Insider Sell: CIO Nicholas Daffan Sells Shares of Verisk Analytics Inc

Verisk Analytics Inc (NASDAQ:VRSK), a leading data analytics provider, has witnessed a notable insider sell by its Chief Information Officer, Nicholas Daffan. On December 12, 2023, the insider executed a sale of 1,480 shares of the company, a transaction that has caught the attention of investors and market analysts alike.

Who is Nicholas Daffan?

Nicholas Daffan is a seasoned executive with a wealth of experience in the field of information technology and data analytics. As the Chief Information Officer of Verisk Analytics Inc, Daffan is responsible for overseeing the company's technological strategies and ensuring that its IT infrastructure aligns with its business goals. His role is crucial in maintaining Verisk's reputation for delivering cutting-edge analytics and decision support solutions to various industries, including insurance, energy, financial services, and healthcare.

Verisk Analytics Inc's Business Description

Verisk Analytics Inc is a global company that provides data analytics and risk assessment solutions to clients in a range of industries. The company's expertise lies in analyzing vast amounts of data to help businesses understand and manage risk, make informed decisions, and optimize their operations. Verisk's solutions are integral to the insurance industry, where they provide critical insights for underwriting and claims management. Additionally, the company's services extend to areas such as natural resources, financial services, and government, making it a diversified and influential player in the analytics space.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions can provide valuable insights into a company's health and future prospects. Over the past year, Nicholas Daffan has sold a total of 9,169 shares and has not made any purchases. This pattern of selling without corresponding buys could signal a lack of confidence in the company's short-term growth potential or simply a personal financial decision by the insider.

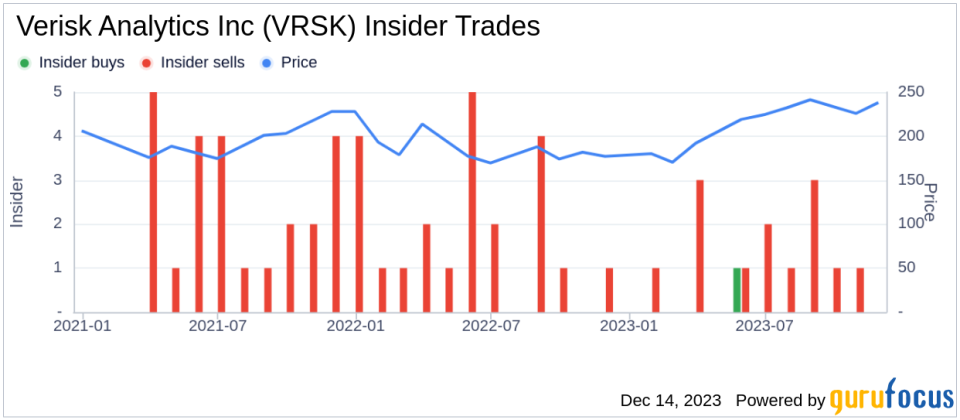

The broader insider transaction history for Verisk Analytics Inc shows a trend of more insider sells than buys over the past year, with 14 sells and only 1 buy. This could indicate that insiders, who are often privy to the most current and detailed information about their company, might perceive the stock as being fully valued or are taking profits after a period of appreciation.

On the day of Daffan's recent sell, shares of Verisk Analytics Inc were trading at $242.1, giving the company a substantial market cap of $35.884 billion. The price-earnings ratio stands at a lofty 72.71, significantly higher than the industry median of 17.175 and above the company's historical median. This elevated P/E ratio suggests that the stock is priced at a premium compared to its peers and its own historical valuation.

However, with a price of $242.1 and a GuruFocus Value of $243.58, Verisk Analytics Inc has a price-to-GF-Value ratio of 0.99, indicating that the stock is Fairly Valued based on its GF Value. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above reflects the recent insider selling activity and can be a useful tool for investors trying to gauge insider sentiment.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value, suggesting that the insider's decision to sell does not necessarily imply an overvaluation based on GuruFocus's metrics.

Conclusion

While the insider's recent sell transaction may raise questions among investors, it is important to consider the broader context. Verisk Analytics Inc's strong market position and the Fairly Valued status based on GF Value suggest that the company remains on solid footing. Investors should weigh insider activity as one of many factors in their decision-making process and consider the company's fundamentals, industry trends, and broader market conditions before drawing conclusions.

As always, insider transactions should not be used in isolation but rather as a piece of the puzzle when analyzing a stock's potential. With Verisk Analytics Inc's robust analytics capabilities and its strategic role in risk assessment across various industries, the company continues to be a key player worth monitoring by those invested in the data analytics sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.