Insider Sell: Co-COO Joel Reiss Sells 3,000 Shares of TransDigm Group Inc

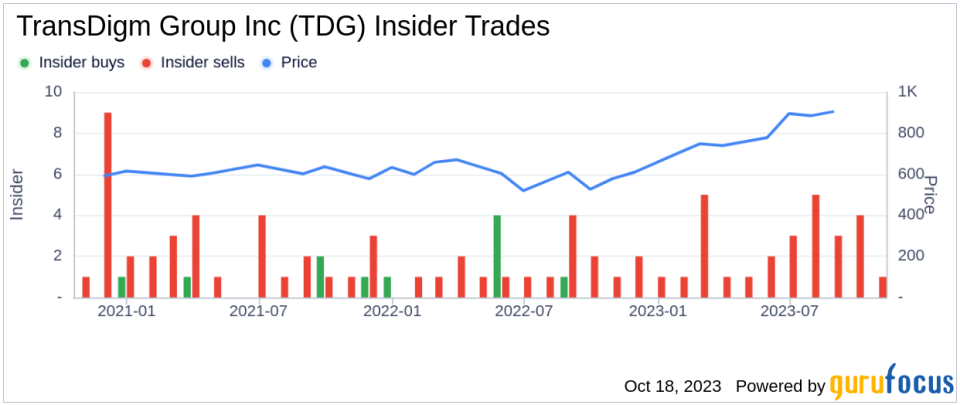

On October 16, 2023, Co-Chief Operating Officer Joel Reiss of TransDigm Group Inc (NYSE:TDG) sold 3,000 shares of the company's stock. This move is part of a larger trend for the insider, who has sold a total of 15,000 shares over the past year and has not made any purchases.

Joel Reiss is a key figure at TransDigm Group Inc, serving as the Co-Chief Operating Officer. His role involves overseeing the company's operations and ensuring that they align with the company's strategic goals. His insider trading activities, therefore, provide valuable insights into the company's performance and future prospects.

TransDigm Group Inc is a leading global producer, designer, and supplier of highly engineered aerospace components, systems, and subsystems. The company's products are used in commercial and military aircraft, including mechanical/electro-mechanical actuators and controls, ignition systems and engine technology, specialized pumps and valves, power conditioning devices, specialized AC/DC electric motors and generators, and engineered latching and locking devices.

The insider's recent sell-off is part of a broader trend at TransDigm Group Inc. Over the past year, there have been 29 insider sells and no insider buys. This trend suggests that insiders may be taking profits or have concerns about the company's future prospects.

The relationship between insider trading and stock price is complex. While insider selling can sometimes indicate a lack of confidence in the company's future prospects, it can also simply reflect personal financial decisions. In the case of TransDigm Group Inc, the stock price has remained relatively stable despite the insider's sell-off.

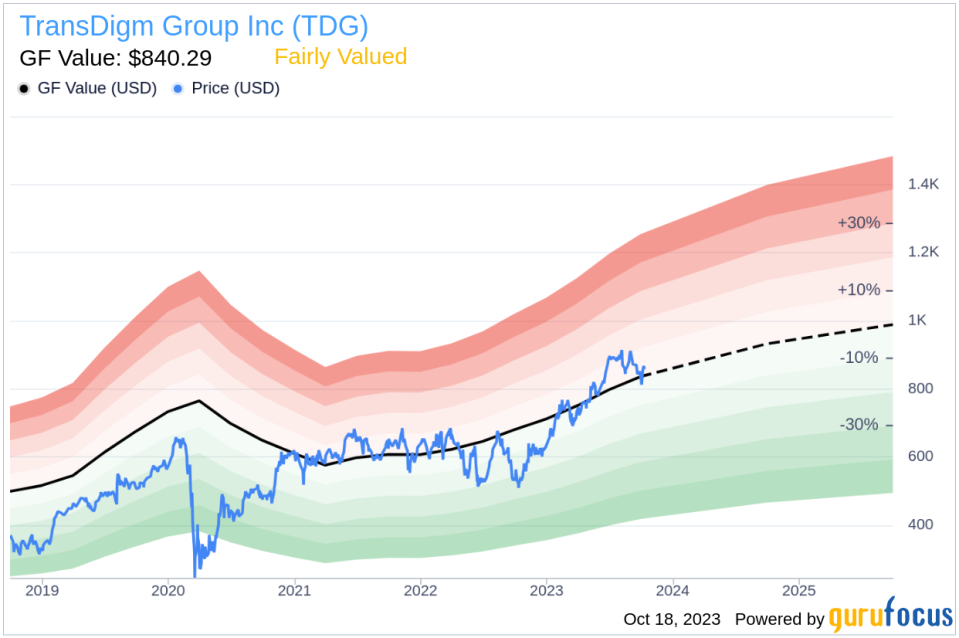

On the day of the insider's recent sell, shares of TransDigm Group Inc were trading for $862.38 apiece, giving the company a market cap of $47.633 billion. This price represents a price-earnings ratio of 45.99, which is higher than both the industry median of 31.9 and the company's historical median price-earnings ratio.

According to GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, TransDigm Group Inc is fairly valued. With a price of $862.38 and a GuruFocus Value of $840.29, the stock has a price-to-GF-Value ratio of 1.03.

In conclusion, while the insider's recent sell-off may raise some eyebrows, it is important to consider the broader context. Given the company's strong market position and fair valuation, investors may still find value in TransDigm Group Inc.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.