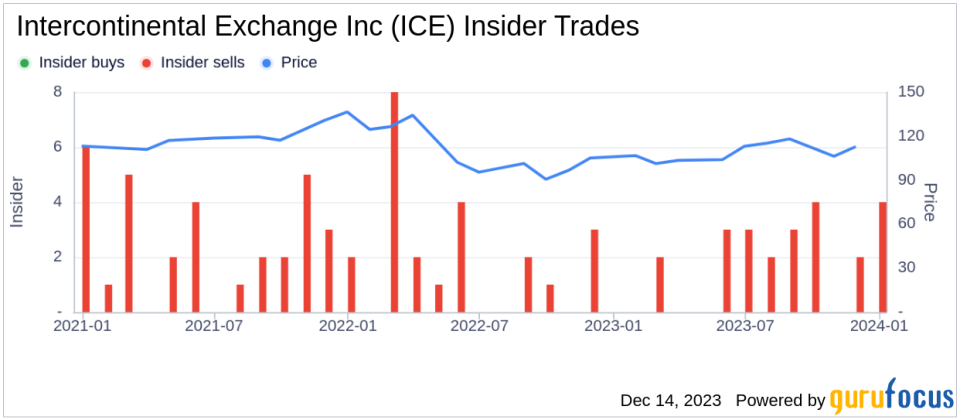

Insider trading activities, particularly sells, can provide valuable clues about a company's internal perspective on its stock's valuation and future prospects. In the case of Christopher Edmonds, the insider's recent sell of 1,266 shares follows a pattern observed over the past year, where he has sold a total of 9,990 shares and made no purchases. This consistent selling could signal a belief that the stock may be fully valued or that there may be limited upside potential in the near term.

It is important to note that insider sells can be motivated by various factors, including personal financial planning, diversification of assets, or other non-company related reasons. However, when analyzing insider trends, the absence of insider buys over the past year, coupled with 23 insider sells, may suggest a cautious stance from those with intimate knowledge of the company's workings.

The relationship between insider trading and stock price is not always straightforward, but it can influence investor sentiment. In the context of Intercontinental Exchange Inc, the stock was trading at $115 on the day of Edmonds's recent sell, giving the company a market cap of $70,589,644,000. This valuation places ICE in the higher echelon of publicly traded companies, reflecting its significant market presence and financial stability.

The price-earnings ratio of 28.61 is higher than the industry median of 18.35 and also exceeds the company's historical median price-earnings ratio. This elevated P/E ratio may indicate that the stock is priced at a premium compared to its peers and its own historical standards, which could be a contributing factor to the insider's decision to sell shares.

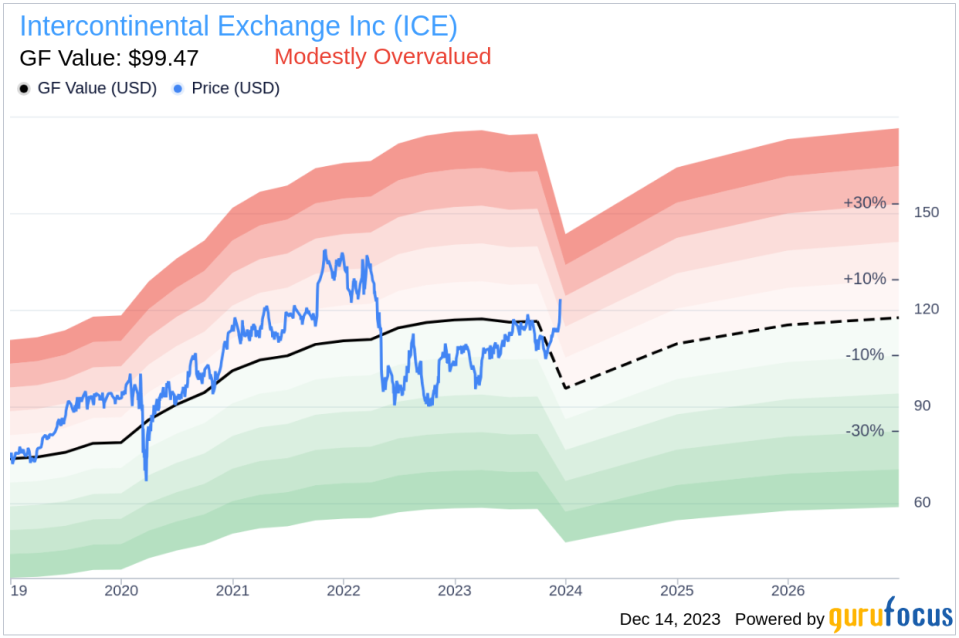

When considering the stock's valuation in relation to the GuruFocus Value, ICE appears to be modestly overvalued with a price-to-GF-Value ratio of 1.16. The GF Value, which is calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, suggests that the stock's current price exceeds its intrinsic value estimate of $99.47.

Given these valuation metrics, the insider's sell activity may reflect a view that the stock's current price has surpassed what is justified by the company's fundamentals and growth prospects. This perspective is further supported by the GF Value assessment, which indicates that the stock is trading above its estimated fair value.

The insider trend image above provides a visual representation of the selling pattern among insiders at Intercontinental Exchange Inc. The absence of buys and the prevalence of sells over the past year can be interpreted as a lack of confidence in the stock's ability to provide significant returns in the near future.

The GF Value image further illustrates the stock's current standing in relation to its intrinsic value. With the price exceeding the GF Value, investors may want to exercise caution and consider the implications of insider selling activities when making investment decisions.

In conclusion, the recent insider sell by Christopher Edmonds, along with the broader trend of insider sells and the absence of buys at Intercontinental Exchange Inc, may signal a cautious or bearish outlook from those with the most intimate knowledge of the company. Coupled with the stock's valuation metrics, which suggest a modest overvaluation, investors should weigh these factors carefully when assessing the potential for future stock performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.