Insider Sell: Ciena Corp's CEO Gary Smith Unloads Shares

In a notable insider transaction, Gary Smith, the President and CEO of Ciena Corp (NYSE:CIEN), sold 4,166 shares of the company on December 15, 2023. This move has caught the attention of investors and market analysts, as insider activity, particularly from high-ranking executives, can provide valuable insights into a company's financial health and future prospects.

Who is Gary Smith? He has been at the helm of Ciena Corp as the CEO since May 2001 and has played a pivotal role in steering the company through the dynamic landscape of the telecommunications industry. Under his leadership, Ciena has grown into a global player, providing network hardware, software, and services to facilitate the delivery of voice, video, and data services.

Ciena Corp, headquartered in Hanover, Maryland, specializes in the design, manufacture, and sale of network equipment and software services. The company's offerings enable a wide range of network operators to deploy and manage complex optical, Ethernet, and wireless networks. Ciena's solutions are critical in addressing the ever-growing demand for network bandwidth and performance, driven by the proliferation of data-intensive applications and services.

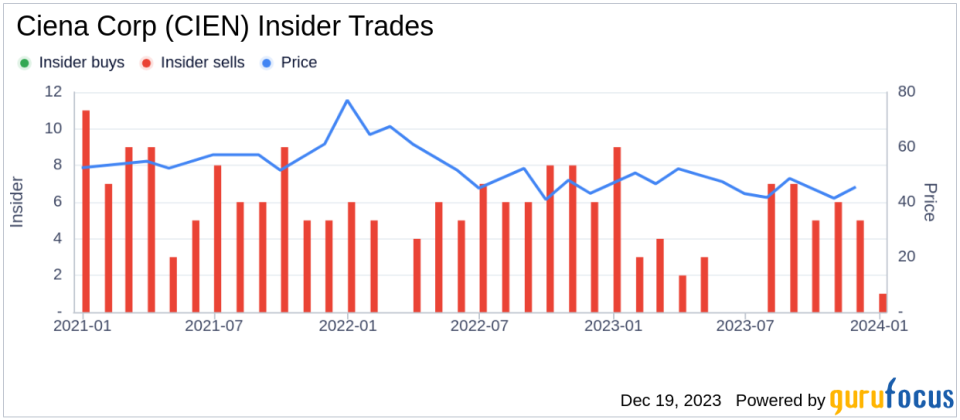

The insider's recent sale is part of a broader pattern observed over the past year. According to the data, Gary Smith has sold a total of 70,621 shares and has not made any purchases. This one-sided transaction history could signal various things, from personal financial planning to a perceived fair valuation of the company's stock by the insider.

Looking at the broader insider trends for Ciena Corp, there have been no insider buys over the past year, while there have been 46 insider sells in the same timeframe. This trend might raise questions among investors about the confidence insiders have in the company's future performance.

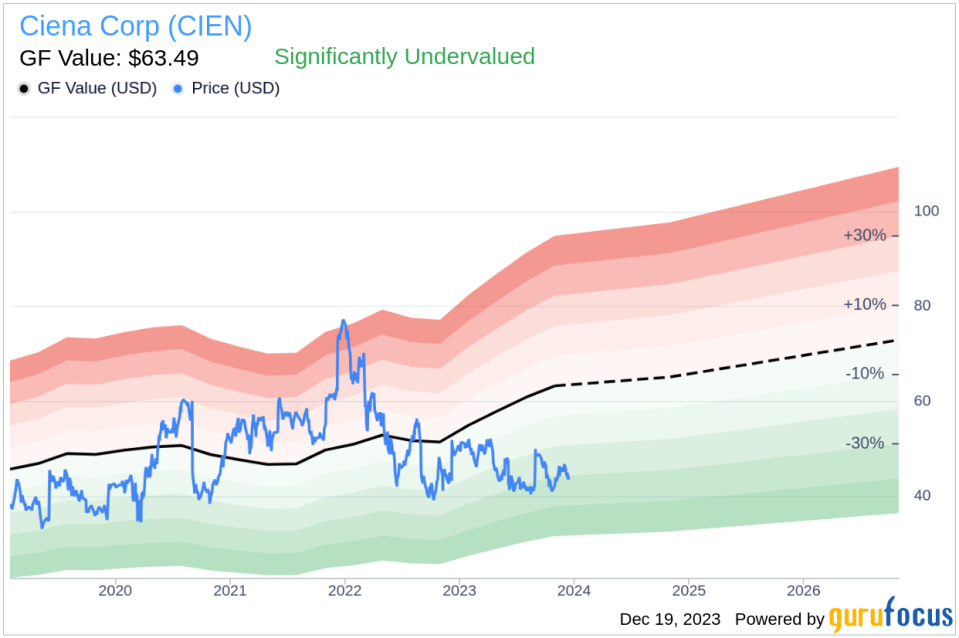

On the valuation front, shares of Ciena Corp were trading at $43.68 on the day of the insider's recent sale, giving the company a market cap of $6.229 billion. The price-earnings ratio stands at 25.15, which is slightly above the industry median of 22.875 but below the company's historical median price-earnings ratio. This could suggest that the stock is reasonably valued in comparison to its peers and its own trading history.

However, when considering the GuruFocus Value, which is an intrinsic value estimate, Ciena Corp appears to be significantly undervalued. With a price of $43.68 and a GuruFocus Value of $63.49, the price-to-GF-Value ratio is 0.69, indicating that the stock might be trading at a discount relative to its estimated true value.

The GF Value is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts. The historical multiples include price-earnings, price-sales, price-book, and price-to-free cash flow ratios. The GuruFocus adjustment factor takes into account the company's past returns and growth, while future performance estimates are sourced from Morningstar analysts.

When analyzing insider buy/sell activity, it's important to consider the context and potential motivations behind the transactions. Insiders may sell shares for various reasons unrelated to their outlook on the company, such as diversifying their personal portfolio, tax planning, or other personal financial considerations. However, consistent selling by insiders, particularly without any corresponding buys, can sometimes be interpreted as a lack of confidence in the company's future growth prospects or valuation.

In the case of Ciena Corp, the insider selling trend, coupled with the current valuation metrics, presents a mixed signal. While the insider's selling activity might raise some concerns, the stock's significant undervaluation according to the GF Value suggests that the market might be overlooking the company's potential. Investors should weigh these factors alongside other fundamental and technical analyses to make informed decisions.

Ultimately, insider transactions are just one piece of the puzzle when it comes to evaluating a stock's potential. While they can provide valuable insights, they should not be the sole basis for investment decisions. As always, a comprehensive approach that considers a range of indicators is the best strategy for navigating the complexities of the stock market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.